China's EV Boom Has Left It With A Battery (And Crime) Problem

There are plenty of different reasons why electric vehicles haven't yet taken off in certain markets the way automakers and government regulators once hoped they would. Indeed, there may be more EVs on American roads today than there were a decade ago, but for many car buyers, factors such as driving range, charging speed, and price continue to be major hurdles to switching to electric.

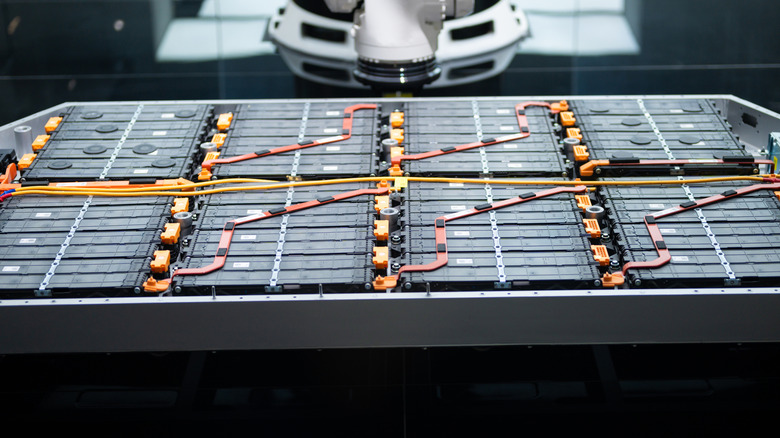

But beyond those consumer-facing issues, there's also the larger problem of what to do with EVs once the cars — and more specifically, their batteries — are used up. It's a problem that's become quite major in the Chinese market, as the early iterations of the country's many EVs have begun to reach the end of their usable lifespans. In fact, it's projected that some 7 million tons of batteries in Chinese-market EVs will be giving up the ghost by 2030.

Globally, the issue of battery disposal and recycling has long been recognized as an issue that comes with the wider adoption of electric vehicles. To that end, there have been promising developments when it comes to recycling components, like methods for harvesting 99% pure lithium from used EV batteries. In China, though, the uniquely rapid growth of EVs over the last decade has led to a large and growing "old battery" problem that's put the environment and public health at risk, as well as opened the door for sketchy criminal operations.

Battery degradation: The flip side of the EV boom

Why is China in particular experiencing this problem so significantly? Because of the speed and scale at which the country has adopted electric vehicles, and also the rapid advancements of the vehicles themselves. While Western governments have provided lots of support for EV adoption over the last decade, it pales in comparison to China, which has used massive government backing to develop its "New Energy Vehicle" industry into a world leader. And in many ways, this has put China ahead of the West when it comes to EV tech and infrastructure.

Within the Chinese market, this has resulted in a significant EV boom. In fact, CNBC reported that nearly 60% of China's new car sales in November 2025 were electric vehicles. But now the country is experiencing the flip side of that boom as drivers look to retire their old EVs, which face a combination of battery degradation and obsolescence in the face of newer models. MIT Technology Review did some investigating on this growing problem and found that China's battery recycling infrastructure has simply not kept pace with the scale of its EV adoption.

Unregulated Chinese EV battery recyclers and their risks

There are many ways old EV batteries can be recycled. They can be fully broken down with their metals reused to make new batteries, or the batteries can be repurposed into new tasks like powering homes. In China, though, many of these unregulated recyclers are playing by their own rules. Because they skirt government regulations, they can often pay more for old batteries, which in turn can be rearranged and resold as "new" battery packs that aren't actually new.

Even worse, when batteries are too damaged or degraded to be reused, they are then just crushed and sold off as raw metals. With no rules being followed, this process can be a major fire risk and very hazardous to the environment, thanks to leaking chemicals and contaminated wastewater. To do all this safely and by the book, there's a lot of upfront costs involved, and industry consensus is that battery and car companies themselves are best positioned to safely recycle retired EV batteries.

Most of China's larger automakers already offer battery recycling services for their old vehicles, often with credits given toward new car purchases. But with a greater number of EVs to be retired in the coming years, it seems that a broader, safer, and more complete recycling system is needed. And while there isn't the same degree of urgency in other global markets, there's no doubt the world's automakers will be watching China's situation closely to see what lessons can be learned.