FTX Assets Missing Ahead Of Bankruptcy Proceedings

As bankruptcy proceedings begin for cryptocurrency exchange FTX, sources report a substantial shortfall in assets. James Bromley, an attorney representing FTX, said even after a week of investigation into FTX and Alameda Research, precise valuation of either company is unclear, According to the New York Times. Significant sums may have been stolen or are otherwise missing.

FTX and Alameda Research, a quantitative trading company, were both owned by Sam Bankman-Fried. The relationship between the two companies came under substantial scrutiny after FTX failed to cover withdrawals during a run on its assets. Described by the Times' sources as "symbiotic," investigators suspect unethical or even illegal connections between FTX and Alameda, as we've reported before.

The Wall Street Journal reports both FTX and Alameda are under investigation by authorities in New York State, alongside federal investigations by the Justice Department and the Securities and Exchange Commission. More disclosures are expected in coming days.

Incompetence, malfeasance, both, or neither?

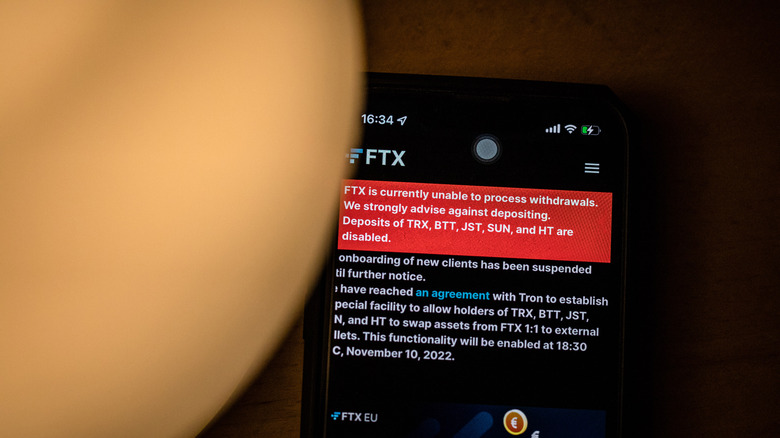

Disclosures to date reveal that FTX was $3.1 billion in debt to its 50 largest creditors. Those creditors have thus far gone unnamed. There may be more than a million other creditors waiting to be paid, including individuals, who had invested personal savings on the exchange. Per WSJ, few if any investors have yet been paid back. Funds on the exchange are currently frozen.

FTX CEO Sam Bankman-Fried resigned Nov. 11. John J. Ray III, an executive who specializes in handling businesses in bankruptcy and under investigation, is currently at the helm. Per the Times, circumstantial evidence regarding criminal activity at and around FTX has already been presented, including a hack on FTX during the run on its assets and an unrecorded $300 million purchase of real estate in the Bahamas, where FTX is legally located.

According to the Times, FTX's current management is content to lay all its woes at the feet of Sam Bankman-Fried. According to Bromley, Bankman-Fried ran FTX as a "personal fiefdom," controlling its finances personally and moving money freely between it and Alameda Research, where he was also CEO. Ray, who handled the aftermath of the Enron scandal, stated he had never seen "such a failure of corporate control."

Investigations are ongoing. Further disclosures may reveal who else was unknowingly or maliciously involved in questionable dealings at FTX and Alameda.