6 Apps That Will Help You Stick To Your Budget In 2024

Whether you're a broke student struggling to pay your tuition or are a freelancer with multiple sources of cash inflow, money definitely does not come easy. Regardless of what you do or how much you earn, setting aside some money to help you out in rocky times is crucial. However, keeping track of your finances is far from easy, and figuring out how to begin is often the most difficult part.

Since Notion has tons of templates for budgeting monthly expenses, you may find people recommending you use it to track your finances. However, if you've never used Notion, you may have to take time to familiarize yourself with the platform. Other than the time you'll need to dedicate to learning the ins and outs of Notion, you may be better off using a dedicated app to budget your expenses.

Fortunately, there are tons of iPhone and Android apps that you can install on your device to help you stick to your budget. All the apps we've included are rated highly in the Apple Store and Google Play Store and are downloaded by tens of thousands globally.

Goodbudget

Goodbudget is a free app available on both Android and iOS. The budgeting app developed by Dayspring Partners has over a million downloads on the Google Play Store and has a rating of 4.6 stars on the App Store.

Goodbudget uses the envelope system, a budgeting method that allows you to track your monthly spending by dividing your monthly income into separate envelopes. Each envelope represents a specific expense category, such as groceries, food and dining out, and gas. Depending on how much you think you'll need to allocate to each expense, you'll have to assign an amount to each envelope. Make sure to omit your fixed expenses, like tuition and rent, from your income before allocating amounts to your envelopes.

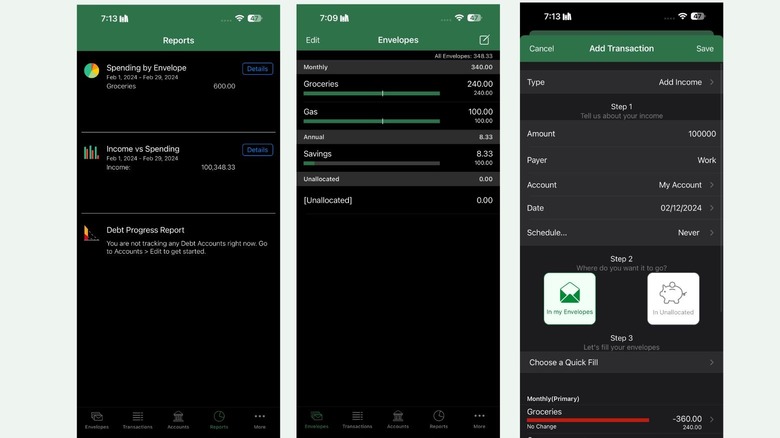

Once each envelope has been created, you can only spend the money assigned to each envelope. Once you've spent all the money in a certain envelope, you'll need to wait until the next month to spend in that category. When you launch the app, you'll see four tabs: Envelopes, Transactions, Accounts, and Reports.

The Envelopes tab displays your envelopes and the remaining amount for each envelope. As the name suggests, the Transactions tab lists all your financial transactions and is the tab you need to go to as soon as you receive a payment or spend some money. The Accounts tab displays all your savings, checking, cash, and debt accounts. The Reports tab visually displays your spending habits by providing charts for how much you spend by envelope, your monthly income vs spending, and if you track debt accounts, your debt progress report. Unfortunately, you can only add a maximum of 10 monthly and annual envelopes on a free account.

NerdWallet

If you aren't a fan of the envelope budgeting system to track your finances, we recommend giving the 50/30/20 tracking system a shot. Put simply, to use this budgeting system, you need to split your expenses into three different categories: needs (non-negotiable expenses), wants (non-essential purchases), and savings. NerdWallet is a free app available on both iOS and Android.

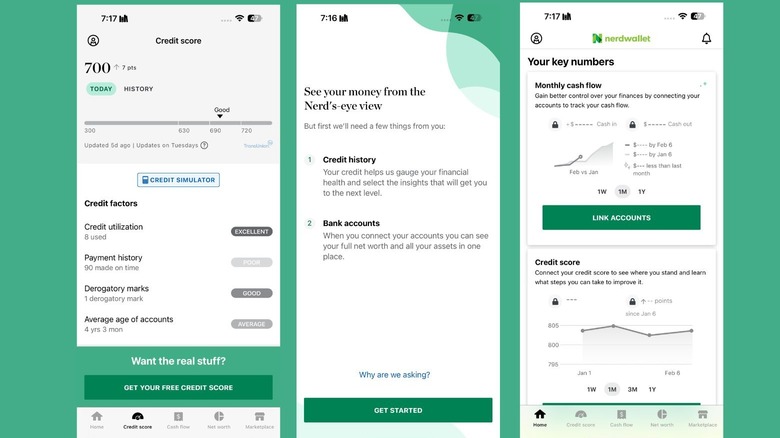

With over a million downloads on the Google Play Store and a solid 4.8-star rating on the App Store, there's no doubt that a lot of people trust this app with their finances. To begin tracking your spending with NerdWallet, you only need to create an account and link it with your credit and debit cards, savings accounts, checking accounts, etc. You'll also be asked to enter some personal information, and then your past transactions will be grouped into different categories automatically.

