Robinhood Lifts Many "Volatile" Stock Limits As GameStop Shares Stumble

Robinhood has gradually been lifting its restrictions on volatile share purchases, though stocks at the heart of recent Reddit-fueled surges like GameStop and AMC remain relatively locked down. The popular trading platform found itself at the center of controversy from both users and politicians alike last week, after it unexpectedly clamped down on sales of some of the most in-demand stocks.

It was a move that prompted no shortage of conspiracy theories, though the reality turned out to be more of a lesson in trading minutiae than anything else. Robinhood detailed the process that goes on behind the scenes when a user buys or sells a stock, including the involvement of SEC-registered clearinghouses, and it was clear that many users simply weren't aware of the full details.

"When you buy or sell a stock, Robinhood sends your orders to market makers that execute your trades," Robinhood explained. "Market makers send a record of the trade to Robinhood Securities, which works with a clearinghouse to record the trade. It takes two days for the clearinghouse to transfer the stock to the buyer and funds to the seller. This is known as "clearance and settlement." In other words: everyone getting what they agreed to when the trade executed."

In short, Robinhood explained, clearinghouses are required to have a deposit requirement to cover the settlement period of transacted securities. If the value of those securities rises dramatically – as it did for stocks like GameStop, AMC, BlackBerry, Bed Bath & Beyond, and others – then so too does the deposit requirement. Robinhood saw its requirement increase tenfold, it says, and so was forced to enact buying restrictions on the particularly volatile stocks.

At one point on Friday, January 29, for example, fifty stocks were listed on that roster. Most limited traders to a single share of $AMC, #BBBY, $GME, $KOSS, $SBUX, and other companies.

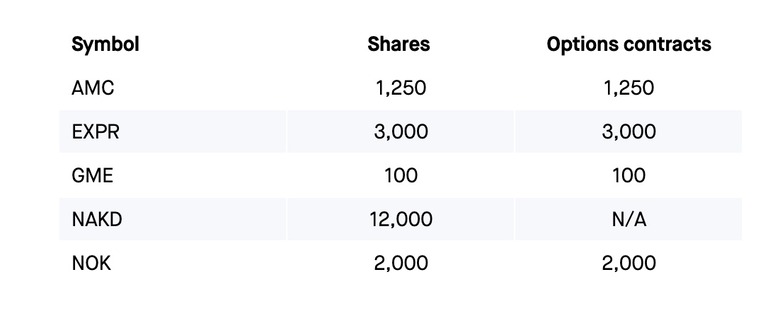

As of today, though, the majority of Robinhood's limits have been lifted. At time of publication, five remain on the volatile list: AMC, EXPR, GME, NAKD, and NOK. That means that traders are capped in how many shares they may hold at any one time, and – in four out of five of the cases – how many options contracts they may have.

Currently, for example, Robinhood users can hold up to 100 GME shares, and up to 1,250 AMC shares. All five remain on the block list for fractional shares, meanwhile. Those with a fractional position will be able to sell and close that, but they can't open new fractional positions. Recurring investments in the volatile stocks have also been blocked.

Whether those restrictions will remain necessary for much longer is questionable. Today, for example, GameStop stock is trading at around $100, a far cry from its high in excess of $450 last week. $KOSS is at around $20, less than a fifth of last week's high, while $AMC shares have sunk to under $8 apiece, down from almost $20 last week.