Qualcomm Q2 Sales Results Show $3.9 Billion In Revenue

It appears that everyone is excited to let the world know that they're massively successful today, both Qualcomm and Apple showing off fabulous numbers in print form for the public to digest. It's a LOT to digest when you've got it all lying out there in front of you, and indeed we DO have their entire sales call and numbers here in this post, but let's see if we can't filter it down a bit for those average citizens who, like me, like to see giant numbers after money signs right underneath year markers.

First, Qualcomm notes that this is a record quarter for them, posting revenues of $3.9 billion being no small pot of cash to scoff at. They've also noted that this translates to a total of $.59 in EPS, Earnings Per Share. There's also another EPS number in there, but unless you know what non-GAAP means, I suggest you skip it. Next, Qualcomm's operating income is $1.07 billion, that being down 3% from the quarter that came before this one, but up 38% from last year at this time. Can you say big growth?

And for those of you who've been lost since the article started, lemme explain who Qualcomm is. It's the brand name given to those friendly folks who create the chipsets that are inside your smartphones. Not ALL smartphones, of course, but they're working to fix that! Take a look at our gigantic Qualcomm Portal to see all the coverage we've got on this radically excellent set of power generators in developers clothing. But before you go, you have a reading assignment – the entire press release below! Hooray!

Qualcomm Announces Second Quarter Fiscal 2011 Results

Record Revenues $3.9 Billion

GAAP EPS $0.59, Non-GAAP EPS $0.86

— Raises Fiscal 2011 Revenue and Earnings Guidance —

SAN DIEGO, April 20, 2011 /PRNewswire-FirstCall/ — Qualcomm Incorporated (Nasdaq: QCOM), a leading developer and innovator of advanced wireless technologies, products and services, today announced results for the second quarter of fiscal 2011 ended March 27, 2011.

"We are pleased to report record quarterly revenues, and we are raising our revenue and earnings guidance for the year as the demand for smartphones across an array of geographies and tiers continues to grow," said Dr. Paul E. Jacobs, chairman and CEO of Qualcomm. "In addition, we have resolved the second of the two previously disclosed licensee disputes. We continue to execute on our strategic priorities as our partners deploy our technologies and solutions to offer leading wireless products and services to consumers worldwide."