Keep in mind that NerdWallet can access your transaction history and credit score. The app automates the process of manually tracking each transaction you make, which is helpful if you tend to forget things easily. What makes this app stand out from the others is that NerdWallet notes the dates of your past payments and then lists your upcoming bills.

So, if you have a lot of bills to pay off every month, this feature can help. You can also lock the app and use your device's passcode or Face ID to unlock it to ensure your finance record stays private.

Wallet

If it's your first time tracking your finances and you're looking for an app that has an easy-to-use interface, you'll love Wallet. Designed by BudgetBakers, the Wallet app has over five million downloads on the Google Play Store and has 4.4 stars. The free app is available on both Android and iOS devices.

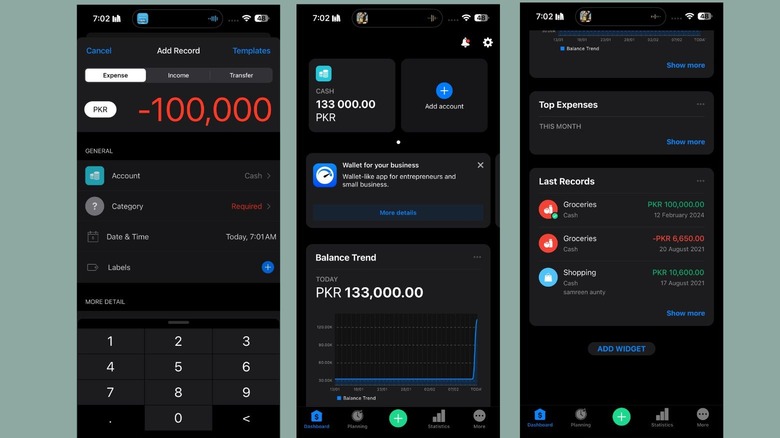

Unlike most of the other budgeting apps you'll find, all you need to do to begin tracking your finances using Wallet is to sign up with your Google account. Once you connect Wallet with your bank account, each transaction you make will automatically be added to your expenses. With Wallet's premium subscription, your transactions will also automatically be categorized. However, if you're wary of linking your bank account with a third-party app, you can add your balance and manually record each expense as time passes.

To avoid overspending, you can set up a one-time or recurring budget to help you see where your money is going. If you tend to forget to pay your bills on time and then have to pay an additional late fee, you can use the app's Planned Payments feature to keep track of any transactions you need to make.

Sometimes, you may need a reality check to remind you not to spend too much. One of the best parts about using the Wallet app is the fact that you get a quick overview of your top expenses and your last transactions as soon as you launch the app. You can also add a widget to your iPhone home screen or your Android home screen, displaying the amount you currently have and how much of your income you've already spent.

Money Manager Expenses & Budget

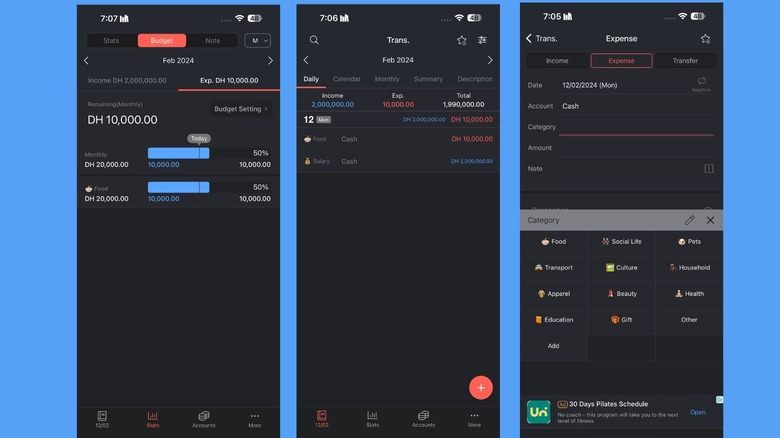

If you're someone who likes planning months ahead of time, the Money Manager Expenses & Budget is an app you need on your device. Money Manager Expense & Budget is a finance tracking app designed by Realbyte Inc. and has over ten million downloads on the Google Play Store. It's free to download and is available on both Android and iOS devices. When you first launch the app, it'll guide you through the initial setup process. You can then manually tweak the app's default settings after understanding how the app works.

