5 Free Excel Templates For Budgeting Monthly Expenses

Most people know and have used Microsoft Excel to some extent, whether that be keeping track of a daily itinerary or creating a calendar for meal planning. There are so many well-known and also unusual ways you can use Excel —you can even create Sudoku puzzles. One common way that people can take advantage of using Excel is to budget monthly expenses. However, there are more ways to do it than simply typing out block by block what you owe and save.

Microsoft offers a plethora of Excel shortcuts and templates for monthly budgeting to get you excited about being financially responsible. It also helps you stick to your plan because many are so visual with pie charts and graphs to help you see where your money is going and if you need to reevaluate your spending habits. Best of all, there's no need to worry about trying to learn any Excel formulas — the templates come ready for you to plug in all your budgeting information. Below are five free-to-use Excel templates to help you get on the right financial track.

Family monthly budget

Excel's family monthly budget template allows you to use your family's income and expenses to budget for the household. There are four sections for this template. The first page gives you a complete overview, so you can access all the information upfront. You'll see the income summary, which comes with a one and two income section along with an extra income line. If you need to add more income, just make sure you slightly alter the formula in the Total Income line. For example, if you click on Projected Total Income, you'll need to change D16 to D17 to take in the new information.

In the third tab, you'll see that you have your list of Expense categories. This list communicates with the Monthly expenses tab, so you'll want to make sure it is set up properly before inputting all of your spending. In the end, everything that you input will translate to your Overview page as a neat little graph, so you can see where all your monthly earnings has gone. At the end of the month, you can either download a new family monthly budget or erase all the amounts for a fresh start.

Budget wheel

Do you like to have a quick and to-the-point visual aid for your budgeting needs? Microsoft has created a simple budget wheel formula that gives you hidden instructions, so you'll never get lost while inputting your income and spending allowance. When you download the spreadsheet, the first page will explain how to find the hidden instructions in column A on the Budget wheel page, which is a fairly straightforward budget that gives you the amount you are allowed to spend for each month. However, the first thing you'll need to do is put your monthly income near the top. From there, everything you type in will be in the chart below.

What's cool about this chart, though, is that the amount you have set to whatever frequency will calculate a monthly budget. For example, if you have $50 weekly for food, the pie chart will show $200 for a month. Additionally, if you have $300 set for every six months, the spreadsheet will divide it by six and only show the $50 budget for the month within the pie chart. So even though it doesn't calculate your actual spending, this chart can help get you get on track with how much you're allowed to spend.

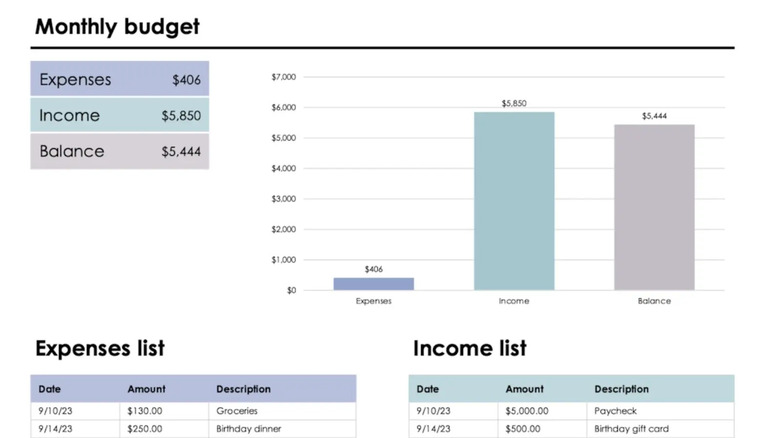

Monthly budget

Are you wanting a simplified one-sheet budget that doesn't require you to think too hard? Microsoft has a monthly budget one-page formula for Excel that will give you exactly what you need. This spreadsheet only focuses on your expenses, income, and balance as a whole. There's no need to have to categorize your expenses or figure out how much you can spend where.