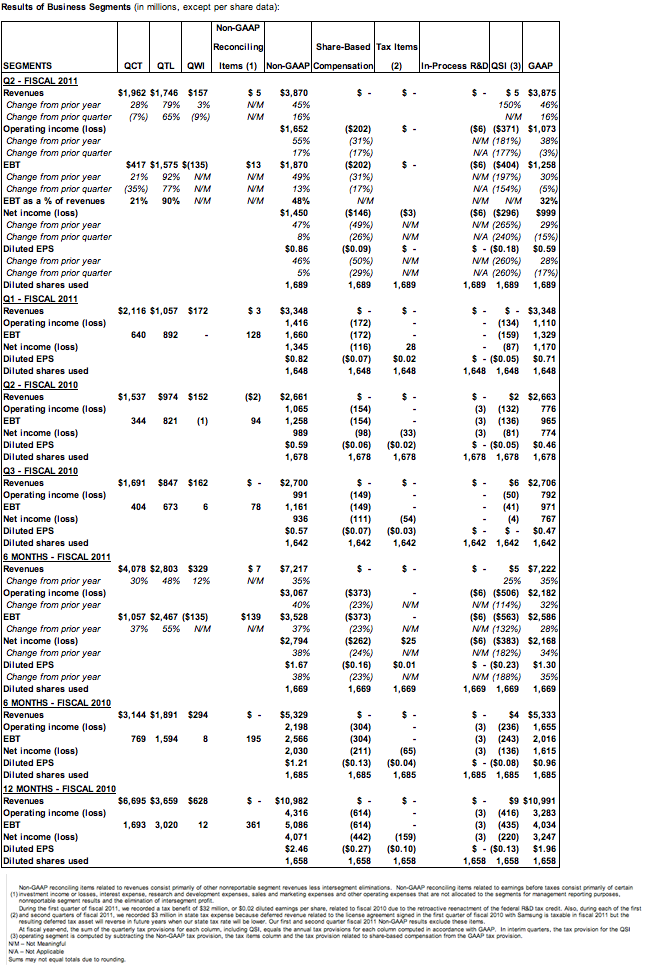

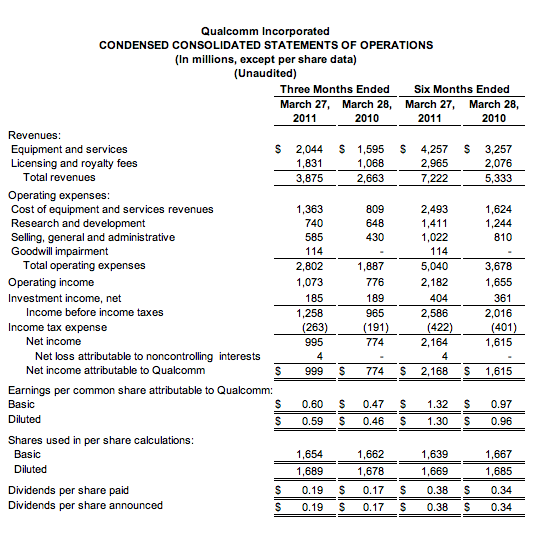

Second Quarter Results (GAAP)

· Revenues: $3.88 billion, up 46 percent year-over-year (y-o-y) and 16 percent sequentially.

· Operating income: $1.07 billion, up 38 percent y-o-y and down 3 percent sequentially.

· Net income:(1) $999 million, up 29 percent y-o-y and down 15 percent sequentially.

· Diluted earnings per share:(1) $0.59, up 28 percent y-o-y and down 17 percent sequentially.

· Effective tax rate: 21 percent for the quarter.

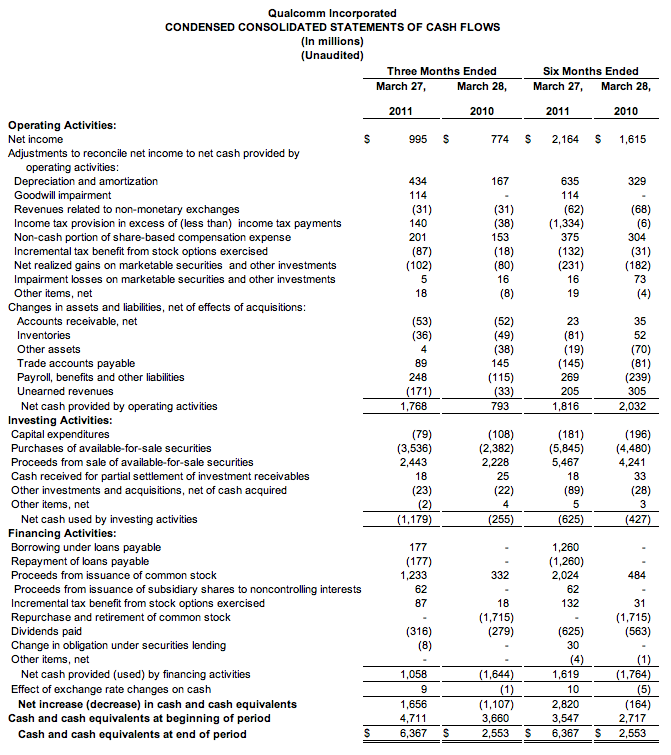

· Operating cash flow: $1.77 billion, up 123 percent y-o-y; 46 percent of revenues.

· Return of capital to stockholders: $316 million, or $0.19 per share, of cash dividends paid.

(1)

Net income and diluted earnings per share throughout this news release are attributable to Qualcomm (i.e., after adjustment for noncontrolling interests), unless otherwise stated.

