Apple Card Now Comes With A High-Yield Savings Account

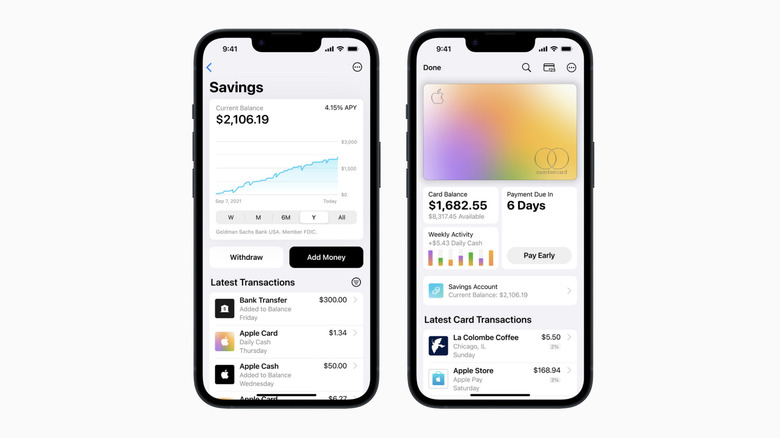

Apple Card owners now have another lucrative reason to bite into Apple's financial services product. The company is introducing a high-yield savings account option for Apple Card users with an annual growth of 4.15%. That's not too shabby, especially compared to Primis, Via, Bask, Salem Direct, and Ivy Bank, which offer the best savings account APY returns. Apple claims it offers an APY over ten times the national average.

The company's savings account initiative, being offered in collaboration with Goldman Sachs, was first announced in October last year. There is no minimum deposit value to obtain the 4.15% APY benefit, and Apple hasn't placed any minimum balance requirements either. All you need is a functional Apple Card and the Wallet app installed on your iPhone, and you're good to go. However, a maximum deposit balance value is set at $250,000 for the Savings Account return.

So far, Apple has been rewarding users with Daily Cash in their digital wallet for purchases made using the Apple Card. However, there has been no way of growing those cash rewards. Now, users can compound its growth by up to 4.15% by simply transferring it to their savings account. There is also an option in the Wallet app to change the destination of rewards from the Daily Cash vault to the savings account with assured returns.

A lucrative deal for Apple diehards

All deposits made in the Apple Card-linked Goldman Sachs account are insured by the Federal Deposit Insurance Corporation ("FDIC). As for the 4.15% interest, Apple says, "fractional interest is rounded to the nearest whole cent each month for credit to your Account." It is also worth pointing out that there are no service charges or maintenance fees from Apple or Goldman Sachs. Still, third-party banking entities may levy a fee subject to their terms and conditions for financial transactions.

Users can withdraw funds from their Apple Cash deposit and funnel it into the savings account at their will, and vice versa. However, the minimum transaction value must be at least $1, while the maximum transaction should be no more than $10,000. Apple has also put together a limit of $20,000 per rolling 7-day period. Cash deposits and wire transfers are not allowed.

Apple will also let you deposit money from another bank account to your Apple Card-linked Goldman Sachs account for higher returns. To link another account with their Apple Card account, users must certify that they are the legitimate owner of that particular bank account registered on US soil. Business accounts are not permitted for the linking process. The savings account initiative comes hot on the heels of the buy-now-pay-later service launched a few weeks ago to make Apple purchases easier.