12 Tech Disasters That Lost Millions

We may receive a commission on purchases made from links.

The annals of tech abound with failure. By some measure, the failures allow us to realize success. It is simply impossible to conceive of developing new technologies with 100% success every time. However, investment into development is not cheap, nor is it inexpensive to get things in the hands of consumers.

While failure on some level is imminent, the amount of money involved and the frequency with which it happens is staggering. With billions on the line, invested into bringing hardware and software to market, multiple events can transpire to set it all off on the wrong course. Sometimes outside forces such as weather and volatile market conditions can derail a project while other times sheer ineptitude and a lack of due diligence on the part of investors can wipe out fortunes. But while opportunities to get rich continue to exist, so too will the opportunities to erase your net worth in an instant. Here are 12 times a tech disaster lost someone millions.

Juicero

The market for fresh fruit juices and juice mixtures in the U.S. is huge. The desire for "juicing" and producing all manner of smoothie, juice extracts, and the like remains strong. This presents an opportunity for clever entrepreneurs to capitalize on the demand and deliver products for people to satisfy their cravings at home.

The folks at Juicero had a novel idea in meeting this demand with a machine that provided fresh-squeezed juice from a proprietary device that worked exclusively with their packaged ingredients. To make it exclusive, the machine, which cost $700 at launch, scanned a QR code on the packaging to operate and pump out fresh-squeezed fruit juice in the comfort of the user's home.

Things seemed to be going swimmingly until a couple of eagle-eyed reporters from Bloomberg published an article showing that your own two hands and a pair of scissors can do the same thing this $700 machine could do. The reaction was swift and sales took an immediate nosedive. Once the public discovered they were being taken for a ride, the company quit operations, losing investors, including Google parent Alphabet and basketball player Kobe Bryant, upward of $120 million, according to the Consumerist. Fortunately, the only physical damage from this disaster was some bruised egos of people who wasted $700 on a glorified Capri Sun dispenser.

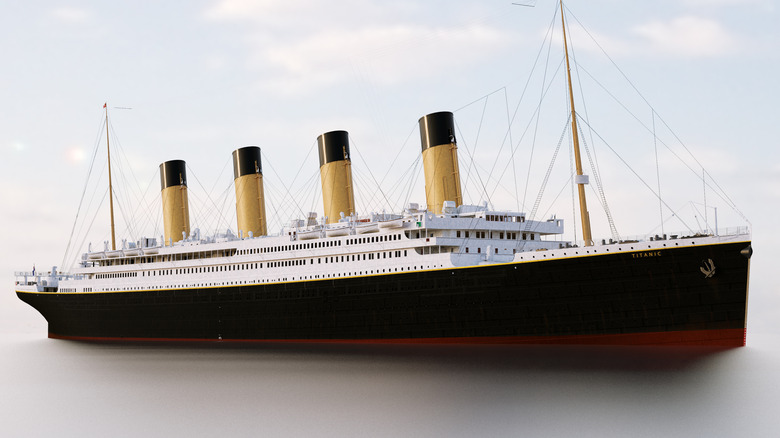

RMS Titanic

In an era before jets ruled the skies, shipbuilding was among the most technologically advanced transportation industries. Building on the knowledge and expertise developed since seafaring humans set to water, shipbuilders of the early 20th century built magnificent vessels capable of feats not imaginable a generation before.

Built-in the shipyards of Belfast, the RMS Titanic represented the best and newest shipbuilding techniques and technology of its time and had been celebrated for representing a new era of ocean travel, with accommodations and luxury never before seen on the water. The shipbuilders were so proud of their ship-making skills that they arrogantly proclaimed the vessel to be unsinkable.

The Titanic proved to be a sinkable vessel on the night of April 15, 1912, when it sank to the ocean floor after colliding with an iceberg. According to Brittanica, several oversights and mishaps contributed to the collision along with a series of bad decisions bolstered by the hubris of thinking the ship unsinkable.

While the tragedy of lost human life, 1517 people dead, cannot be measured in dollars or pounds, the financial cost to the ship's owner, White Star Lines, was immense. Investopedia estimates the Titanic cost $7.5 million to build in 1912 dollars and that represents about $400 million in today's money. Considering brand new cruise ships can cost more than a billion dollars, that estimate is reasonable. Furthermore, costs associated with the fallout continued to mount long after the ship sank.

