8 Mobile Tax Apps To Ease Your Filing Season Woes

Tax season is again upon us, and the big questions include where to file, who to use to file, and how much my refund will be. While physical tax preparers are still big business for those who need extra help with complex tax issues, many mobile apps can guide you through filing your returns. These apps usually take the form of a guided interview, with written questions to understand your income, liabilities, deductions, and potential tax credits. The app then inputs everything into the correct sections of the IRS and state forms and sends them off to be accepted.

Should you use one of these tax apps instead of a tax professional to handle your filing? Most taxpayers will be fine with one of the mobile apps, which walks you through every aspect of your taxes. For filers with more complicated tax pictures, many of the tax apps have higher, paid tiers that give access to a tax professional. Some apps let you upload your documents and have a professional put the returns together without you needing to input a single number. With the IRS saying the average refund in 2020 was $1,232, it's up to you to decide if the app or the professional will give you the maximum amount of refund when you file.

Best overall: TurboTax

TurboTax is the most expensive tax preparation service, but you get more help and deep options for guided returns if that's what you need. It was the first to implement the interview-style program for preparing your taxes, and the user experience has iterated and improved over the years. You never have to think about which section of the IRS forms or schedules to put numbers in because the app does everything for you. You can get expert support via live chat or video calls if you get stuck.

You can file your taxes on the TurboTax Android app or the iOS app or switch to the website during your tax preparation, and all of your data will keep in sync. The service has a free version, which handles Form 1040 only without any additional schedules if your tax situation is more complex. If you need more in-depth help, TurboTax Deluxe will cost you $49 for federal returns, and help you with Schedule A, which allows for itemized deductions. You need TurboTax Premier ($89 for federal) to report investment or rental income. To deal with self-employment, you need TurboTax Self-Employed, which comes out at $119, but you also get a year of Intuit's QuickBooks Self-Employed service for easy invoicing and tracking of expenses. State filing is an additional $54 for any paid tiers. TurboTax Live has four tiers of assisted preparation and four tiers of full service, starting from $0 and going up to $399 if you need full service for your self-employment gigs. This time of year, you can often find discounts on all TurboTax packages.

Best for free filing: Cash App Taxes

You can file your federal and state taxes with Cash App Taxes, which won't cost you a cent. Previously known as Credit Karma Taxes, the tax preparation service was sold to Cash App in November 2021. It supports most of the main IRS forms and schedules, so almost everyone can use it, in line with parent company Square's "purpose of economic empowerment." You'll have to find a competing service if your taxes need one of the missing IRS forms. You'll also have to look elsewhere if you need to file returns in multiple states or do part-year returns. The one thing you miss by not paying for the service is that the level of help content isn't the same quality as the major players in the tax preparation market.

You'll need the Android or iOS Cash App mobile app installed on your phone to start preparing your taxes. The only way to log into the Cash App Taxes website is to scan a QR code with the mobile app. That adds another layer of security to your taxes, which is no small thing. You can also file your taxes from the mobile app, which is a new addition. Customers also get free Audit Defense, a Max Refund Guarantee, and an Accurate Calculations Guarantee.

Best for easy uploads: H&R MyBlock

H&R Block is one of the premier tax prep companies, and their mobile apps have everything you need for tax season. Many filers will be just fine with the free option. Still, there are upcharges for additional help ranging from expert tax professional help, either after you put your return together or during the process with various live help options. To make things faster, you can take pictures of your W-2 and other tax forms like 1099s with the camera on your smartphone. Then H&R Block does text recognition on the form, putting the info where it needs to be on your return.

H&R Block has four tiers which go up in price depending on how much help you want and how complex your taxes are. There's a free tier; Deluxe Online, which is $55 for federal and $37 per state; Premium Online, which is $75 federal and $37 per state; and Self-Employed Online, which tops out at $110 federal and $37 per state. Again, during tax season, there are often discounts available. The free tier is perfect for those who only need to file their Form 1040 while supporting W-2 income, student costs, retirement income, and some credits like the Child Tax Credit and Earned Income Credit. Mobile apps are available for both Android and iOS.

Best for affordability: TaxSlayer

TaxSlayer doesn't just take the hard work out of your tax returns with an easy-to-navigate UI, it takes the sting out of your filing with some of the lowest fees of all tax prep services. Once you get onto the paid tiers, they automatically import W-2 information from your payroll providers and find the necessary information from your last year's returns. The interview-style tax prep walks you through entering all the details the IRS needs, and you can navigate your return at any time to change things if you remember something else.

Simple tax returns can be filed by TaxSlayer for free, with state filing included. Classic is $19.95 and does all forms, deductions, and credits. Premium adds live chat access to Tax Pros and preferred support via phone or email for $39.95. Self-Employed is $49.95 and walks you through deductions, expenses, income, and Schedule C. The three paid tiers charge $39.95 per state return you must file. TaxSlayer's mobile apps for both Android and iOS make it easy to navigate through your filing.

