12 Of The Most User-Friendly Apps For Mobile Banking

In the digital age, convenience is king. Most of us are finding new and innovative ways to manage our lives with a few swipes on our smartphones. But despite our familiarity with smartphones and apps, finding the perfect mobile banking app can sometimes feel like navigating a maze without a map. Luckily, user-friendly banking apps have arrived on the scene, a game-changer in how we interact with our finances right in the palm of our hands.

It's becoming increasingly clear that mobile banking apps such as Chime and Discover Mobile are defining an all-new standard of user expectation. However, they don't just focus on checking account balances or transferring money. They help empower users with tools for financial wellness, ranging from high-yield savings accounts to real-time transaction notifications, internet banking tips to keep your info safe, or even rewards programs that make saving and spending equally satisfying.

We're going to explore apps that have not only earned a reputation for smooth interfaces and intuitive user experiences but also ones that have integrated new features to make managing our money less of a chore. Whether you are a seasoned saver or are just beginning to put aside money, you will find a digital solution to your perfect banking needs in this round-up of the 12 most user-friendly apps for mobile banking.

Even your old phone could save you money in 2024 with these apps. Let's dive in and start simplifying your finances.

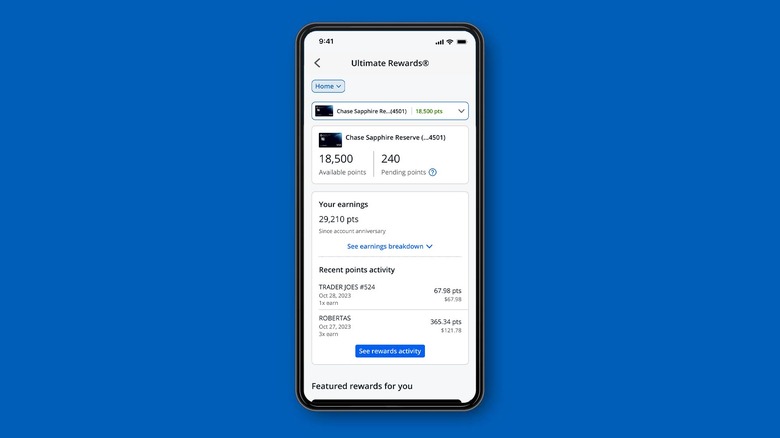

Chase

You're probably already familiar with Chase, or at least heard it buzzing around in conversations about easy banking. Chase is a widely known and trusted bank and its app is basically a Swiss Army knife for all of your daily banking needs. Whether you're sending money to friends on Zelle or Venmo, paying bills, or monitoring your account balance, the Chase Mobile app has the functionality most users look for without fluff.

This app also includes access to the Credit Journey tool, which lets users keep a close eye on their credit score with only a couple of swipes. While not essential, Credit Journey is a useful feature that Chase offers to help anyone manage their financial health, with no Chase account required.

Chase Mobile is a straightforward app that's easy to use and backed by serious security protocols. It has options for investing and trading on the go, and a budget-planning tool for newcomers who need a bit more guidance. Overall, it's a practical choice for those who want a hassle-free banking experience. The Chase Mobile is available for download on iOS and Android.

PNC

The PNC mobile banking app is best known for features that support sending and receiving money, bill scheduling, payment tracking, and establishing savings goals. The array of tools in its Virtual Wallet makes PNC Mobile Banking a go-to app for users aiming to keep a tight rein on their financial lives.

This is a great app that will help you stick to your budget. Users can send and receive money using Zelle, a convenient feature for splitting bills or sharing costs with friends and family. For those trying to avoid overdraft fees, the app's Low Cash Mode can be a lifesaver, giving you more control over your account balances and daily transactions.

The PNC app makes mobile banking easy and convenient with its virtual deposit feature that helps make quick check deposits without stopping by a branch. Plus, the app covers those who don't want to carry around their wallet and cards. A smartphone can be a debit and credit card for transactions, including SmartAccess cards. These practical, everyday features make the PNC app an excellent choice for simplicity and keeping your bank close at hand. The PNC Mobile Banking app is available for download on iOS and Android.

Chime

Chime might not be a familiar name to most, but it's certainly making waves in the banking community. Designed with simplicity and ease of use, the Chime app changes how users interact with their finances. It's an entirely online bank that offers users most of the features of a traditional bank, like checking accounts that come with a debit card, bill pay, and savings accounts, but doesn't offer paper checks.