Quibi

The internet has brought us a great many things since its invention. Among them are some fantastic streaming video services that allow us to watch television shows and movies on demand. Some of these great services include Hulu, Netflix, and Amazon Prime, but not Quibi. In a list of great streaming services, Quibi is definitely not included. It could have been included. But it's not.

Quibi had all the potential of any tech startup and brought in some incredible talent and an even more incredible pile of cash. When someone with as long a history in Hollywood as Jeffrey Katzenberg starts up an entertainment venture, most people would assume he knows what he is doing after having so many other successful ventures on his resume. Most people would be wrong, so terribly wrong.

For reasons unknown, Quibi was limited to short videos limited to mobile screens only. They attempted to correct this mistake, but it was already too late. This choice proved to be its Achilles heel. The only thing more astounding than this terrible decision was the sheer amount of money spent to hire a-list Hollywood actors, producers, and directors. The entire Quibi run from start to finish was six months. One impressive part of the Quibi saga is that Katzenberg started it with a shoestring budget of only $1.5 billion. More impressive is that he was able to raise more than a billion dollars and set it on fire in such a short time.

Mariner I

The successful launch of Sputnik by the Soviet Union set the space race into top gear, and the U.S. responded by putting as much effort into space exploration as possible. One of the efforts was the Mariner I research craft, which set off to study Venus in 1962 (via Mental Floss). According to NASA's statment about the cost, "Total research, development, launch, and support costs for the Mariner series of spacecraft (Mariners 1 through 10) were approximately $554 million." According to the US Inflation Calculator, the total in today's money exceeds $5 billion. If the costs were evenly divided among all 10 spacecraft, Mariner I cost $500 million.

The craft was intended to fly by Venus and collect data about the planet. The Soviet Union had already attempted to reach Venus and failed. Electrical Design Magazine's details of the mission report the spacecraft started to veer off course due to an unscheduled yaw-lift maneuver. Ground control sent an abort command just 293 seconds into the mission.

In a review of the flight, NASA discovered a missing hyphen in the code that allowed incorrect guidance signals to be sent to the craft. While failed missions are built into many plans from NASA, the failure due to a single character of code could be seen by some as a disastrous waste of taxpayer dollars. A second spacecraft was already prepared and launched within months of the Mariner I failure and became the first successful planetary discovery mission from Earth.

WeWork

Of the many challenges entrepreneurs face is where to start their company. Commercial real estate can be expensive and generally requires long-term commitments. That is where WeWork fits in.

Providing a ready-to-use, fully furnished workspace to startups with the ability to lease short-term and expand offers flexibility and alleviates many headaches associated with startups. WeWork set up its business by leasing out large spaces and subletting ready-to-use individual desks and workstations with a slew of perks such as free beer and cafes. The company's problems weren't with the business model, but with the management.

Buzzfeed found that the one thing that WeWork did better than anything was raise capital. By floating huge potential –- that anyone who worked in an office is a potential customer –- and generating hype, WeWork managed to raise ever-growing investments into the company to the point that its valuation rose to the billions, despite operating on razor-thin profit margins, if not losses. All of the hype and flurry of these investments came to a head after its initial public offering, or IPO, in 2019.

The Guardian explained how the WeWork IPO failed miserably and within six weeks, the CEO has resigned and given up his shares, with the company taken over by its largest shareholder, Softbank. WeWork still exists, albeit with a more conservative and stable management team in place, and is also no longer a tech darling surviving merely on hype.

The Morris Worm

The modern digital age presents all manner of opportunities for nefarious digital activities with the threat of viruses, trojan horses, keyloggers, and more circulating online. Dozens of companies have created software to combat these threats, contributing to a thriving and profitable industry. However, there was a time before these threats existed, when few people anywhere even used a computer, much less one on a network.

In the early days, networked computers existed in universities and the majority of its users were research students. This was a precursor to the world wide web and the internet of today. Out of sheer curiosity to see just how many users connected to the network, Robert Morris created a program to help him track users. What he created accidentally became the first computer virus, as it quickly replicated itself, spread to other computers on the network, and caused multiple systems to overload and crash.

