Nvidia's Market Share Plummeted In China – From 95% To None

Nvidia is riding the AI wave, commanding a lion's share of the GPUs that power AI data centers. The gold rush has pushed the company's market cap to over $4 trillion, but its presence in one of the world's hottest AI markets has come crashing down to nothing, per its chief, with a similarly glum forecast for shareholders interested in the company's Chinese endeavors.

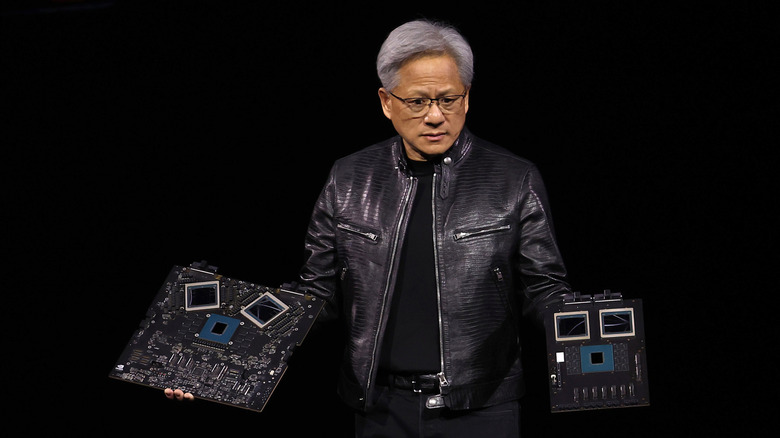

"At the moment, we are 100% out of China, and so China is zero percent," Nvidia CEO Jensen Huang said in an interview with Citadel Securities. "We went from 95% market share to zero percent, and so, I can't imagine any policymaker thinking that that's a good idea." He further added that the policies implemented by the government pushed the U.S. into losing one of the largest markets in the world — although recent developments in 2025 may improve the situation for Nvidia.

Jensen Huang: "We (Nvidia) are 100% out of China. We went from 95% market share to 0%. I can't imagine any policymaker thinking that's a good idea."

Chinese AI labs like DeepSeek now have to use Chinese chips for both inference and training.

Chinese chips will inevitably rise... pic.twitter.com/0xL05sKbff

— Yuchen Jin (@Yuchenj_UW) October 17, 2025

The events leading to Nvidia's exodus from the Chinese market began with a U.S. ban on the sale of AI chips, such as the A100 and H100 chips, to Chinese companies in 2022. Back then, officials argued that doing so would stop the use of AI for China's military purposes, while experts argued that the U.S. simply wanted to maintain its dominance in the AI industry. A year later, the rules were tightened to close any trade loopholes. In 2024, it was reported that entities in China were still able to access the banned Nvidia chips after buying server hardware from companies like Dell. All of this has led to the situation Nvidia finds itself in now.

A brighter road ahead for Nvidia

Nvidia is currently involved in multiple AI projects for U.S.-based companies, including the Stargate Project with OpenAI, which is worth $500 billion and entails building gigawatt-scale data centers for AI development and research. In January this year, the US government imposed tighter export rules on the export of AI chips and even limited companies' ability to share information. The trade restrictions didn't quite bear the intended results, however, as Chinese companies such as DeepSeek, Baidu, and Alibaba continued developing top-tier AI models.

DeepSeek's impact on the market was so staggering that Nvidia lost "$600 billion in market value in the biggest wipe-out in history," as per Bloomberg. Nvidia CEO Jensen Huang was aware of the situation and mentioned that "the export control was a failure" at a tech forum in March (via The Guardian). Huang pointed out that the restrictions only inspired Chinese companies to accelerate their AI development, while adding that China had become home to over 50% of the global AI researcher talent pool.

In the past few months, however, the situation looks to have changed. In May, Nvidia reportedly started development of chips that it could sell to Chinese companies without violating U.S. sanctions and export rules. However, the U.S. government also came up with a surprising solution in August, offering Nvidia and AMD export licenses that will allow them to sell their AI chips to China in exchange for a 15% share of the revenue.