At every point, Chime puts the user experience first by designing all aspects of the app to be straightforward. With real-time transaction notifications, automated AI tools for saving you money, and fee-free overdrafts up to a limit, among other things, these features empower users to improve their financial wellness. Registration involves just a few taps on your device, paving the way for a hassle-free banking journey.

Chime's commitment to no hidden fees is a breath of fresh air for anyone tired of navigating the fine print. With Chime, what you see is what you get: a clear, efficient, and super user-friendly mobile bank designed with the customer in mind. The Chime app is available for download on iOS and Android.

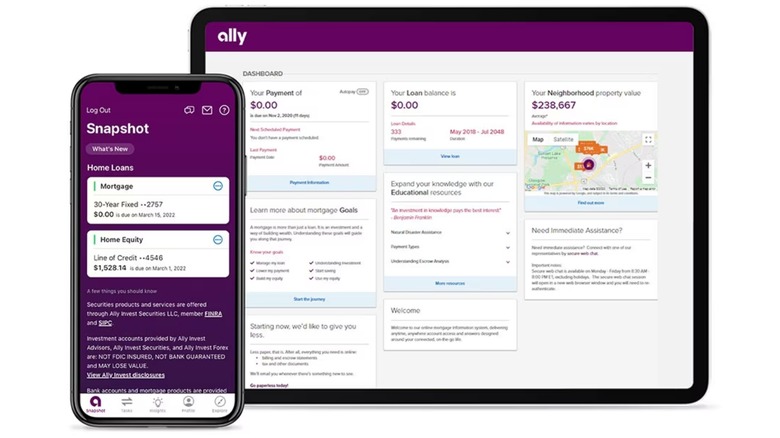

Ally

Ally is one of the world's leading online banks. Ally was awarded "Best Bank of 2024" by NerdWallet and "Best Customer Service" by Money. It shouldn't surprise you that the company works hard to provide the best mobile experience possible. While Ally's app is comprehensive and user-friendly, it stands out for its fee-free structure and saving features.

For users looking for a helping hand in jumpstarting their savings, Ally is a great choice. The app allows you to automate your savings with automatic transfers between checking and savings accounts, with a handy savings feature that rounds up all debit purchases to the nearest dollar and drops the remainder into your savings account. Ally's app also includes a feature that allows users to set and track savings goals — a terrific motivation to build up emergency funds, vacation funds, or plan for big-ticket purchases. It's also a nice visual way to monitor your progress.

Once you've started saving, you might also want to track your spending better. Ally's app also allows users to download a useful function called Card Controls. With this feature, you can customize how your debit card is used, setting spending limits and location controls.

Ally is an excellent option for anyone serious about saving and looking to get a handle on their financial health. The app is designed for ease of use and provides an ultra-convenient digital banking solution. The Ally: Banking & Investing app is available for download on iOS and Android.

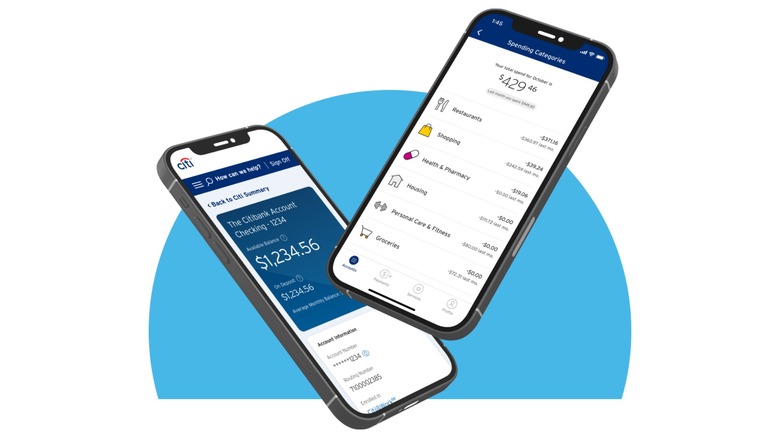

Citi

The Citi Mobile app sets the standard for the modern mobile banking experience, with advanced features that blend with a clean and easy-to-navigate user interface. Citi has put the users' needs (even those of less tech-savvy variety) first. Hence, the streamlined interface ensures you can complete your banking to-do list without wasting time. Whether checking balances, transferring funds, or paying bills, Citi Mobile makes these operations effortless.