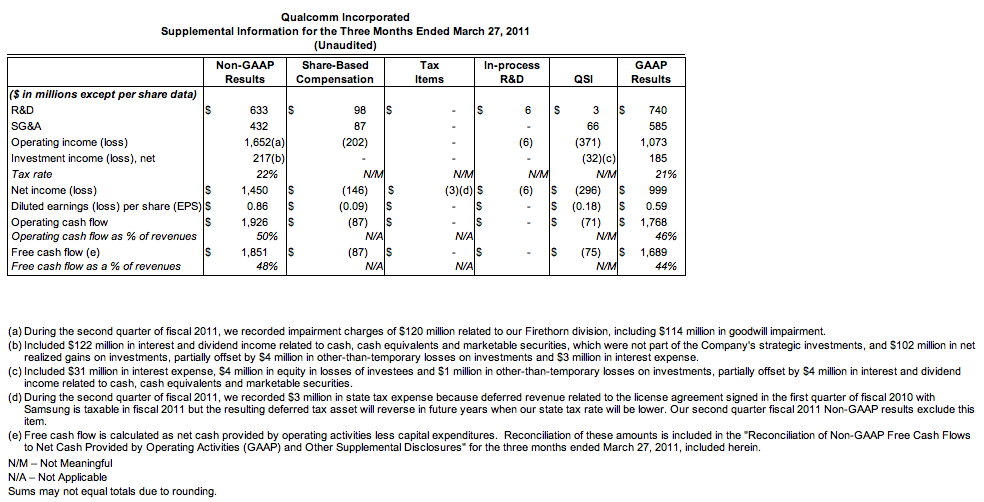

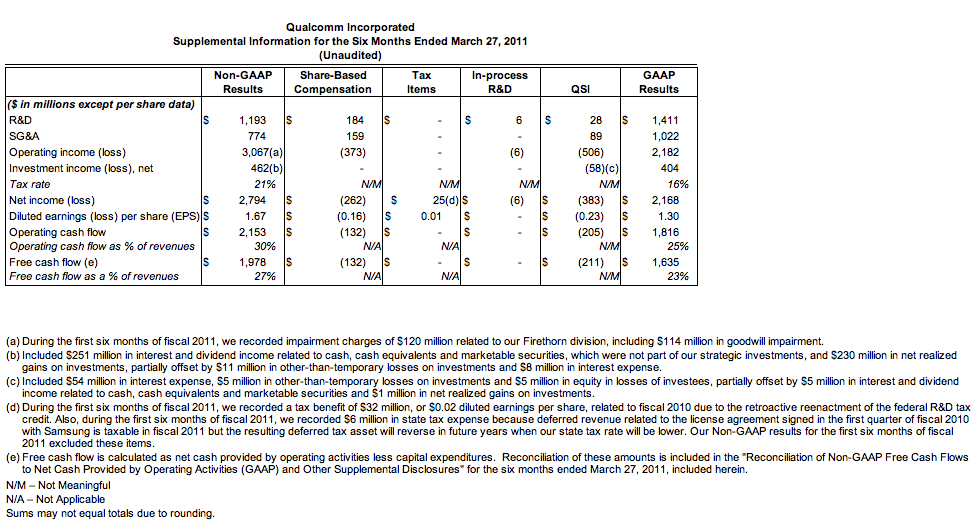

Non-GAAP Second Quarter Results

Non-GAAP results exclude the Qualcomm Strategic Initiatives (QSI) segment, certain share-based compensation, certain tax items that are not related to the current year and acquired in-process research and development (R&D) expense.

· Revenues: $3.87 billion, up 45 percent y-o-y and 16 percent sequentially.

· Operating income: $1.65 billion, up 55 percent y-o-y and 17 percent sequentially.

· Net income: $1.45 billion, up 47 percent y-o-y and 8 percent sequentially.

· Diluted earnings per share: $0.86, up 46 percent y-o-y and 5 percent sequentially. The current quarter excludes $0.18 loss per share attributable to the QSI segment and $0.09 loss per share attributable to certain share-based compensation.

· Effective tax rate: 22 percent for the quarter.

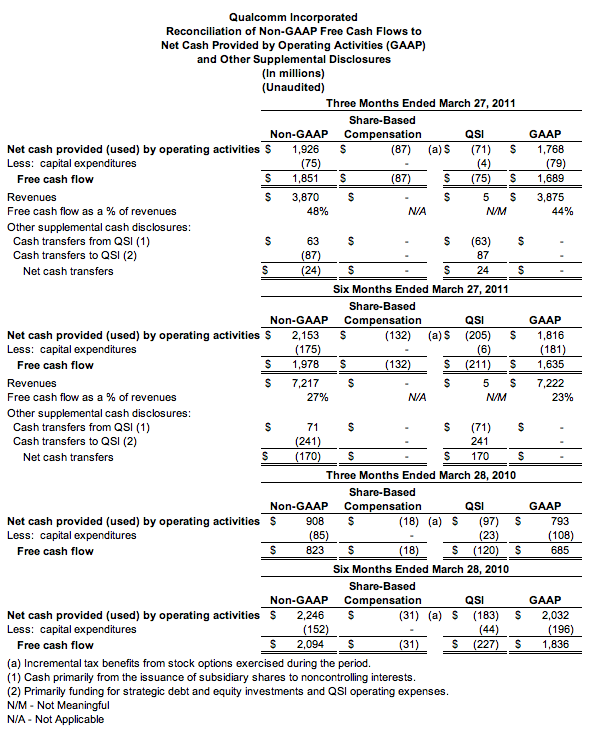

· Free cash flow: $1.85 billion, up 125 percent y-o-y; 48 percent of revenues (defined as net cash from operating activities less capital expenditures).