The fallout caused the burgeoning world of computer users to recognize the potential for damage that can be caused by improper lines of code and resulted in the first conviction under the 1986 Computer Fraud and Abuse Act. Morris received a light sentence as he had no nefarious intentions and the resulting damage was an accident. However, fixing the problems required hours of work to clean up and reboot the systems, and the FBI estimates the damage to have cost anywhere from $100,000 to $10 million.

Fisker Autmotive

Electric cars dominate the headlines of the automotive world today and several companies exist to meet the demand for zero-emission vehicles. Many companies have tried to deliver viable concepts that could meet demand. Tesla has wildly succeeded in this, while Fisker did not.

Started by Henrik Fisker, a talented auto designer responsible for fashionable designs on cars such as the Aston Martin V8 Vantage and the BMW Z8, the company built a luxury hybrid sports sedan called Karma. While the car had striking features, owners quickly found flaws in the design. In Edmunds' review of the 2012 Karma, cons are biggest in the interior and include cramped space in the rear, blind spots, inferior materials, and a very small trunk. With a list price above $100,000, it was difficult to attract buyers with these negative attributes. Furthermore, Consumer Reports gave it a failing grade and in the end, the company failed to deliver.

Fisker folded by 2013, beset by its problems and the dangers of working within a niche market. While Fisker had enticed many big-name investors, the biggest-name investor was the U.S. government. As a part of the initiatives of the Obama administration to spur development in electric cars, Fisker received government-backed loans with approval for as much as $500 million. The Atlantic states that the actual amount received totaled no more than $200 million and the government recouped about a quarter of that, but still, $150 million of taxpayer money was lost for good.

Microsoft Zune

Steve Jobs sprung the iPod on an unsuspecting public at a time when most people had only recently come to grips with the reality that everything they know was headed for the digital realm. Internet was getting faster and technologies to facilitate entertainment via digital platforms popped up seemingly weekly.

The iPod was a rousing success for Apple and many companies introduced mp3 players around the same time, but none of them enjoyed the market share of the iPod (via MacWorld). With the size and strength of Microsoft, the company should have been able to compete with its own player. It achieved success with the XBOX game system and Windows was still the most used operating system in the world, so why didn't the Zune work?

According to Medium, the Zune was a high-quality product with an enjoyable interface. Its specifications were comparable to the iPod, and it performed comparably as well. However, the conclusions are that Microsoft failed in marketing the devices and targeted either too narrow a crowd or just the wrong crowd altogether. Poor timing likely also contributed to its demise, being five years behind its biggest competitor. In 2007, Tech Crunch reported on Microsoft profits being off by $289 million as a result of the slow-selling Zune, which had been discounted from its original retail of $229 down to $168. By 2011, the Zune was killed off completely.

Theranos

Health care is an industry that thrives on innovation. Investors are keen to jump on new ways to perform processes that speed up treatment and reduce costs. However, it is not every day a 19-year-old college dropout is at the head of such a venture.

Theranos was founded by Elizabeth Holmes in 2003 with the promise of a faster, easier, cheaper, and better way to get results from blood testing. Integral to effective health care, blood testing can be a time-consuming and expensive diagnostic. Theranos developed a device that was compact, portable, and could take blood measurements using small blood samples, such as from a pinprick, rather than a vial. The technology generated a lot of interest as many in the science and healthcare field were keen on seeing this product come to market. Holmes was so successful at creating buzz that she was able to raise nearly $1 billion and her company's value shot to $10 billion, per Investopedia.

At some point, people started looking closer at what Theranos was really doing as delivery of the test equipment was not happening, and the tight security and secrecy around the company looked suspect to many. In the end, Holmes and company president Ramesh Balwani were charged with several counts of fraud by federal regulators. The house of cards finally came crashing down and Theranos dissolved with Holmes convicted of 11 charges filed against her. Investors including Betsy DeVos and Rupert Murdoch reportedly lost over $600 million, according to CNBC.

