6 Dealer Fees You May Be Able To Negotiate When Buying A Car

A car's purchase price is just the tip of the iceberg when it comes to the true cost of ownership. Beyond the sticker price, there's insurance, registration, sales tax, and ongoing maintenance expenses like brakes, belts, filters, and fluids — the hidden costs of buying a new car. Every few years, you'll need a new set of tires, and sooner or later, something will break and need repairing.

With so many factors in play, costs can add up very quickly, which makes knowing where and how to save especially important. Buying tires during the off-season, for example, can shave a noticeable amount off the total bill. Comparing insurance rates is another example. According to a ValuePenguin survey, 76 % of buyers who have shopped and compared various insurance quotes reported saving money.

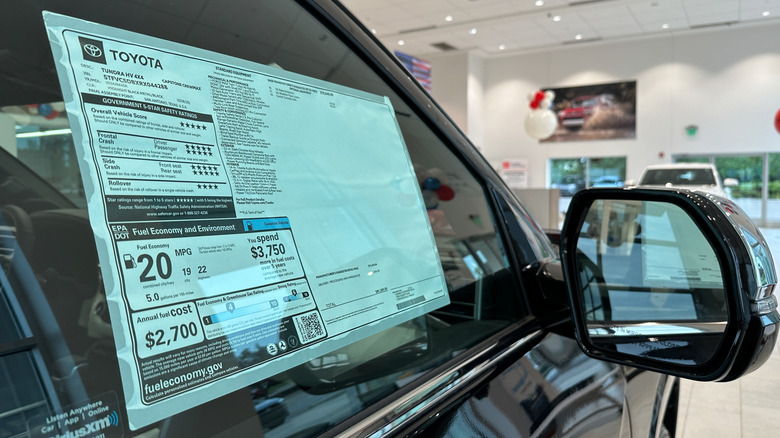

When it comes to the biggest expense — buying the car itself — there are also opportunities to spend less. Most buyers know that negotiating the asking price is common practice. However, that's not the only place where savings can be found, especially at the dealer, where add-ons and fees can stack up fast. With that in mind, here are six dealer fees you may be able to negotiate when buying a new car.

Dealership added accessories fees

According to the Federal Trade Commission, "Car dealerships can't charge you for add-ons you don't want." These can be anything from protection packages, all-season floor mats, anti-theft devices, VIN-etching, non-factory installed window tints, "desert packages," a third blinking brake light, paint protection film, or tires inflated with nitrogen. They do so because these accessories add substantial profit margins to the final bill.

Trusting everything a car dealer says is one of the 12 things first-time buyers always get wrong about buying a new car. Therefore, when reading the sales contract, make sure you go over all of the fine details. If you spot any fees associated with such add-ons, make sure to either heavily discount them or refuse them outright. Sure, there is often value in some of these accessories, but more often than not, they will be priced too high.

If you are fine with paying a bit extra for dealership-installed window tints because you don't want to go through the process yourself, then such add-ons can be worth it. However, the worst part is, as Chevy Dude puts it, "if you have any additional add-ons to your vehicle that are not OEM, it does void your warranty." This means that not only will you be overcharged, but you can potentially void the warranty.

Delivery and preparation fees

When buying a car, no matter if it's used or new, dealerships will often charge you a pretty sum for "delivery prep", "vehicle prep", "predelivery inspection," or "vehicle procurement" fees. In essence, these should already be accounted for in the mandatory destination charge on a new car, meaning that they can present pure overcharging. The devil is in the details, and reading all of the documentation is going to tell you what is or is not included.

You can always check online what a specific charge means and whether it should or should not be included. Some people are willing to overlook these because they've gotten a good deal elsewhere, but when in doubt, check online or directly ask the dealer. For instance, the destination charge should include a full tank of fuel, but if you see a different fee that charges you money for a fuel fill, make sure to negotiate it off. The general idea here is to not be afraid to say no, and to always be vigilant and ask questions.

Market adjustment fees

A market adjustment fee (mark-up) is basically a dealer's way of saying that the car you want is in big demand, so you'll have to pay more to get it. This is often the case with brand-new or limited production cars that are backed with backlogs of orders, sometimes even for years. For example, when the new Ford Bronco came out, the demand was massive, and that prompted dealers to charge equally massive mark-ups.

Back in 2021, Road and Track reported that dealerships were willing to charge reservation holders $5,000 to $10,000 in mark-ups for the new Bronco. A dealer might justify the price hike by saying that the car will appreciate, and thus that you will be able to sell it for more than what you paid for it in due time. The reality is that a dealer does not have to sell you a car at MSRP; they can both lower or raise the price.

You do not have to buy a car with a massive markup, and you can try to negotiate it down. This is one of the main reasons why you should never buy the first model year of a new car. For super high-performance cars, such as the Porsche GT3, a markup can be more than $100,000. For ultra‑high-end hypercars like the Ferrari F80, The Drive recently reported what it called the "mother of all markups" — a staggering $2.5 million above MSRP.

Advertising fees

An advertising fee may appear on a vehicle's invoice, and it's sometimes listed separately from the window sticker price. To confirm, check the itemized dealer invoice or ask the dealer directly. The dealer essentially wants you to pay for the listing they put on Edmunds or AutoTrader. Although an official advertising fee does exist, it's typically one manufacturer's charge through dealers, not the one dealers charge to consumers.

It's important to differentiate the manufacturer's charge (the non-negotiable one) and any of the additional advertising charges a dealer might want you to pay. Falling for pushy sales tactics is one of 6 mistakes to avoid when buying a car at the dealership, and charging multiple advertising fees is sadly part of it. To know the difference, be on the lookout for advertising fees that are not included in the invoice, but appear as separate fees.

Loan payment fees

According to a Consumer Reports survey, about a third of consumers who took out an auto loan directly from a manufacturer were surprised by extra fees packaged with the loan. For example, one reported being charged a $10 customer service fee each time she made a timely payment. Although consumers might believe these only cover the car and the interest, as seen with the example above, they can cover many additional charges.

As such, typical loan-related fees can include GAP insurance, loan origination fees, payment processing charges, or bundled prepaid maintenance, without clear disclosure. The reality is that these loans are often worse than those you can get directly from a bank or credit union. Dealerships can mark up your interest rate to earn money from affiliated lenders.

The solution here is to familiarize yourself with the ins and outs of different payment methods and read the fine print before you sign on the dotted line. Regardless of where your loan comes from, it is almost always negotiable, and that's something you should know before leasing a new car. You can also ask the dealer to itemize every fee on the loan contract.

Inspections and emissions fees

Emissions inspections vary across different states. Some states don't require regular car inspections, such as Florida, Washington, and Michigan. Other states, such as California, Illinois, or Nevada, require emissions inspections at least in certain areas. Consequently, in California, a dealer might handle the emissions inspection and pass that cost onto you. However, you are not obliged to carry out the emissions inspection through the dealer.

Car and Driver reports that these inspections can be done by your own mechanic. Besides your own licensed mechanic, you can also do these through independent testing shops because they can be more affordable, and because they don't have a financial incentive to find a problem in the same way a dealer might. If you do decide to do it through the dealer, you should be aware that these are often negotiable.

To ensure you get your money's worth, it's best to check ahead of time what an independent center, your licensed mechanic, or the dealer might charge you. If one of these offers you a noticeably lower rate than the dealer, you can use that as leverage to negotiate a discount more effectively. Scheduling the inspections beforehand can also help to avoid last-minute markups and give you time to shop around.