Detailed reconciliations between results reported in accordance with generally accepted accounting principles (GAAP) and Non-GAAP results are included at the end of this news release.

In the comparisons summarized above, the following should be noted with respect to results for the second quarter of fiscal 2011: GAAP and Non-GAAP results included $401 million in revenues related to prior quarters as a result of agreements entered into with two licensees to settle ongoing disputes, including an arbitration proceeding with Panasonic Mobile Communications Co. Ltd.; GAAP results included $310 million in expenses in the QSI segment related to the FLO TV™ restructuring plan; and GAAP and Non-GAAP results included $120 million in impairment charges related to our Firethorn division, including $114 million in goodwill impairment.

Second Quarter Key Business Metrics

· CDMA-based Mobile Station Modem™ (MSM™) shipments: approximately 118 million units, up 27 percent y-o-y and flat sequentially.

· December quarter total reported device sales: approximately $40.0 billion, up 44 percent y-o-y and 18 percent sequentially.

o December quarter estimated CDMA-based device shipments: approximately 195 to 200 million units, at an estimated average selling price of approximately $200 to $206 per unit.

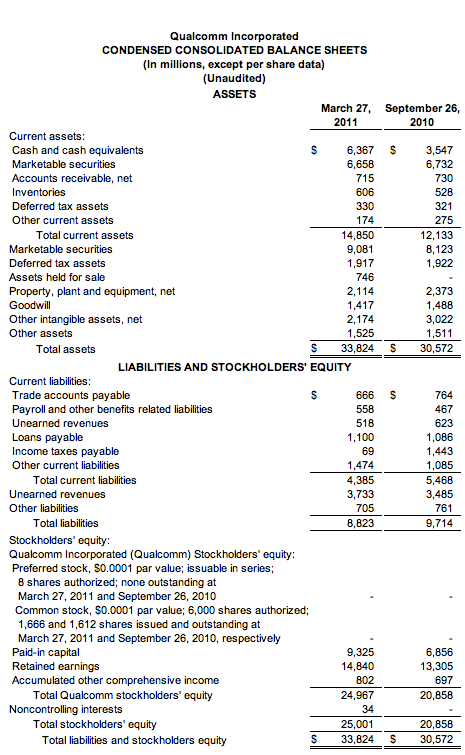

Cash and Marketable Securities

Our cash, cash equivalents and marketable securities totaled approximately $22.1 billion at the end of the second quarter of fiscal 2011, compared to $19.1 billion at the end of the first quarter of fiscal 2011 and $18.2 billion a year ago. On April 7, 2011, we announced a cash dividend of $0.215 per share payable on June 24, 2011 to stockholders of record as of May 27, 2011.

On January 5, 2011, we announced that we had entered into a definitive agreement under which we intend to acquire Atheros Communications, Inc. for $45 per share in cash, which represented an enterprise value of approximately $3.1 billion on that date. The transaction has received the approval of Atheros' stockholders and certain foreign regulators, and the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, has expired. The completion of the merger remains subject to the satisfaction of certain closing conditions, including the receipt of an additional foreign regulatory approval. We continue to expect the merger to close in the third quarter of fiscal 2011.