Citi Mobile employs cutting-edge security measures, including biometric logins. It also provides real-time alerts, which will keep you posted on suspicious activity on your account. These safety features from an established brand certainly offer users substantial peace of mind.

Citi Mobile packs a punch with its features. You can easily check your account balance, monitor your FICO score, and easily set up and manage your savings goals. In addition, you can also conveniently lock and unlock your debit card, make transfers, and pay bills, among many other available features.

You can even see a brief summary of your accounts without having to log in—very convenient for quick looks. Citi Mobile is a great example of how technology, with its user-centric approach, makes banking possible for all types of users in an even better, easier, more secure, and efficient way.

The Citi Mobile app is available for download on iOS and Android.

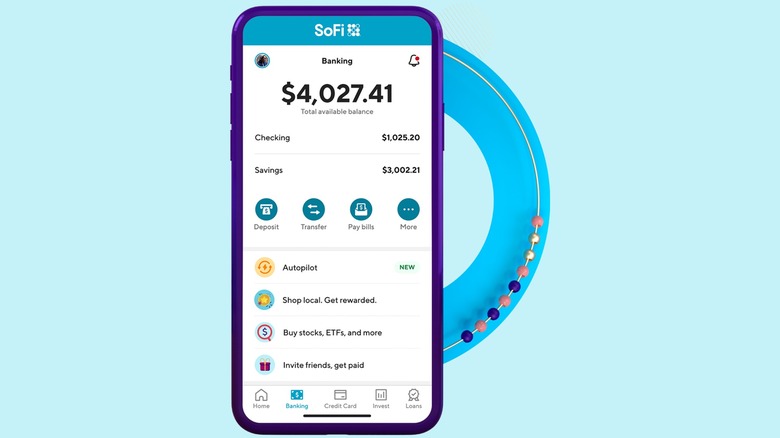

SoFi

SoFi Checking & Savings offers a more down-to-earth, approachable take on banking with its user-friendly app. It's built to make everyday financial tasks like transferring money and depositing checks more straightforward. The app's design is simple and intuitive, which helps take the stress out of managing your money.

SoFi is not only for your day-to-day banking needs, but also aims to improve your overall financial well-being. With no monthly fees and high-interest savings accounts, it can help you save more and reach your goals. Plus, it is packed with plenty of built-in tools. Track spending, set savings goals, get your paycheck early, and even use ATMs without fees across the country. It's designed flexibly, consolidating loans and investments into one place, and is much more than just a depository for your money.

On top of all this, being a SoFi member has its perks, like getting cash back on purchases, discounts on other SoFi products, and free access to financial advisors. However, it's worth mentioning that the app lacks a Zelle integration and includes ads, which can upset an otherwise smooth banking experience. The SoFi Checking & Savings app is available for download on iOS and Android.

Wells Fargo

Although Wells Fargo is an old name in banking, it has stepped up its game in the mobile banking arena. With this single app, you can send money, pay a bill, deposit a check, and get account alerts. It even has a built-in virtual assistant to help answer the many questions you may have about banking—questions that can take all manner of fun and informative directions.

This app was designed to make banking as stress-free as possible. The design is geared toward ease of use and uncomplicated navigation. From features like snapping a pic for a mobile deposit to sending money to friends with Zelle, everything they do is with your time in mind. Custom alerts are another neat touch, helping you keep tabs on your account without having to log in constantly.

Another example of Wells Fargo using technology to make banking smoother is allowing users to have a virtual assistant at their fingertips throughout the banking process. It's convenient for getting quick answers to frequently asked questions without digging through multiple menus.

The Wells Fargo app is a solid pick for those looking for the all-inclusive features of an online banking solution with the security of an established bank. It's designed with the aim of making your financial management easier on the go. The Wells Fargo Mobile app is available for download on iOS and Android.

