NFTs Are Now Almost Worthless: Here Are 5 Reasons Why They Didn't Work

NFTs were one of the biggest internet sensations of the past couple of years. Token collections came out of nowhere and became wildly successful overnight despite being quoted at mind-boggling prices. Everyone and their cats (and monkeys) scrambled to buy some to secure first-investor advantage and avoid a tale akin to the Bitcoin Pizza Guy's. This was the next big thing. The finance of the future.

Brand and celebrity participation further fueled the frenzy, as big names like luxury car maker Rolls Royce and basketballer Steph Curry joined in on the non-fungible ride. There were serious doubts about the long-term viability of NFTs, but interest in the concept outgrew the criticism as larger transactions, such as Jack Dorsey's $2.9 million sale of the first-ever tweet, occurred.

These days, the NFT euphoria has worn off, and prices have also drastically plummeted. That first tweet NFT is now worth a measly $2,000 (per Forbes), and many of the other collections have tanked just as woefully. A report by dappGambl showed that over 95% of NFT collections now have a market cap of zero ether. By all indications, the NFT bubble is leaking air fast — some might even say it has already burst. In all, the big question is: what went wrong? Why did the NFT market crash?

No utility

Before we begin, here's a quick and simple guide to what NFTs are and how they work, in case all of it is still unclear to you (which is totally understandable).

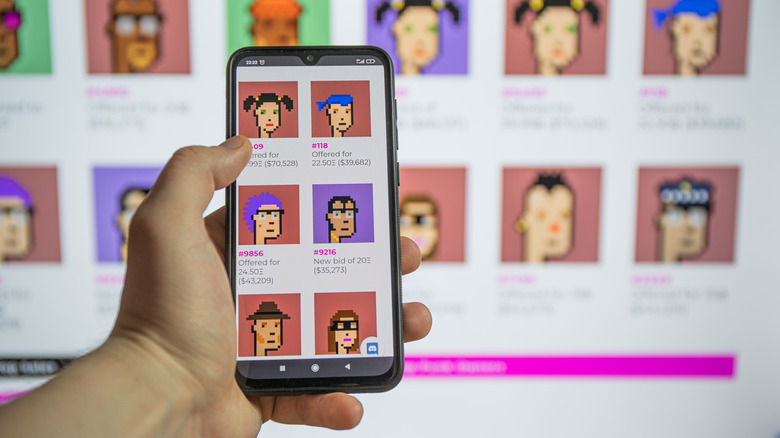

NFTs broke into the mainstream in January 2022, when their trading volume soared to $17.6 billion, a staggering 21,000% growth compared to the previous year, according to a report by NFT analytics platform Nonfungible.com. Based on the number of cryptocurrency wallets registered, the number of active users increased from 89,000 to 2.5 million. There was a 3,700% increase in vendors and a nearly 3,000% increase in buyers, all within that period.

However, this explosive growth did not see a commensurate increase in the use cases of NFTs. The tokens have no real-world utility, and even their virtual application is limited in many ways. There's not much else you can do with an NFT than hold on to it till you find someone who deems it valuable enough to buy it, which is precisely where the ultimate problem lies. NFTs have no intrinsic value — since demand and price are driven by speculative interest, a loss of interest will inevitably result in a price crash.

Some tokens, such as those in the gold standard NFT collection, Bored Ape Yacht Club, buy you access to exclusive content, events, and esteemed social circles. But if you can afford an 80K pixelated smart contract, you might as well join an actual upscale country club.

Supply surpassed demand

Demand and supply govern and regulate the price of a commodity in any economy: prices go up when demand exceeds supply, and vice versa. It's basic economics. But again, the NFT market defies this fundamental rule of commerce. Marketplaces are (and continue to be) flooded with tokens that have no utility or prospects despite there being no demand for them.

Per the data supplied by dappGambl, just 21% of the more than 73,000 NFT collections have been sold; this implies that 79%, or four out of every five NFT collections, have not been sold. This surplus not only undermines token prices but also erodes buyers' confidence in the viability of NFTs as an investment option.

Value and scarcity go hand in hand — the few NFT collections that are still well-priced understand this. For example, the Bored Ape Yacht Club fabricates scarcity by capping the tokens to 10,000 total and creating rare avatars within the collection. Any rational investor would be reluctant to put money into or hope to make money from a market where there is more supply than demand.

Wash trading

There's almost no avoiding wash trading in markets where prices are driven by interest. Wash trading happens when someone buys an asset and "resells" to themselves to create false activity in a bid to generate demand and artificially inflate market prices. It played a significant role in the NFT bubble of 2022, and it's still a major reason for the volatility the overall crypto market is infamous for.

Per a CoinGecko study, NFT wash trading accounted for about 23% of the trading volume across the top six marketplaces combined as of February 2023. And that's a much milder number than the 67.1% recorded the previous year. The act is more popular on NFT marketplaces that incentivize trading activity, such as LooksRare and X2Y2 — bigger names like OpenSea and Blur recorded lesser wash trading numbers, most likely because they charge significant transaction fees.

Wash trading might trigger a transaction or several, but of course, that kind of activity is not sustainable. The unsuspecting investors who fall victim to the scam soon discover the actual value of the token, and prices adjust accordingly. What's ironic about the whole thing is how counterproductive wash trading is for the NFT market. Word gets around about the fraudulent dealings, and that discourages potential investors, which is bad news for a largely speculative market.

No regulation

Another reason why investors pulled out of the NFT market en masse is the utter lack of regulation in the space. In its current state, the crypto economy is a financial Wild West. No authority governs the activities in the space, so there isn't a system of amends for any losses or injustices one might face. All investments have a risk factor, but at least traditional investment is guided and governed by entities to ensure fair play for and by all parties. But there's no such arbitrator if you lose money to an NFT investment, and of course, that makes any investor think twice about buying into the market.

And the problem isn't just that there's no regulation; it's that the NFT market is difficult to regulate. Copyright laws don't apply since many NFTs are variations of one image, and ownership is tricky to track and prove — the law does not yet recognize the blockchain as proof of ownership, plus most NFTs are stored off-chain anyway. Unsurprisingly, such an unregulated market is bound to be prone to scams, and despite it being a nascent industry, the NFT space has had many of those, as well as several costly hacks — which are good enough to warn off many potential investors looking for long-term prospects.

Ridiculous energy consumption

For all its functional and commercial flaws, NFTs are still so costly to make and sell, and that might be the final nail in the coffin for them. The tokens have to be minted for them to be added to the blockchain, and each minting consumes a ridiculous amount of energy. The dappGambl study found about 195,699 NFT collections without ownership and calculated that the energy it would have taken to mint them is the equivalent of about 27 GWh (gigawatt hours), which amounts to about 16,000 metric tons of CO2 emission.

Wired also reports that the sale of a piece of crypto art consumed 8.7 MWh (megawatt hours), which is a whole lot when you consider that the average U.S. household consumes about 10.7 MWh per year. This enormous energy consumption translates to huge gas fees buyers have to pay for transactions. Adrien Book of Honeypot documents that it costs $50 to make a random NFT for research purposes, but it is listed for $1.99 and would attract $100 in gas fees. At the end of the day, only 2 cents goes to the NFT creator in profits. The entire process is financially irrational and detrimental to the environment.

We may see a future where documents for assets become NFTs, from driver's licenses to certificates of ownership or even homes themselves. NFTs have a lot of promise as deeds of authenticity, but monetizing that function before it has even found structure was not a great idea.