Best for peace of mind: TaxAct Express

While all the tax prep services will help you get your returns in, if you need complex help, TaxAct will give you the best experience for the least cost. The simple interface walks you through preparing your return, points out deductions and credits, and has an add-on for a professional to look over things before the returns are filed (for an additional fee). Personalized tax expert help is free, through Xpert Assist. The fees can be paid out of your potential tax refund, so you don't even need to pay upfront. The one major thing TaxAct does differently is it will pay any additional tax owed to the IRS, up to $100,000 if its software makes an error.

TaxAct has a free tier for simple Form 1040 returns. Expect to pay $39.95 for filing your state return, even if the federal is free. The next tier is $24.95 and includes more deduction options like childcare expense credits, homeowner credits, health savings account owners, and student loan holders. Premier is $34.95 and adds forms for investment income, rental property income, and foreign bank accounts. Self-Employed is $64.95 and covers credits and deductions for anyone self-employed. All the paid tiers cost $44.95 for filing state returns. The TaxAct mobile apps are very similar to the website-based experience and are easy to use.

Best for experienced filers: Liberty Tax

Liberty Tax has less hand-holding than most other services, which experienced tax filers might appreciate. The tax preparer also has in-person tax offices where you can transfer your filing and forms if you get stuck and need more help than the phone support can give. You can also get a free double-check at any participating location to ensure your returns are accurate before sending them to the IRS.

Unlike all the other tax preparers on this list, LibertyTax doesn't offer a free option. It's still very much a brick-and-mortar operation and prices accordingly. The basic tier is $55.95 for federal returns, including Form 1040 and 8853 and Schedule A and B. Deluxe costs $75.95 for federal and adds some additional forms and Schedule C, with the ability to itemize deductions and claim tax breaks. The Premium tier is $95.95 and is best for self-employed tax filers or those with international tax liabilities. All tiers charge $36.95 for every state return you must file along with your federal one, and the tiers are often discounted during tax season. The LibertyTax mobile app lets you snap pictures of all your tax documents, and a qualified tax professional will put your return together.

Best for freelancers: Quickbooks Self-Employed

Quickbooks Self-Employed isn't a tax filing app, although you can get a discount on filing through TurboTax as they're both owned by Intuit. Designed for sole proprietors and freelancers, it has all the tools you need to keep an eye on income, expenses, and everything else you will need for tax season. You can invite your accountant or tax preparer to see your books and keep track of the business-related entries in your bank account. The service is aimed at users with a side gig, so if you already have separate business banking and credit, you'll want to look at QuickBooks Online or comparable services from other vendors.

Subscription costs for the Self-Employed version of Quickbooks are $15 per month, with a 50% discount for the first three months of service. This subscription adds the ability to invoice customers and clients, send pay-enabled invoices, track expenses and income, use QuickBooks Payments, and track mileage.

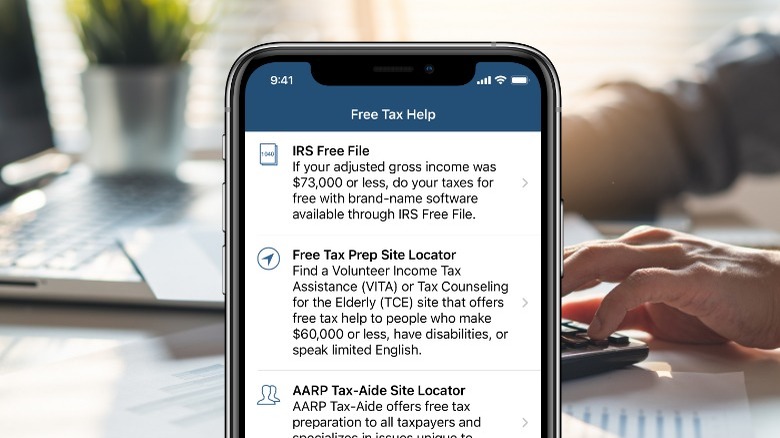

Best for information: IRS2Go Mobile App

The IRS has its own mobile app, IRS2Go, a handy repository for information and limited tax-related tasks. It's available on Android, Amazon Fire, and iOS and helps before and after filing your return. The app lets you track your filing and refund status, with the status being updated usually within 24 hours from electronic filing and four weeks from paper filing. While the app won't help you file your return, it does have links to IRS Free File, which is the free filing service for taxpayers with an adjusted gross income of $73,000 or less.

The app also allows for paying federal taxes owed using IRS Direct Pay which doesn't come with any associated fees. Other links help you find free tax help if you qualify, like if you have disabilities, are elderly, speak limited English, and make under $58,000 annually. Another search finds AARP Tax-Aide Sites, which have AARP volunteers helping those older than 50 with low or limited incomes.