BMW Isn't Giving Up On This Controversial Electric Car Technology

When it comes to the future of sustainable automobiles, the odds are heavily in favor of battery electric vehicles (BEVs) and far away from hydrogen fuel cell cars. Yet, a few EV sluggards in the industry are still holding on tightly to the cause of hydrogen fuel cell-powered vehicles, and among them is German giant BMW. In a press release published on August 31, BMW said that it will start making hydrogen fuel cells destined for the BMW iX5 Hydrogen car at its Munich plant.

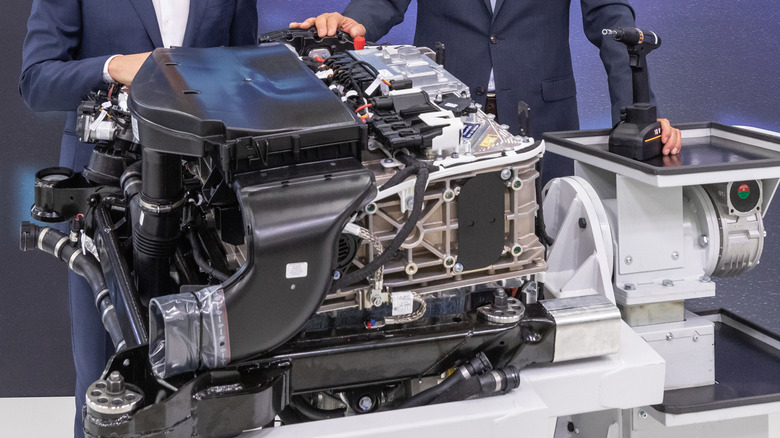

The automaker revealed that the in-house fuel cell systems can muster 125kW of raw power and reach 175 horsepower. Combined with the custom powertrain that bundles BMW's fifth-gen eDrive technology and a high-performance battery, the net output goes up to 275kW and 374 horsepower. The entire setup consisting of a fuel cell, electric motor, and a pair of hydrogen tanks will go inside the iX5, which will only get a limited production run. The model won't be sold to the masses anytime soon, and will instead be used as a showcase in multiple markets.

To recall, fellow German automobile giants Mercedes and Audi have already scrapped plans for fuel cell cars and are betting on an electrified future. It appears that BMW also has similar thoughts about fuel cell cars serving as a complementary solution to BEVs instead of a rival. "We think hydrogen-powered vehicles are ideally placed technologically to fit alongside battery-electric vehicles and complete the electric mobility picture," BMW AG board chairperson Oliver Zipse was quoted as saying.

The road ahead for BMW's hydrogen car tech

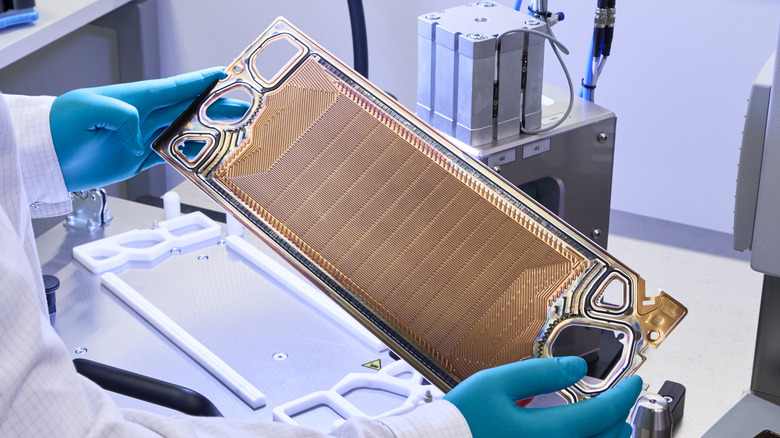

Regarding the progress moving ahead, BMW claims that it has doubled the continuous output of its fuel cell while simultaneously reducing the bulk and size. The company is sourcing the individual fuel cells from Toyota, which are then stacked together and linked with other parts such as a compressor, electrodes, coolant pump, and pressure plate to make a fully-functioning fuel cell system.

As mentioned above, the iX5 Hydrogen fuel cell car will only be deployed for testing and demonstration purposes across the globe. However, BMW sales head Pieter Nota told Nikkei that the company plans to mass produce these vehicles starting as soon as 2025. In March 2022, BMW took the iX5 Hydrogen for test rides in the extreme cold of the Arctic circle and demonstrated that the hydrogen fuel cell car "defies even the lowest temperatures," at least according to the press release it published at that time.

Back then, the company also revealed plans for the small-scale production of the iX5 Hydrogen for showcasing purposes. BMW is being lent a helping hand by Toyota, a long-time collaborator that is also among the first brands to put a hydrogen fuel car on the road with the Mirai sedan. But the biggest problem that BMW faces is catalyzing the development of a solid infrastructure of charging stations, at least in a handful of target markets. Plus, it also needs to prove that this can be a profitable endeavor for fellow brands to seriously consider mass production of at least a few fuel cell cars.

Why is hydrogen fuel cell tech still lagging?

According to the Canadian Hydrogen and Fuel Cell Association, the carbon footprint of a fuel cell car only stands at 2.7 grams per kilometer (around 0.6 miles), while that of electric vehicles is much higher at 20.9 grams over the same distance. Another advantage is the fuel system's bulk. The hydrogen fuel cell tank in the Toyota Mirai is over five times lighter than the battery inside a Tesla Model 3, making it an ideal solution for a wide range of vehicle types than just cars. Hydrogen fuel cell cars make virtually no noise, the only emission is water vapor, they can be juiced up significantly faster than electric cars (that is, in roughly five to 10 minutes), there is no effect of external temperature on fuel efficiency, and the range can also comfortably touch the 300-miles mark.

The mass adoption, however, is hindered by a chicken and egg problem. Despite being more cost-efficient in the long run, there just aren't enough refueling stations for hydrogen-powered cars, which dampens customer enthusiasm as well as adoption by brands. Of course, hydrogen fuel cell cars are also significantly more expensive than BEVs, something that can't be solved without production at scale.