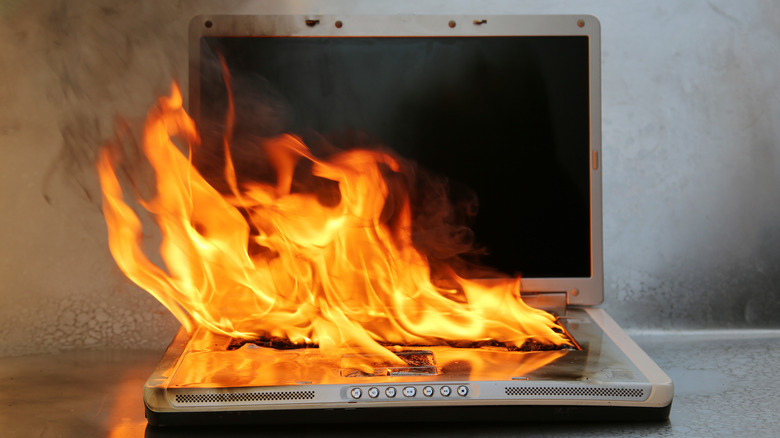

Samsung Galaxy Note 7

Samsung is arguably the premier Android smartphone maker and has held that title for many years. While the Korean company has been producing all manner of electronics for decades, their phones are the device most people associate with the brand, and for good reason. The Galaxy Note capitalized on a trend of growing smartphone screens at a time when most phones were not considerably larger than a deck of cards. The Note series took off and became one of Samsung's best sellers. But growth is not always without growing pains.

Not long after the introduction of the Galaxy Note 7 series, reports started popping up of people's phones spontaneously combusting, smoking, and smoldering themselves into a semi-molten lump of worthless electronic junk. When problems arise on one of the best-selling devices on the planet, news stories are quick to follow. The Note 7 fires gained notoriety and Samsung had to act fast, not only to save face in the public eye but to minimize any liability for injuries or damage caused by the phone. In the end, Samsung directed all Note 7 owners to power down their devices and issued a recall costing the company an estimated $17 billion, according to Reuters.

Pets.com

Amazon, eBay, Zappos, Alibaba, and Netflix are all prominent websites launched in the 90s that most are familiar with. Each was early to selling online and saw great success. At one time, many people thought Pets.com would be among them. Mostly it was the people running Pets.com who thought it would go on to great success — but it didn't.

Pets.com launched in 1998 as the premier web destination for the needs of all pet owners. In the late 1990s, the internet was still a world of dial-up connections and slow-loading websites. Some early adopters started on small budgets and used various strategies to build a customer base slowly and consistently. Pets.com decided to raise as much venture capital as possible and dump it into advertising.

Jeff Fischer of The Motley Fool wrote, "When the company went public on Valentine's Day this year, management knew that very soon it would need more money given its marketing spending plan." Furthermore, the people that ran Pets.com did little market research and somehow didn't realize their most profitable items, like food and litter, are heavy and costly to ship. The smaller and cheaper to ship items like dog toys don't make up enough volume to produce the regular and consistent profits the consumables would.

By the turn of the millennium, The New Tork Times reported that Pets.com shut down having run through $147 million and Computer World noted the domain Pets.com had been sold to Petsmart by the end of 2000.

Mt. Gox Bitcoin fiasco

Bitcoin is now common parlance among finance types. Its history is short but weaves a twisted tale. Bitcoin is a digital currency not backed by any central bank. It is traded solely by moving digital packets between computer servers with other servers checking the validity and authenticity of the packets. These packets, or wallets, can be stored on an exchange, a sort of repository for digital currency.

Mark Karpeles ran Mt. Gox around 2010 and had accumulated a substantial amount of Bitcoin in its reserves — it was responsible for nearly 70% of all Bitcoin transactions at the time, (via Investopedia). This not only made it a popular place for people willing to bet on cryptocurrency, but it also made for a very attractive target for hackers with nefarious intent.

As Wired explains, Mt. Gox suffered two different hacks, one small and one large. The smaller breach resulted in a limited number of Bitcoin being taken and the issue had been seemingly resolved with the stolen coins replaced by Mt. Gox. The second hack, which some speculate is part of an ongoing attempt from the first, was larger and led to a loss of 650,000 to 850,000 bitcoin valued at billions of dollars.

The fallout led to charges and a conviction against Karpeles in a Japanese court. 200,000 bitcoin in possession of Karpeles were recovered, but the vast majority were long gone and left customers of Mt. Gox with little to show for their holdings.