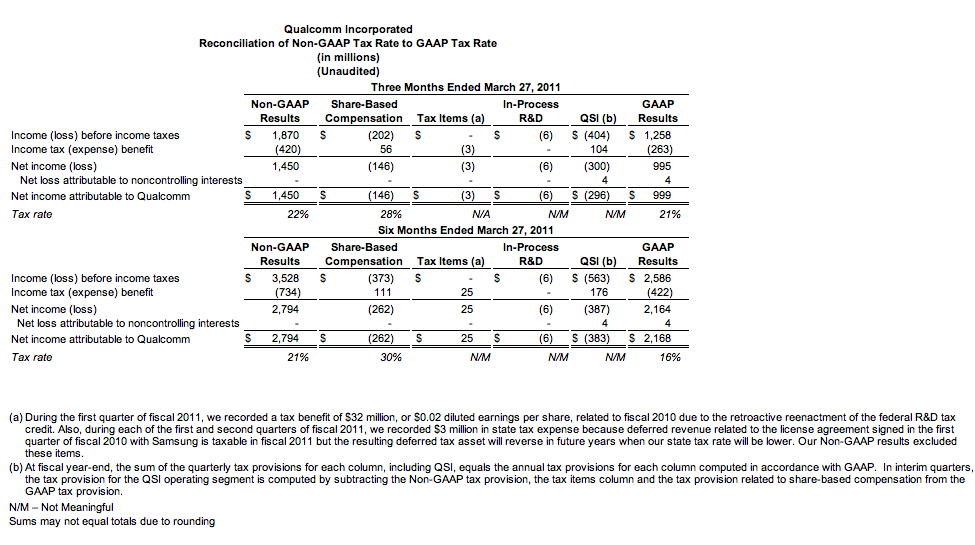

Effective Income Tax Rate

Our fiscal 2011 effective income tax rates are estimated to be approximately 17 percent for GAAP and approximately 21 percent for Non-GAAP. The second quarter rates of 21 percent for GAAP and 22 percent for Non-GAAP are higher than the estimated annual rates primarily due to additional U.S. income resulting from the settlement of ongoing disputes with two licensees during the second quarter of fiscal 2011.

Qualcomm Strategic Initiatives

The QSI segment manages our strategic investment activities, including FLO TV, and makes strategic investments in early-stage and other companies and in wireless spectrum, such as the Broadband Wireless Access (BWA) spectrum won in the India auction. GAAP results for the second quarter of fiscal 2011 included an $0.18 loss per share for the QSI segment. The second quarter of fiscal 2011 QSI results included $376 million in operating expenses and restructuring charges primarily related to FLO TV.

We have agreed to sell substantially all of our 700 MHz spectrum for $1.9 billion, subject to the satisfaction of customary closing conditions, including approval by the U.S. Federal Communications Commission. The agreement follows our previously announced plan to restructure and evaluate strategic options related to the FLO TV business and network. Under the restructuring plan, the FLO TV business and network were shut down on March 27, 2011, and we are no longer pursuing the MediaFLO Technologies business. Restructuring activities under this plan were initiated in the fourth quarter of fiscal 2010 and are expected to be substantially complete by the end of fiscal 2012. The spectrum was classified as held for sale at March 27, 2011.

In the second quarter of fiscal 2011, restructuring and restructuring-related charges related to this plan included in QSI results were $310 million. We estimate that we will incur future restructuring and restructuring-related charges associated with this plan of up to $65 million, which are primarily related to lease exit and other costs.

