Here's Why Rite Aid, CVS Don't Accept Apple Pay

This week, and really since inception, Apple Pay has had a lot of attention. The recent chatter surrounds Apple Pay problems, where some retailers are sidestepping the service due to their allegiance elsewhere. The problems are significant, but not insurmountable. Now Apple is responding, and a hashtag (#PayItSafe) has been created to unify fronts. Though Apple Pay isn't new to mobile payments, they did rally the most of banners in a unified direction. Here's why their opposition is significant, and might actually be a problem.

CurrentC is, if I may be so bold, really stupid. Right from the jump, their website asks you to sign up to find out when CurrentC will come to your town. I'm not even really sure what that means. I know that an iPhone 6 can be to my town — even my doorstep — in 7-10 days. Why I'd wait for a different program is beyond my scope of understanding.

The platform Rite Aid and CVS seem to be favoring also doesn't do anything special other than cobble in a rewards system for using it. Apple Pay has that in the works, reportedly, so I'm left waiting for CurrentC to hit my town. Please reference my above statement for clarity on why that's just plain wrong.

Even though CurrentC is wrong for me, a myriad of retailers seem to think it's wonderful. Before we get to why CurrentC is potentially dangerous, here's a list of some of the larger retailers that are currently signed up for CurrentC:

Gap

Old Navy

7-11

Kohls

Lowes

Dunkin' Donuts

Sam's Club

Kmart

Sears

Banana REpublic

Bed, Bath & Beyond

Wendy's

When compared to our list of retailers supporting Apple Pay, none of the above mentioned retailers is on the list (we'll get to that in a second).

That's why CurrentC is dangerous: it has backing. Though this limited list of retailers isn't big, it does have some heavy hitters. Walmart, Old Navy, and 7-11 alone comprise a big chunk of our spending as consumers. So, CurrentC has solid support.

That doesn't mean CurrentC is really supported, though.

Sources tell me that within the ranks of Rite Aid, executives are at odds about which direction to take their mobile payment scheme. Between two of the top execs in the company, one wanted to allow customers to pay with both Apple Pay and CurrentC, while the other was set on painting customers into a CurrentC corner.

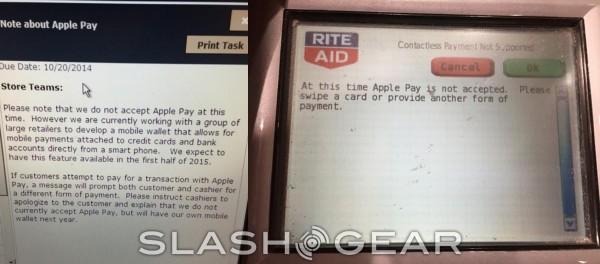

But why would Rite Aid — among others — eliminate Apple Pay from their registers? It's secure, simple to use, and really popular. They need to do nothing aside from allow it to happen on their existing hardware, too. So why did they back out instead of jumping in?

Sadly, they may have had to.

According to our source, the CurrentC agreement signed by retailers states that no other form of mobile payment can be taken. It's not known how long the agreement retailers signed for using CurrentC is, but unless they leave altogether, Apple Pay (along with Google Wallet) and CurrentC remain at odds. That makes this upstart mobile wallet a bit of a problem for consumers who want to use a payment system they're already comfortable with.

Over the weekend, a few readers reached out to tell me that their respective Google Wallet or Apple Pay mobile payment systems worked at Rite Aid and CVS. I won't speculate on why that is, but there could be a provision in the CurrentC agreement that has to do with regional availability. Remember, we're still waiting on CurrentC to get to our town.

The CurrentC scheme is long in the tooth, too. Having been in the works since 2011, it still doesn't have legs. Now it's both a bad idea and late to the game, just like other mobile wallets that failed to get off the ground.

Apple's response? Classic Apple. They note Apple Pay has received a warm reception, and there are 220,000 locations already taking it. According to Business Insider, that's over double what CurrentC has.

As history will tell you, battling Apple is a losing proposition. Every. Single. Time.

So does CurrentC have a hope against Apple Pay? It's hard to say. Their offering isn't nearly as secure or easy (it's based on QR codes), and isn't nearly as popular (you probably hadn't heard of it before this weekend). People aren't clamoring to buy a Big Mac just to see if CurrentC works.

CurrentC does have retailer backing, though — from some big players. It will take a big effort for those retailers to remove themselves from the CurrentC agreement they signed (if they want to), which was likely done well ahead of Apple Pay even being a blip on their radars. Now that Apple Pay is here, and "we the consumer" want it, there might be change.

Like always, we'll just have to let retailers know how we feel with our wallets. Our digital wallets.