How Biden's New Electric And Hybrid Rules Could Affect The Next Car You Buy

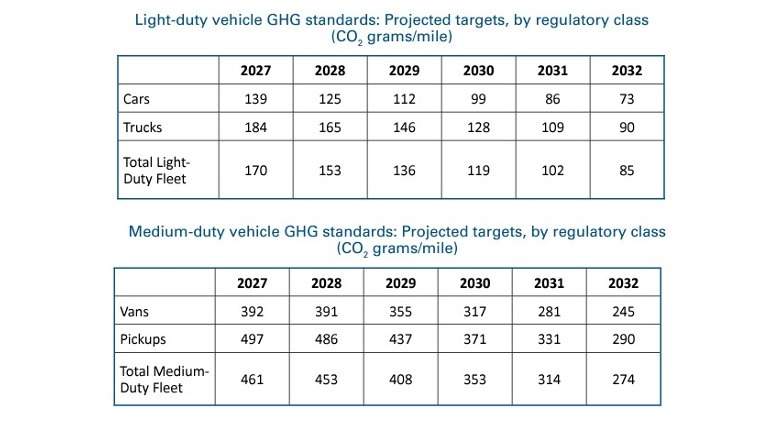

The Biden administration, in partnership with the U.S. Environmental Protection Agency, has announced fresh guidelines to reduce tailpipe emissions from cars and bring down the environmental burden of greenhouse gases. The updated guidelines — which go into effect for model year 2027 cars, and those hitting the roads through 2032 — give a more relaxed pathway for carmakers to gradually reduce emissions.

Notably, the EPA says automakers can meet the emissions limits through a mixed sales approach based on the vehicle types. That includes traditional gasoline-powered cars, hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery-electric vehicles (BEVs). The agency's roadmap hinges on developments in the EV segment, alongside government benefits and increased local production facilities on U.S. soil.

"Proven technologies such as BEVs and PHEVs are already poised to become a rapidly growing segment of the U.S. fleet, as manufacturers continue to invest in these technologies and integrate them into product plans, and infrastructure continues to be developed," says the agency. While the overarching focus is on reducing greenhouse gases, hydrocarbons, nitrogen oxides (NOx), and particulate matter (PM2.5), the EPA stresses the shift will benefit buyers.

"Once fully phased in, the standards will save the average American driver an estimated $6,000 in reduced fuel and maintenance over the life of a vehicle," the EPA said in a press statement. The agency touts savings worth $62 billion in annual fuel costs, and roughly $6,000 for an American car owner over the life of a vehicle.

EPA assures car buyers are the ultimate winners

Citing the availability of over 100 fully and partially electric car models on the market, the EPA notes that its new rules will expand the choices available to customers, which also gives them the freedom to choose how they fuel up their cars. Of course, the expansion of electric charger networks and standardization of connectors — like Tesla's NACS adoption — are a big part of EPA's push. Of course, it's also a clear nudge for OEMs to move ahead with electrification goals, with a lowered sales goal this time around.

"Car makers get a renewed chance at an emerging market, consumers get innovative automobile technology and the atmosphere gets a little breathing room," Angel Lance, chief of consulting firm Motive Power and decarbonization-focused National Public Utilities Council (NPUC), tells SlashGear. "We are all winners with these updated guidelines," she adds.

That said, there's a bittersweet price hike caveat here. The EPA predicts that the new rules will raise the technology expenses for car makers by approximately $1,200 for smaller cars, and $1,400 for larger vehicles between 2027 and 2032. This prediction reflects the money that the industry will have to spend to meet these standards, and does not directly translate to the price that buyers will pay for a new car. However, that's not a rock-solid assurance, and depends more on the market dynamics.

Winners and losers of Biden's new electric and hybrid car rules

What if, instead of absorbing the costs, a carmaker passes it on to the customers? That's an undesirable predicament. If the 2023-2024 spell — which saw even market leaders like Tesla reducing sticker price — is any indication, carmakers would prefer to trim profit margins and stay competitive. In either situation, the EPA says federal electric car incentives worth up to $7,500 should lighten that pinch for buyers. However, adjusting to the new rules won't be easy.

The EPA says it expects the share of electrified light-duty vehicles (model years 2030-2032) to reach between 30 and 56% of a brand's net sales. For carmakers like Toyota, which vocally opposed the EPA's emission rules, it might have to rethink its entire strategy to accommodate. In 2020, Toyota President Akio Toyota labeled the EV race as overhyped, pointing out the infrastructure challenges and the costs associated with the transitions.

Earlier this month, Bentley delayed its EV goals. Ford also scaled down the production of its electric truck and mellowed its EV battery plans. "These adjusted EV targets — still a stretch goal — should give the market and supply chains a chance to catch up. It buys some time for more public charging to come online, and the industrial incentives and policies of the Inflation Reduction Act to do their thing," says John Bozella, chief of Alliance for Automotive Innovation — one of the biggest automotive lobbying agencies out there.

Adapt and survive

Multiple car brands cited in a CNBC report highlighted that the EV rush has slowed down, and automakers are now cautious; giving more attention to hybrids while offering the best of both worlds with a dual gas-electric sales strategy. However, that approach is risky, as well. Tesla, despite its numerous commitment issues, continues to move ahead like a juggernaut, while Chinese brands like BYD are already making Western carmakers sweat and pushing them to lower costs.

State-level rules can further shrink the breathing room for carmakers. "Depending on which state they live in, there could be other mandates that car makers and consumers will be working to live within that may further influence their production or purchasing considerations," Lance tells us, citing the California Executive Order that mandates all cars sold in the state to be zero-emission vehicles by 2035.

A pushback against the EPA's guidelines is imminent, but the broad stroke is that electrification is here to stay — either through BEVs or hybrid solutions. It's up to car brands to decide how they adapt to it without losing their competitive edge. The likes of Tesla, sitting atop a tightly consolidated supply chain and advanced software stack, seem like the obvious beneficiaries. But if the EPA rules finally push rivals to shift gears, the market will get competitive and price wars are inevitable. That ultimately and ideally means more choice and likely lower costs. Either way, the consumer seems to be the winner.