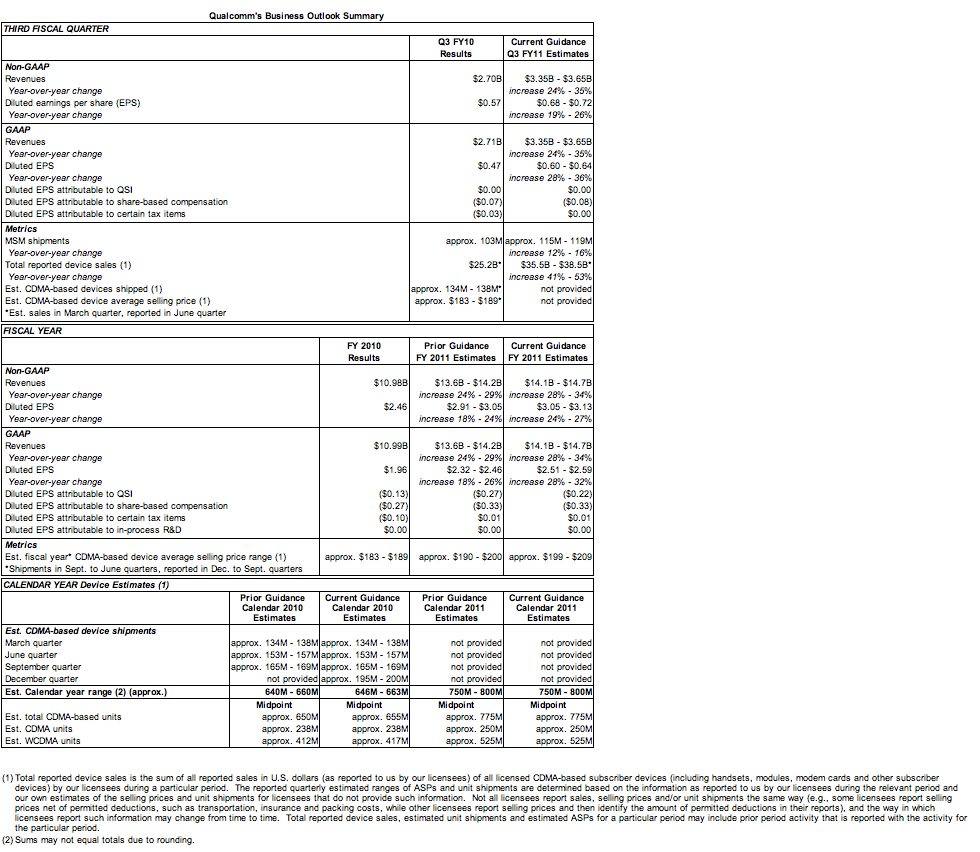

Business Outlook

The following statements are forward looking and actual results may differ materially. The "Note Regarding Forward-Looking Statements" at the end of this news release provides a description of certain risks that we face, and our annual and quarterly reports on file with the Securities and Exchange Commission (SEC) provide a more complete description of risks.

Our outlook does not include provisions for future asset impairments or the consequences of injunctions, damages or fines related to any pending legal matters unless awarded or imposed by a court, governmental entity or other regulatory body. Further, due to their nature, certain income and expense items, such as realized investment gains or losses, or gains and losses on certain derivative instruments, cannot be accurately forecast. Accordingly, we only include such items in our business outlook to the extent they are reasonably certain; however, actual results may vary materially from the business outlook.

In addition to our ongoing operating costs, our business outlook for fiscal 2011 includes restructuring and restructuring-related charges attributable to FLO TV that are currently expected to be incurred.

We have not included any estimates related to the Atheros business in our third fiscal quarter or fiscal 2011 outlook. The transaction is expected to close in the third quarter of fiscal 2011.

The following table summarizes GAAP and Non-GAAP guidance based on the current business outlook. The Non-GAAP business outlook presented below is consistent with the presentation of Non-GAAP results included elsewhere herein.

Conference Call

Qualcomm's second quarter fiscal 2011 earnings conference call will be broadcast live on April 20, 2011, beginning at 1:30 p.m. Pacific Time (PT) on the Company's web site at: www.qualcomm.com. This conference call may contain forward-looking financial information and will include a discussion of "Non-GAAP financial measures" as that term is defined in Regulation G. The most directly comparable GAAP financial measures and information reconciling these Non-GAAP financial measures to the Company's financial results prepared in accordance with GAAP, as well as the other material financial and statistical information to be discussed in the conference call, will be posted on the Company's Investor Relations web site at www.qualcomm.com immediately prior to commencement of the call. A taped audio replay will be available via telephone on April 20, 2011, beginning at approximately 5:00 p.m. PT through May 20, 2011 at 9:00 p.m. PT. To listen to the replay, U.S. callers may dial (800) 642-1687 and international callers may dial (706) 645-9291. U.S. and international callers should use reservation number 56703245. An audio replay of the conference call will be available on the Company's web site at www.qualcomm.com following the live call.

Editor's Note: To view the web slides that accompany this earnings release and conference call, please go to the Qualcomm Investor Relations website at: http://investor.qualcomm.com/results.cfm

Qualcomm Incorporated (Nasdaq: QCOM) is a world leader in 3G and next-generation mobile technologies. For more than 25 years, Qualcomm ideas and inventions have driven the evolution of wireless communications, connecting people more closely to information, entertainment and each other. Today, Qualcomm technologies are powering the convergence of mobile communications and consumer electronics, making wireless devices and services more personal, affordable and accessible to people everywhere. For more information, please visit www.qualcomm.com

Note Regarding Use of Non-GAAP Financial Measures

The Company presents Non-GAAP financial information that is used by management (i) to evaluate, assess and benchmark the Company's operating results on a consistent and comparable basis; (ii) to measure the performance and efficiency of the Company's ongoing core operating businesses, including the Qualcomm CDMA Technologies, Qualcomm Technology Licensing and Qualcomm Wireless & Internet segments; and (iii) to compare the performance and efficiency of these segments against each other and against competitors outside the Company. Non-GAAP measurements of the following financial data are used by the Company's management: revenues, R&D expenses, SG&A expenses, total operating expenses, operating income (loss), net investment income (loss), income (loss) before income taxes, effective tax rate, net income (loss), diluted earnings (loss) per share, operating cash flow and free cash flow. Management is able to assess what it believes is a more meaningful and comparable set of financial performance measures for the Company and its business segments by using Non-GAAP information. As a result, management compensation decisions and the review of executive compensation by the Compensation Committee of the Board of Directors focus primarily on Non-GAAP financial measures applicable to the Company and its business segments.

