Robinhood Crypto Trading Outage Strikes As Dogecoin Spikes [Update]

Robinhood is experiencing issues this morning, with the company acknowledging that users are having problems with crypto trading. It's another frustrating outage for the popular trading platform, and comes as meme-stock turned Elon Musk favorite Dogecoin (aka DOGE) sees a surge in price.

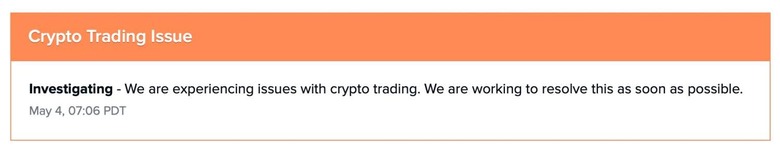

"We're currently experiencing issues with crypto trading," Robinhood confirmed on its Twitter support account. "We're working to resolve this as soon as possible."

According to the Robinhood service status tracker, the company began investigating the problem at 10:06am EDT today, May 4. Almost all of the company's other services are unaffected, meaning users are still able to participate in equities, options, and fractional equities trading. Bank transfers are experiencing "degraded performance," Robinhood says, though it's unclear if that's connected at all to the crypto trading problems.

Unsurprisingly, Robinhood users aren't impressed. The company's Twitter is being peppered with frustrated would-be crypto traders, who had been hoping to take advantage of DOGE's rise this morning. The stock – which began as a joke, but which gained unexpected traction in no small part due to Elon Musk's vocal support for Dogecoin on Twitter – has surged significantly in recent weeks, hitting an all-time high today.

That coincided with the listing of DOGE on eToro, a multi-asset brokerage, on Monday, and then Gemini following suit on Tuesday. eToro claimed strong client demand had led to the decision.

It's not the first time Robinhood has crashed when DOGE surged. The same thing happened back in April, in fact.

Robinhood has been a popular platform for newbie crypto traders, with the company's easy to use app and fractional share system proving alluring for those wanting to dip a toe into the market. However that popularity has brought headaches with it, too. Earlier this year, as GameStop (GME) shares surged following Reddit interest, Robinhood enacted tough caps on trading for it and other highly volatile shares.

The justification for that, Robinhood said, was its back-end commitments to cover trades in place, which had rocketed with the sudden interest in a handful of companies. All the same, that didn't stop conspiracy theories that everyday investors were being manipulated while hedge funds and larger organizations were still allowed to trade.

Update: Robinhood says crypto trading should be operational for all users again.