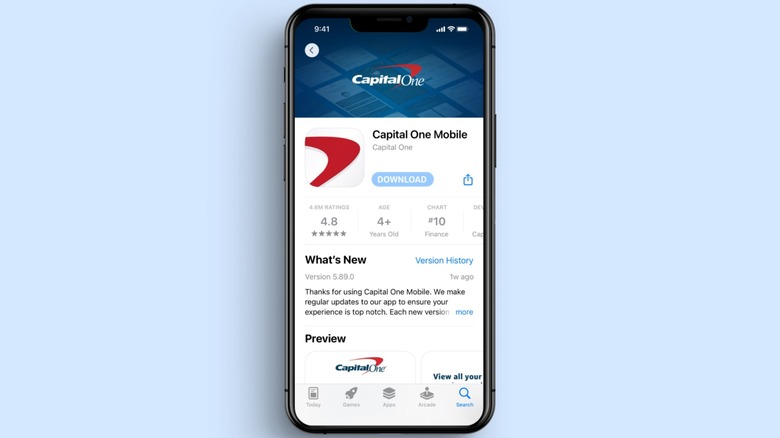

CapitalOne

Capital One may not be the first banking app that springs to mind when considering money management, but this offering is gaining attention for all the right reasons. The company started as a card issuer in the 80s and then moved into auto lending in the next decade. Although it wasn't until 2005 that Capital One got into commercial banking, it's become a trusted name in the financial industry worldwide.

Combining strong security with a smooth user experience can often be a challenge, but Capital One has risen to the challenge by providing an easy-to-navigate and feature-packed mobile solution. The app integrates easily with digital wallets for easy payments and instant real-time purchase notifications. The Capital One app covers all the banking app basics.

It includes capabilities for checking balances, transferring funds, paying bills, and a free credit score tracking program called CreditWise that allows users to keep a weather eye on their credit scores, without running a full report. With high APYs, no account maintenance fees (like many other national banks), and over 70,000 fee-free ATMs, Capital One offers everything you'd want from a full-service bank and the convenience of secure online banking. The CapitalOne Mobile app is available for download on iOS and Android.

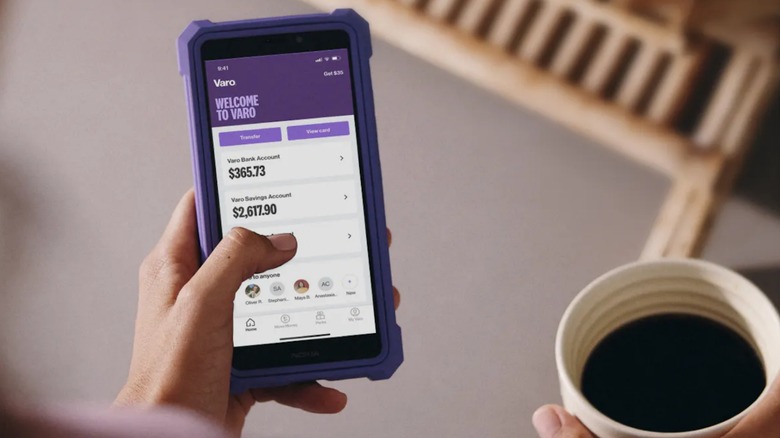

Varo Bank

As an online-only bank, Varo Bank redefines mobile banking with a simplified, efficient app clearly designed with the customer in mind. The clean UI (user interface) from Varo makes transferring money, depositing checks, and checking balances as easy as tapping on a smartphone.

Varo has made a name for itself with one of the best APY rates in the industry. Vero Bank provides a fee-free checking account, savings account, and many savings tools, all of which are available through a user-friendly mobile app.

Varo also incorporates cutting-edge technology to safeguard user information and transactions, much as you'd expect from a digital-first bank. Users rave about the Zelle integration and speedy transactions. Its built-in financial advice and budgeting tools really put it over the top as a solid choice for a wide variety of users' needs.

It's clear from user reviews that both Android and iPhone users love the app, with 4.7 and 4.9 stars, respectively. The app is highly rated, is noted for its excellent customer service, and costs nothing, making it a great choice for mobile banking. One point of contention is that customer service is sometimes hard to reach. The Varo Bank: Mobile Banking app is available for download on iOS and Android.

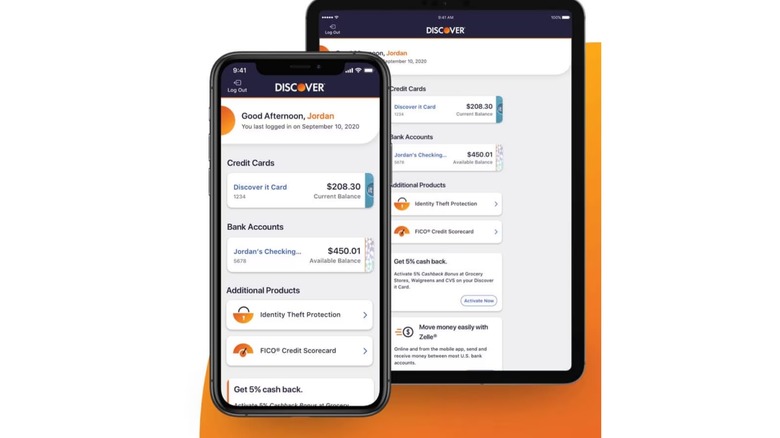

Discover

Tracking your money is easier and perhaps even more fun with Discover Mobile. Discover is consistently rated highly for its customer service and Quick View feature.

