The FTX Collapse Explained: What Really Happened?

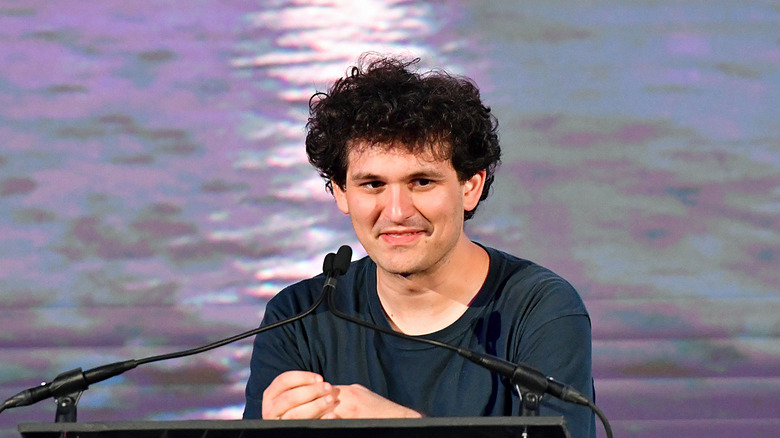

The collapse of FTX, once the third-largest cryptocurrency exchange in the world, has sent shockwaves across the industry. The brainchild of Sam Bankman-Fried, the company witnessed a meteoric rise, but the fall was even more spectacular. Run by a group of friends living in a lavish Bahamas penthouse, Bankman-Fried became the darling of crypto stakeholders.

The son of Stanford Law professors, the young crypto trailblazer was already worth $22.5 billion at the age of 29 and had more than his fair share of glowing profiles written in the news. In an interview with Financial Times, Bankman-Fried boldly claimed that FTX could one day consider buying giants like Goldman Sachs and the CME group.

He further garnered a cult following with his modest lifestyle, which was all about loose tees, following a vegan diet, and driving a Toyota Corolla. Bankman-Fried also signed The Giving Pledge, committing to give away a majority of his wealth to charitable causes, and he also appeared in a video that introduced him as "The Most Generous Billionaire."

Talking to Bloomberg, he stunningly claimed that "If you mark everything to market, I do believe at one point my net worth got to $100 billion." That's a lot of money, considering the core FTX exchange business only hit a peak market value of $32 billion. But it only makes the tale of Bankman-Fried's fall from the heavens even more awe-inspiring. So, how did he squander all that fame and fortune?

The intertwined fates of Binance and FTX

In 2019, back when FTX was a rising star in the crypto industry, Binance made an equity investment in the company and also purchased an undisclosed amount of the FTT coin. But in July last year, when FTX was raising serious investor capital, Binance CEO Changpeng Zhao announced that the company was divesting its stake in FTX, and received $2.1 billion in return that was paid in the form of BUSD and FTT tokens.

FTX continued to grow despite the crypto industry entering a long winter, bleeding over a trillion dollars within a year. But all hell broke loose following a CoinDesk report, which revealed that a majority of Alameda Research's assets are in the form of FTX and there was a deep intermingling of resources between the two companies.

Concerns were raised that FTX and Alameda were misusing the synergy to manipulate the market and prop up FTT's value. Reports of regulatory scrutiny into the FTX empire soon followed, alongside rumors of insolvency. Binance was quick to dump its entire FTT holdings worth over half a billion.

But this point, murmurs of a liquidity crunch at FTX were everywhere. FTX wasn't really immune to the upheavel in the crypto industry, after all. Almost like dominoes fall, giants such as Terra and Luna had gone out of business, while the likes of Celsius, Voyager Digital, and Three Arrows Capital had taken the bankruptcy route.

A doomed buyout

On Nov. 8, Zhao tweeted that the liquidity crunch at FTX is very much real. More importantly, he announced that Binance signed a letter of intent to acquire FTX in order to rescue the sinking ship. The buyout agreement between the two companies was non-binding in nature, but it was still surprising, as the two crypto industry stalwarts were slinging mud at each other before.

Zhao tweeted that Bankman-Fried reached out to him with an offer to save FTX with an acquisition, adding that the crypto exchange was on the verge of a collapse. FTX had already stopped fund withdrawals on its exchange, and a red banner at top of the website also advised interested parties from making any fresh investments. The signs of an implosion were apparent, and the Binance buyout seemed like a safe route to recovery.

But just a day later, Binance backed out of the deal. The company announced on Twitter that reports of "mishandled customer funds and alleged US agency investigations" into FTX had forced the company to back out of its commitment. Binance further mentioned that the situation at FTX was beyond help and recovery.

Impending regulatory investigations were also cited as a reason for backing out of the deal. The only United States Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) had already started looking into the company following concerns of yet another crypto bust.

The bankruptcy saga

Before everything went south, Bankman-Fried was apparently salty about the whole Binance deal fallout. As per internal communication seen by The New York Times, the FTX chief told his circle that Binance probably "never really planned to go through with the deal." Caroline Ellison, a friend of Bankman-Fried who was running Alameda, also told employees that she was sorry for the current state of affairs.

She reportedly admitted that "Alameda had taken out loans and used the money to make venture capital investments, among other expenditures." The admission was not really secret, as previous reports had more or less established that customer funds were misappropriated and used to fund other FTX group ventures.

Like clockwork, and staring at a shortfall worth $8 billion with no deep-pocket savior like Binance, FTX filed for bankruptcy. Bankman-Fried resigned from his position, but this likely won't be the end of the story. Investigations into FTX and Alameda research suggest that the former is over $3 billion in debt only to its top 50 creditors, and anywhere between one or a couple billion dollars worth of assets has just vanished without a trace.

In Bankman-Fried's absence, John J. Ray III has taken over as the new CEO to assist with the bankruptcy proceedings. However, multiple news outlets report that pieces of evidence that could trigger criminal investigation against key FTX figures have already been identified and submitted. Interestingly, possibilities of system manipulation, and even a hack, are also being investigated.

What the fallen crypto prince has to say?

In his first public appearance since the FTX catastrophe, Bankman-Fried sat for a remote interview with The New York Times. The volley thrown his way was rather blunt, questioning his fall from an industry stalwart to the becoming the subject of multiple criminal investigations. Among other things, Bankman-Fried claimed that he had close to nothing left of his once massive fortune, adding that he may only about $100,00 left in one of his accounts.

Bankman-Fried had an apologetic tone throughout the interview and minced words, passing off most of the blame as mere oversight. He didn't say if he will return to the U.S. for prosecution, despite lawmakers such as Elizabeth Warren and Sheldon Whitehouse demanding criminal charges against him. On being puzzled if he knew about the mixing of funds between Alameda and FTX, Bankman-Fried said he "didn't knowingly commingle funds."

When asked about Alameda and the overlap of assets with FTX, Bankman-Fried said "I wasn't running Alameda. I didn't know exactly what was going on." However, he did admit ownership of a large Alameda stake, but later clarified that he didn't have enough bandwidth to run two companies simultaneously. Bankman-Fried also claimed that he was thinking about the overall health of the industry, instead of just the impending collapse of the FTT ecosystem as the FTX doom became evident.