The app allows you to create weekly, monthly, and annual budgets for several categories like food, social life, pets, transport, culture, household, apparel, and more. You can view all the transactions you made at the end of the moment in a neat calendar visual. The app can keep track of multiple financial accounts like your debit card, investments, cash, loan, insurance, etc.

If you receive a payment or need to make a transaction on a specific day of every month, you can also set up recurring expenses and incomes to be automatically added to your account. If you subscribe to the app's premium version, the app can also be connected to your PC; you can enjoy an ad-free experience and connect more than 10 accounts.

Honeydue

If you live with your significant other and are tired of falling behind on your bills, Honeydue is an app you need to install on your device right away. Developed by WalletIQ Inc., the couple finance tracking app has been downloaded by more than 100K people on the Google Play Store.

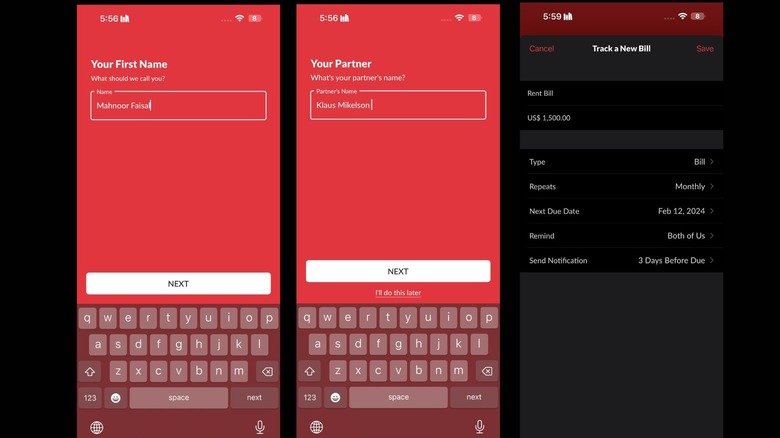

The app has been primarily designed to cater to couples, is available on both Android and iOS devices, and is free of cost. The app has an easy-to-use interface; setting it up will only take a few minutes. When configuring the app initially, you'll be asked to enter your name, your partner's name, and their email. You'll then be asked to enter any common bills.

Honeydue not only helps you and your partner ensure you're both on the same page regarding your spending budget but also reminds you before your bills are due. If you and your partner decide to split a meal or purchase something together, you can also input split expenses to let the other person know how much they owe you. Each transaction is color-coded according to which category it belongs to, along with an emoji indicating whether you or your partner made that purchase.

Rocket Money

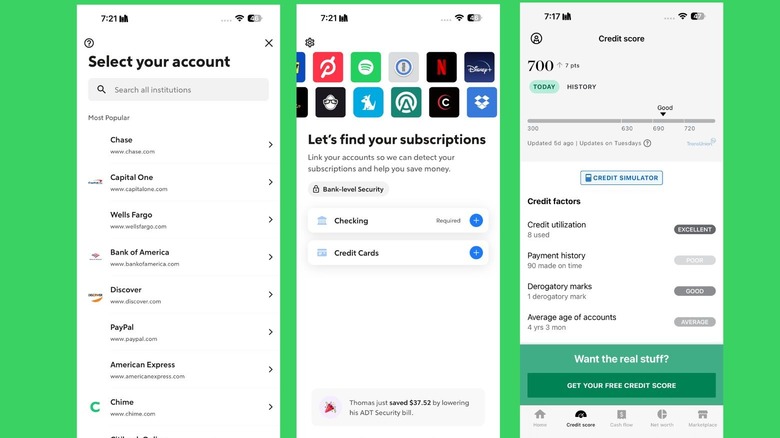

Rocket Money, formerly Truebill, is another great app for limiting overspending. The app is available on iOS and Android devices and is rated 4.3 stars on both the Google Play Store and App Store. Upon installing the app, you'll be asked to answer a few questions. Some of the questions include how Rocket Money can help you achieve your top financial goals and how you currently manage your finances.

Rocket Money can help you figure out when your money goes and tracks your bank and investment accounts. A significant chunk of your income also probably goes towards subscriptions. Rocket Money can help you cut down on the amount you spend every month on subscriptions.

The app hunts down recurring subscriptions you've accidentally subscribed to and cancels them on your behalf. One of the worst things that can happen to you (financially) is realizing that you forgot to cancel a free trial. Rocket Money takes it upon itself to help you out in this sector and reminds you when your free trials are nearing their end. Similarly, you'll also be notified if a service you're subscribed to decides to raise its prices. Additionally, the budget tracking app can also track your upcoming bills and notify you when you need to pay them.