Non-GAAP information used by management excludes the QSI segment, certain share-based compensation, certain tax items and acquired in-process R&D. The QSI segment is excluded because the Company expects to exit its strategic investments at various times, and the effects of fluctuations in the value of such investments are viewed by management as unrelated to the Company's operational performance. Share-based compensation, other than amounts related to share-based awards granted under a bonus program that may result in the issuance of unrestricted shares of the Company's common stock, is excluded because management views such share-based compensation as unrelated to the Company's operational performance. Further, share-based compensation related to stock options is affected by factors that are subject to change, including the Company's stock price, stock market volatility, expected option life, risk-free interest rates and expected dividend payouts in future years. Certain tax items that were recorded in reported earnings in each fiscal year presented, but were unrelated to the fiscal year in which they were recorded, are excluded in order to provide a clearer understanding of the Company's ongoing Non-GAAP tax rate and after tax earnings. In fiscal 2009, the Company included the benefit of the retroactive extension of the federal R&D tax credit in Non-GAAP results because it had previously occurred with relative frequency and was included in the Company's business outlook for fiscal 2009 as the credit had been extended prior to the release of the fiscal 2009 business outlook. In fiscal 2011, however, the Company did not include the benefit of the retroactive extension of the federal R&D tax credit in Non-GAAP results because the Company had not included the potential extension of the credit in its previously released fiscal 2011 business outlook due to uncertainty as to whether and when the federal R&D tax credit would be retroactively extended. Acquired in-process R&D is excluded because such expense is viewed by management as unrelated to the operating activities of the Company's ongoing core businesses.

The Company presents free cash flow, defined as net cash provided by operating activities less capital expenditures, to facilitate an understanding of the amount of cash flow generated that is available to grow its business and to create long-term stockholder value. The Company believes that this presentation is useful in evaluating its operating performance and financial strength. In addition, management uses this measure to evaluate the Company's performance, to value the Company and to compare its operating performance with other companies in the industry.

The Non-GAAP financial information presented herein should be considered in addition to, not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. In addition, "Non-GAAP" is not a term defined by GAAP, and, as a result, the Company's measure of Non-GAAP results might be different than similarly titled measures used by other companies. Reconciliations between GAAP results and Non-GAAP results are presented in the following tables.

Note Regarding Forward-Looking Statements

In addition to the historical information contained herein, this news release contains forward-looking statements that are subject to risks and uncertainties. Actual results may differ substantially from those referred to herein due to a number of factors, including but not limited to risks associated with: the rate of deployment and adoption of, and demand for, our technologies in wireless networks and wireless communications, equipment and services, including CDMA2000 1X, 1xEV-DO, WCDMA, HSPA, TD-SCDMA and OFDMA; the uncertainty of global economic conditions and its potential impact on demand for our products, services or applications and the value of our marketable securities; competition; our dependence on major customers and licensees; attacks on our licensing business model, including results of current and future litigation and arbitration proceedings, as well as actions of governmental or quasi-governmental bodies, and the costs we incur in connection therewith, including potentially damaged relationships with customers and operators who may be impacted by the results of these proceedings; our dependence on third-party manufacturers and suppliers; foreign currency fluctuations; strategic investments and transactions we have or may pursue; defects or errors in our products and services; the development and commercial success of our QMT division's mirasol® display technology; as well as the other risks detailed from time-to-time in our SEC reports, including the report on Form 10-K for the year ended September 26, 2010 and most recent Form 10-Q. The Company undertakes no obligation to update, or continue to provide information with respect to, any forward-looking statement or risk factor, whether as a result of new information, future events or otherwise.

Qualcomm is a registered trademark of Qualcomm Incorporated. Mobile Station Modem, MSM, FLO TV and MediaFLO are trademarks of Qualcomm Incorporated. mirasol is a registered trademark of Qualcomm MEMS Technologies, Inc. CDMA2000 is a registered trademark of the Telecommunications Industry Association (TIA USA). All other trademarks are the property of their respective owners.