Solar Cell Imports Slapped With Trump Tariff In China Trade War

The US government will impose a 30-percent tariff on solar cell imports, the Trump administration has confirmed, raising concerns among green power enthusiasts that costs are set to rise. The decision comes amid ongoing complaints from domestic solar panel manufacturers that the Chinese government was subsidizing production of panels and solar cells, and using that cost advantage to flood the US with cheaper models to boost the country's market share. Critics, though, argue that far from creating US jobs, this move will only reduce solar adoption and kill American jobs.

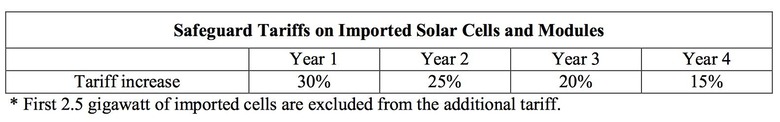

The tariffs are built on a declining scale, according to the government. While in the first year they'll amount to 30-percent on top of imported solar modules and cells, they'll decrease by 5-percent each subsequent year, until reaching 15-percent in year four. The first 2.5 gigawatt of imported cells will be excluded from the tariff.

"In 2011, [the U.S. Department of Commerce] found that China had subsidized its producers, and that those producers were selling their goods in the United States for less than their fair market value, all to the detriment of U.S. manufacturers," Robert Lighthizer, the United States Trade Representative (USTR), said in a statement today. "The United States imposed antidumping and countervailing duties in 2012, but Chinese producers evaded the duties through loopholes and relocating production to Taiwan."

That had a significant impact on US production. With imports reportedly growing by 500-percent between 2012 and 2016, and prices for solar cells and modules dropping by 60-percent, most domestic companies either moved their production outside of the country or shut down altogether. "By 2017, the U.S. solar industry had almost disappeared," Lighthizer says, :"with 25 companies closing since 2012."

According to Lighthizer, the recommendation for tariffs – with initial exclusions – came not from President Trump but the US International Trade Commission (ITC). Though not universally agreed upon, the largest consensus was an increase in duties on solar imports.

It's certainly clear that solar hasn't been as successful in recent years as it has been before, though cheap imports aren't the only factor being blamed. A report by GTM Research into solar installs in Q3 2017 blamed Tesla-owned SolarCity, among other causes, for a slump in adoption. Since acquiring SolarCity, it had been pointed out, Tesla shifted sales into its stores and cut door-to-door residential marketing. That said, the report also cited uncertainty over what was then a work-in-progress response to solar imports as also giving manufacturers pause for thought.

Whether this move by the government to impose tariffs will have a positive impact on domestic production remains to be seen. After all, the USTR points out in today's announcement that last year one of the two remaining US producers of both solar cells and modules ended production and declared bankruptcy. Instead, critics of the tariff like The Solar Energy Industries Association (SEIA) have argued that it's more likely to hurt the job market in the US than benefit it.

"The decision effectively will cause the loss of roughly 23,000 American jobs this year, including many in manufacturing, and it will result in the delay or cancellation of billions of dollars in solar investments," the SEIA said in a statement today. "There were 38,000 jobs in solar manufacturing in the U.S. at the end of 2016, and all but 2,000 made something other than cells and panels, the subject of this case. Those 36,000 Americans manufactured metal racking systems, high-tech inverters, machines that improved solar panel output by tracking the sun and other electrical products."

Somewhat ironically, the SEIA points out, the two domestic solar manufacturers this decision is likely to benefit – Suniva and SolarWorld – are both foreign-owned. While they might be pleased to have the Trump administration on their side, American-owned businesses which also play a role in solar deployment have already been voicing their displeasure. Michael Maulick, the CEO of SunLink which produces solar panel mounts, shares concerns that this could hamper adoption. "While we have always been module agnostic and supported modules of all types," Maulick said, "we also believe the power of choice ultimately provides the most flexibility for customers to make utility-scale and commercial solar more pervasive."

Today's tariff decision also impacts large residential washing machines, with US manufacturers having previously called for "relief against unfair trade practices" after cheaper imports from China, South Korea, and Mexico.

MORE USTR [pdf link]