Why GM's Hydrogen Fuel Cell Engine Has Promise (And Why It Could Still Fail Anyway)

In 1945, the Navy Bureau of Aeronautics inaugurated a program to investigate the prospective use of liquid nitrogen as a rocket propellant. However, it wasn't until 1962, when John F. Kennedy issued a challenge to NASA to safely land a man on the moon, that the hydrogen fuel cell technology really took flight.

Two years later, the Gemini V spacecraft was the first to use fuel cells using cryogenic hydrogen and oxygen tanks to store its reactants, with its water by-products even consumed by astronauts on board. The same fuel cell technology that combined hydrogen and oxygen was used in Apollo 11, the landmark American space flight that landed humans on the moon in 1969.

Amidst all this, General Motors (GM) unveiled the world's first hydrogen-powered fuel cell vehicle, the Electrovan, in 1966. By 2016, GM had invested more than $2.5 billion in hydrogen fuel cell technology, and a year later, it announced its commitment to developing Hydrotec, a zero-emission hydrogen fuel solution.

In 2022, Global Market Insights shares that the hydrogen vehicle market was valued at $2.8 billion and is expected to grow by over 28% from 2023 to 2032. As of 2023, GM is still the only company in the world developing and commercializing hydrogen fuel cells and electric vehicle (EV) battery technology.

Meanwhile, other manufacturers, like Honda, have partnered with GM to co-develop everything from more affordable EVs to hydrogen-powered cars. But what really makes GM's Hydrotec different?

What is Hydrotec?

With goals of zero crashes, zero emissions, and zero congestion, General Motors hopes to create a sustainable solution for vehicles. Through 2025, it plans to double down on its renewable investments by pouring $35 billion into its electric and autonomous vehicles, according to CNBC.

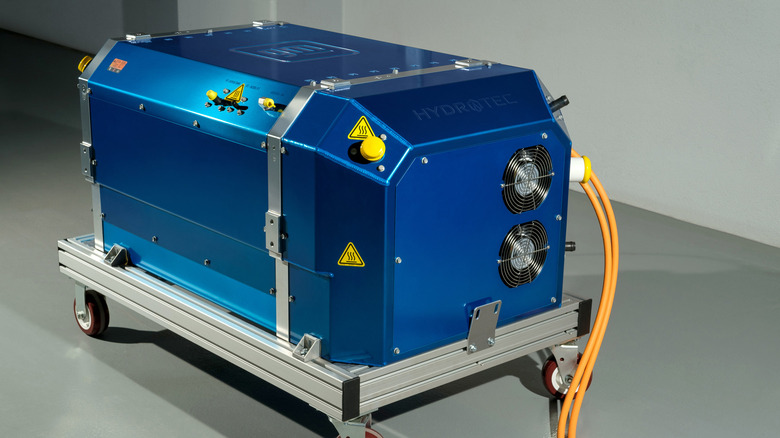

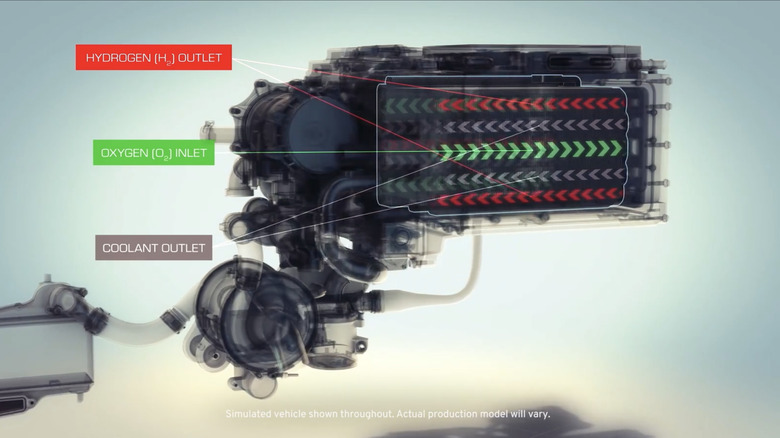

Through its Hydrotec fuel cell power cubes, GM aims to bridge the gap between performance and market viability. Similar to other hydrogen fuel cell engine technology, Hydrotec works by using hydrogen ions to pass through an electrolyte while electrons are routed through wires and back, releasing water as its by-product. However, one key differentiator is that the Hydrotec power cube also has over 300 fuel cells, which can be used for a variety of other uses, from mobile generators to temporary EV chargers.

Aside from this, GM also confirms that its Hydrotec power cubes use relatively lower precious metal content. According to Tech Briefs, Charlie Freese, Executive Director of GM Hydrotec and GM Defense, shared that the second generation of its fuel cell design has reduced loadings of its precious metals from 80 grams of platinum to 20 grams.

Given the use of heavy metals is still a primary point of contention for the hidden carbon footprint of EVs, it could potentially offer a less demanding alternative or reduce reliance on the complex heavy metal mining industry and its ongoing challenges with recycling.

But what makes hydrogen fuel cell technology remain promising after all this time, and what hinders its adaptation and potential?

Why hydrogen fuel cell engines are still promising

In 2023, Freese shared that GM's fuel-cell R&D unit Hydrotec is on track to deploy "the first applications that will be going commercial" of its hydrogen fuel cell technology (via Tech Briefs). According to The Verge, the hydrogen-powered generators will initially only be sold to commercial and military customers. However, GM said it plans on offering versions for residential use in the future.

In his statement to Tech Brief, Freese says, "Large vehicles and heavy payloads – that's where replacing petroleum-fueled vehicles with hydrogen fuel cells works very well." He adds, "That's where we plan to go moving forward." With hydrogen-powered mining trucks and planes already making records, GM will likely lead the charge for this niche. Aside from its zero-emission technology, hydrogen fuel cells also address range anxiety, a critical issue that plagues EV owners.

With a longer driving range than EVs and a refueling process as fast as traditional gas vehicles, it is a perfect combination for commercial applications like serving fleet operations with established operating areas. When it comes to servicing closed-loop systems, such as industrial sites or fleet routes, partners can help build the infrastructure to support their operational needs.

However, like many other types of emerging technology, there are still some key disadvantages that GM needs to address before it can make all this a reality. Unfortunately, some of them can be real dealbreakers for manufacturers and consumers.

What's keeping hydrogen fuel cells in the garage?

While there are many challenges to making hydrogen fuel cells ubiquitous, a couple really move the needle: energy efficiency, infrastructure, and costs.

Firstly, among eco-friendly engines, hydrogen is not the most energy-efficient fuel. Often, the most frequently cited reason why hydrogen cars were designed to fail is that hydrogen cars incur relatively high energy loss for their output. For example, Cinch notes that EVs can convert around 80% of the electricity in their battery to energy. On the other hand, hydrogen cars can only convert a maximum of 40%.

Second, the U.S. Department of Energy (DOE) shares that there are only 59 open retail stations in the United States in 2023. However, the DOE does reiterate not only is there an additional 50 stations in construction, but it also launched the H2USA program, a public-private collaboration addressing key challenges related to hydrogen infrastructure. However, hydrogen refueling sites arguably take up less space than EV charging, and refueling hydrogen-powered vehicles take up significantly less time than charging EVs. According to Toyota, filling up a hydrogen-powered vehicle takes only 3-5 minutes.

Lastly, high fuel costs can make them less affordable to the heavy-duty fleets GM plans to service. Although hydrogen fuel is abundant, the DOE states, "Because hydrogen contains less energy per unit volume than all other fuels, transporting, storing, and delivering it to the point of end-use is more expensive on a per gasoline gallon equivalent basis."