Saygus vPhone $10M Fraud: Here's How Sayers Spent The Money

Back about 8 years ago, Android phones of all sorts were being revealed and released by so many companies, they were coming out of the woodwork. The brand Saygus was one of these many "we have an Android too" phone companies, and the "Vphone" was what the company offered... but never delivered. Fast forward to the year 2021 and the creator of Saygus, one Chad Sayers, is at the receiving end of a lawsuit filed by the United States Department of Justice for $10 million USD in Securities fraud.

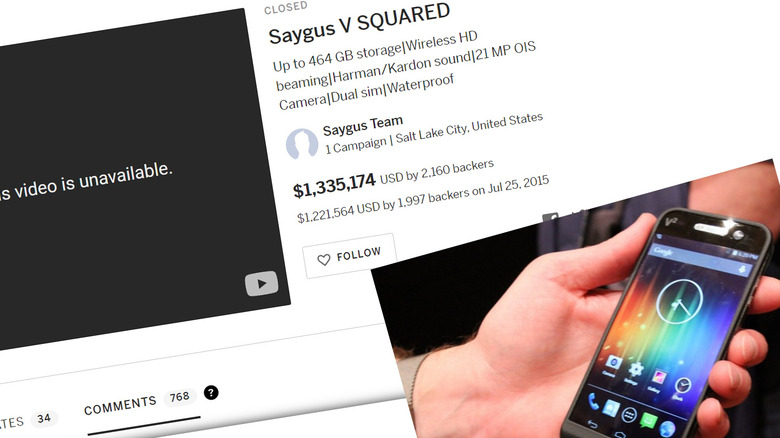

The first Saygus VPhone was revealed in 2009 with some features that were certainly interesting at the time. It had a slide-out keyboard, an early version of Android, a 3.5-inch 800 x 480 pixel touchscreen, and some apparent support from Verizon. This phone was part of what was the Verizon Open Development Initiative, and was supposed to be the first phone in America to support two-way video calling!

This phone was never delivered to customers. Despite the non-delivery of the first phone, Saygus went ahead and revealed another phone called V2, or V Squared at CES 2015. Pre-orders started in January of 2015, and a crowdfunding campaign was launched for the phone in June of 2015. No phones were ever delivered.

In the latest update to the case United States vs. Chad Leon Sayers, the United States Attorney's Office for the District of Utah charged Sayers with one count of Securities Fraud, "alleging that beginning in and around 2012 and continuing to 2020, in the Central Division of the District of Utah, and elsewhere, Mr. Sayer solicited approximately 300 investors to invest approximately $10 million in securities offerings."

After promising "imminent billion-dollar success with the launch of a revolutionary new smart phone," Sayers offered or attempted to offer investments in Saygus. The issue comes in with the last bit: "During the relevant time period, Mr. Sayer, without the authority, knowledge, or approval of investors, used investor funds to pay personal expenses and pay old investors with money obtained from new investors."

Documentation suggests that Sayers "devised and intended to devise a scheme to defraud investors and obtain money and property by means of materially false and fraudulent pretenses, representations and promises, and omissions of material facts." This fraud is alleged to have started in and around 2012 and "continuing to 2020."

Legal documents released this week show that Verizon device certification with Saygus expired in the year 2013. Documentation also suggests that Sayers "regularly used the Saygus business accounts for personal expenses including, but not limited to, paying his own personal loans, credit card bills, personal rent, personal legal fees, and personal car payments."

It's alleged that Sayers used approximately $2.7 million to pay prior investors with new investor money, and $2.17 million for office rent. The defendant is also said to have payed $10k per month on a "consulting contract," $10k a month "for a building sign," and $42,000 per month for "rent on a 25,950 square foot office space for approximately 10 employees."

The defendant is alleged to have spent $800k of investor funds on "settlements on lawsuits with other investors," $500k in legal fees, and $1.7 million to American Express. Also listed are approximately $30k for the defendant's personal credit card and approximately $145k on "shopping, entertainment, food, and personal care."

The United States Attorney's Office for the District of Utah lists the case as scheduled for Jury Trail. This trail is expected to take place on August 30, 2021 at 8:30 AM before Judge David Sam.