If you scroll down to the second half of the page, you'll see two columns: expense list and income list. These lists are where you will type in any paychecks and extra cash flow along with any transactions that occur during the month. In the expenses list, you can write down a description, so you'll know what the money was spent on, but that is simply for your knowledge. These lists are never-ending too, so you don't need to worry about altering the formula at all. Once you write in a number in either column, it will alter both the graph above and the table to show where you are in your monthly income-to-expense ratio.

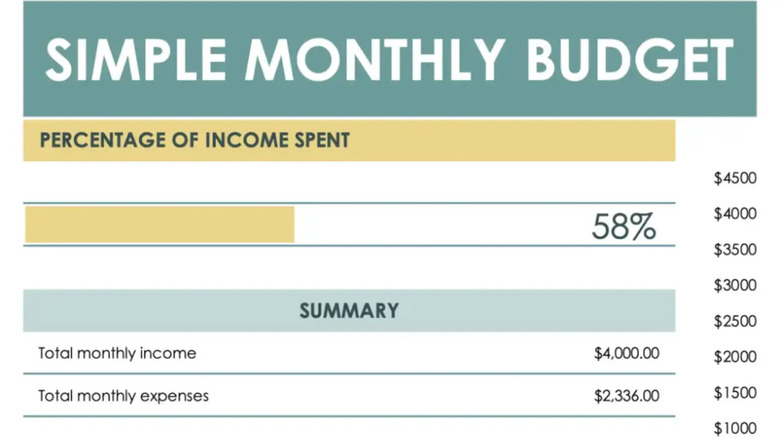

Simple monthly budget

There are so many ways to make handling Excel spreadsheets less stressful, and templates are one of the ways to go. Microsoft's simple monthly budget template is exactly just that. After the summary tab, two other tabs correspond with it — the monthly income tab and the monthly expenses tab. If you are looking for a simple budget, what more could you need beyond that?

The monthly income tab is simply the place to write in any pay or cash flow you have. The monthly expenses tab is where you will type in all your monthly bills and spending. Once done, the summary tab will show not only your total monthly income and expenses but also where you are in income spent. Sometimes seeing how much of what you've spent of your hard-earned money in percentage form can help you slow down your spending habits a bit. If that's not enough, the template does include a bar graph, so there's something for everyone.

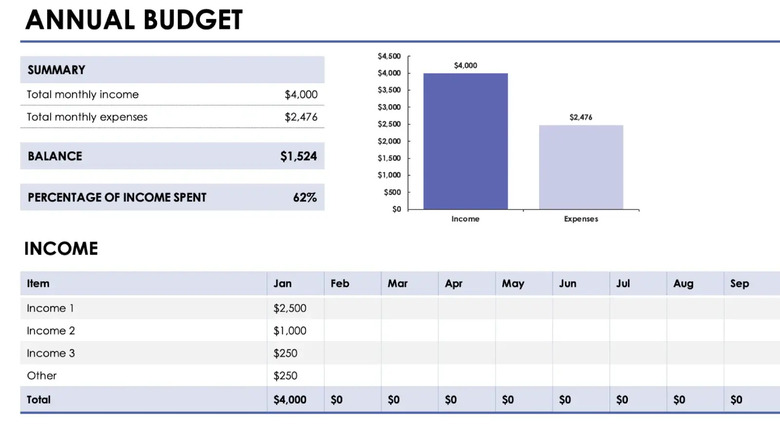

Annual budget

If you're wanting to take your monthly budget to the next level, why not turn it into an annual one? Microsoft's annual budget template allows you to view your spending monthly and watch as your balance changes throughout the year. You'll be able to figure out when your spending habits tend to be higher and lower and possibly use that information to budget even better for the next year.

There are no worries about having to switch tabs between months — everything is ready to view on one page. You'll have a summary list and graph at the top that takes in your income and expenses. Down the page a bit, you'll see where you can input your monthly income and your monthly expenses. If you scroll down a bit more, you'll be able to see a monthly graph of income versus expenses and an annual graph of everything you spend by category. So, if your goal is to save money in the long run, this style budget tool may be what will work best for you.