But Discover Mobile isn't just about the basics. It shines by bringing together all sorts of financial services. From viewing your credit score to tracking your Discover credit cards to managing investments like CDs and money markets, it all lives in the app. That makes it super easy for you to do dozens of different financial tasks without jumping from app to app.

The security is also top-notch. It allows the option of a fingerprint and iPhone Face ID login, meaning your financial info is locked down tight. And if anything comes up, there are human beings at 24/7 customer services ready to offer help with just a call away.

What's amazing is that Discover rewards you for using it. With the Discover Cash Back Rewards program, you get 1% to 5% cash back on purchases, cash-back matching, and eligible miles programs. The best part, however, is that your cash-back rewards never expire.

Discover Mobile brings plenty to the table. It is an easy-to-use, highly functional, and secure service, that offers rewarding perks and supported by round-the-clock customer support. It is a great choice for anyone looking for a solution that offers much more than just the necessities of a mobile banking platform. The Discover Mobile app is available for download on iOS and Android.

Wise (formerly TransferWise)

Moving and using your money internationally has always been fraught with excessive fees, delays, and unfair exchange rates. Wise has worked for over a decade to change this status quo and has built up a strong reputation as the go-to app for travelers and people who live, study, or work abroad.

The key to Wise's success is its transparent fees and competitive exchange rates. The app provides an up-to-date exchange comparison chart showing you the best mid-market exchange rates. It also clearly states what fees are applied to different transactions and applies them when calculating send and receive totals so that you are not caught off guard by hidden charges. This comprehensive exchange system is paired with the ability to hold money in more than 40 different currency accounts to easily track, move, and manage your funds while on the go.

As expected with such a thorough banking app, Wise accounts come with a debit card that makes easy international payments in over 160 countries. But this app goes beyond just changing currencies and assisting payments. It also helps you take control of your saving goals with Wise Jars. These 'jars' function much like savings accounts with other banks but allow you to save money in various currencies, depending on your region. The Wise app is available for download on iOS and Android.

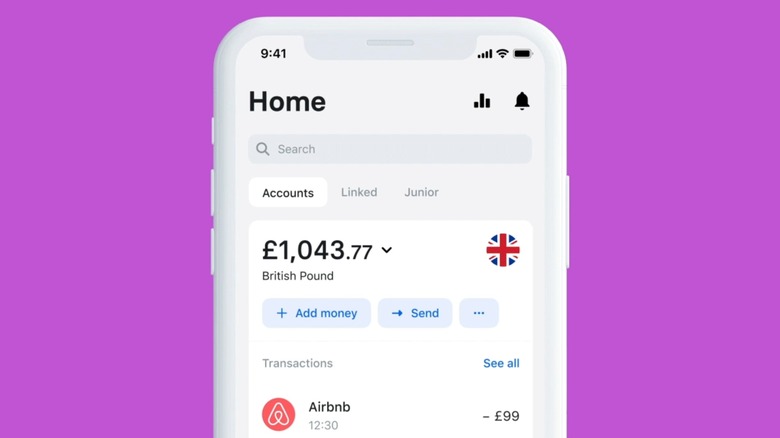

Revolut

Revolut was launched in 2015 and had secured over 100,000 customers by the following year. Today, that number extends beyond 35 million. Built on a mission to provide simplified and borderless financial management to individuals and businesses alike, Revolut has become a strong player in the mobile banking app world.

Initially set up as a prepaid Visa card that allowed travelers to swap between currencies effortlessly, this mobile banking app now has a bunch of new features. A standard personal account gives you easy access to instant international transfers in over 25 currencies as well as a physical and virtual Visa card to access your money fee-free on a network of more than 55,000 ATMs and in stores globally.

Things get even better for the intrepid world traveler with discount airport lounge access in more than 1,400 locations. Revolut is also praised for its user experience, giving customers a functional yet easy-to-navigate app interface to facilitate currency and account transfers as well as no-commission stock trading.

It's little wonder that Revolut has become a favorite among frequent travelers and digital nomads alike. The Revolut app is available for download on iOS and Android.