Sprint Q3 2008 Financial Report: Revenue & Subscribers Both Down

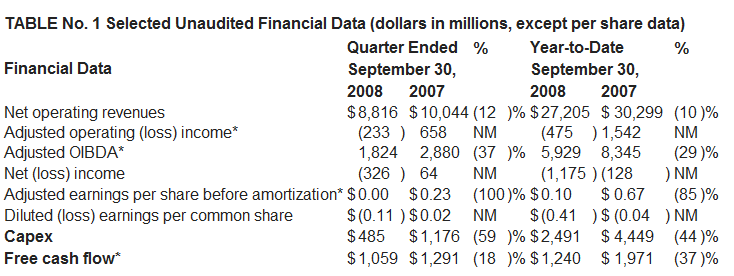

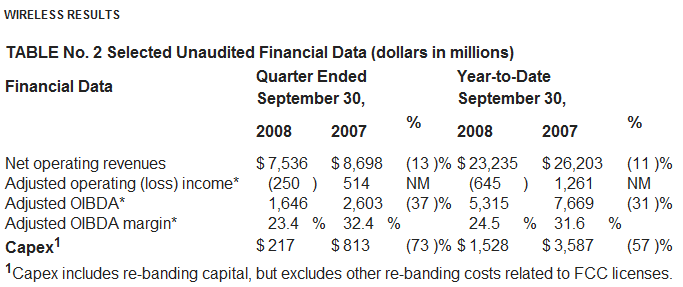

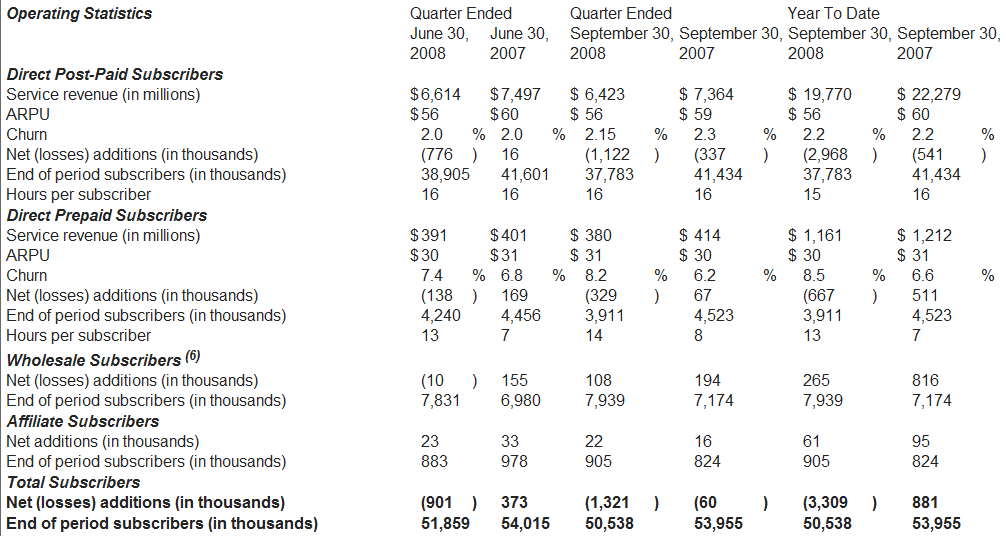

Sprint have announced their Q3 2008 financial performance figures, and while the carrier is putting on a brave face the figures show further decline in wireless revenue. Wireless revenues were down 3-percent from Q2 2008 and a considerable 13-percent from Q3 2007, with reduction in voice call revenue only offset by an increase in data revenue; in fact, the CDMA data average revenue per user (ARPU) rose from 1-percent of total ARPU in Q2 2008 to almost 29-percent in Q3. Overall, Sprint saw a net loss of 1.1m post-pay customers and 329k pre-pay customers in the quarter.

While post-pay ARPU stayed stable from Q1 and Q2, at $56, that's still a reduction of 6-percent over Q3 2007. Pre-pay ARPU rose by a dollar over the same period, to $31. The carrier had a total of 50.5m customers at the end of the quarter, down from 54m at the end of Q3 2007.

Net debt at the end of the period was $18.3bn, comprising total debt of $22.6bn offset by $4.2bn in cash and "marketable securities". Sprint did manage to pay off $1bn during the quarter, though incurred almost half that in further debt as well. Where the carrier did succeed was in customer service, with positive reports in several independent reviews. Full financial statement here.