Apple Moves In On Business Equipment Through 2013 Projects Forrester Research

This week the folks at Forrester have released their Global Tech Market Outlook for both 2012 and 2013, and in this report it would seem that Apple is making such notable inroads on the computer equipment market over the next two years that they've rated them the industry's biggest disruptive force over that time span. In addition, it would seem that this disruption is not only that sales will increase for Apple across such lucrative groups as global business and government purchases of personal computers, but that Wintel PCs and tablet sales in those sectors will begin to change negatively after two positive years of sales to these groups of computer buyers. Could this be the start of Apple taking the global business-based market that for so long has remained solely dominated by Microsoft?

Apple moves in on corporate hardware

Forrester notes in their analysis that for years the computer equipment market for governments as well as businesses has been commanded by the likes of, as they list them, "Dell, EMC, Fujitsu, HP, Hitachi, IBM, Lenovo, NEC, Sun (now part of Oracle), and Unisys." What they show now is that even though Apple has thus far been a marginal factor, it's making a move in on the rest with such relatively new gems as the iPad and factors like an "increasing preference" amongst business and government professionals to own and use Macs.

Because of what's become an obvious trend of a consumerization Information Technology (IT), Apple is inching in on the PC/tablet market currently still held by Microsoft Windows and such hardware partners of Microsoft as HP, Lenovo, and Dell. Everyone from Fortune 500 companies to small business owners have found themselves not immune to Apple's attractive products and preferred ambiance surrounding the iPad. These they break up into the following:

Corporate IT departments picking up "tens of thousands" of iPads for employees for one reason or another, but not Macs.Small business owners purchasing both Macs and iPads which are able to be used for both personal and business use, charging units to their business as a business expense.Professionals dropping cash on Macs and iPads then attempting to get support for reimbursement from the company they work for, using the products then either for work in the office or simply at on-the-go events like conferences.

The Results for Apple

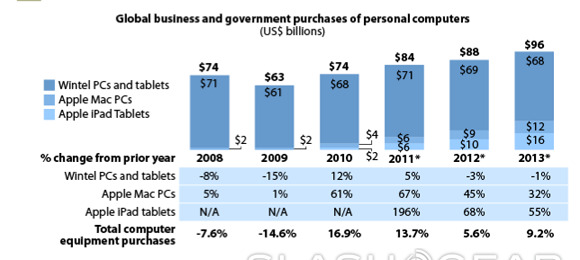

Though Apple doesn't report their sales numbers on what they've gotten back from corporations and governments, Forrester has essentially figured it all out using a couple of factors. First, their "Forrsights" data on both the number of PCs using Apple iOS, then the total number of tablets companies have reported supporting inside a given timeframe (2010-11 here). From this they're able to get projections on both Apple's sales of iPads and Macs to the corporate market in 2012 and 2013. They like up like this:

2011 $6 billion in Macs, $6 billion in iPads

2012 $9 billion in Macs, $10 billion in iPads

2013 $12 billion in Macs, $16 billion in iPads

The Results for Microsoft

The total number of what Forrester classifies as Wintel PCs and tablets are combined in their projections, likely because a breakdown of each different manufacturer selling Windows / Intel toting devices would be massively fruitless and would, of course, miss the point entirely. The point here is that the whole group is losing its share collectively, bit by bit. The industry continues to expand, so as it moves from $84 billion to $88 billion to $96 billion in 2011, 2012, and 2013 respectively, Wintel's total each year goes down. Remember, again, that this is a projection of the Global Business and Government Purchases of Personal Computers measured in USD:

2011 $71 billion in PCs and tablets

2012 $69 billion in PCs and tablets

2013 $68 billion in PCs and tablets

Wrap-up

It's clear that Apple is taking steps into a traditionally Windows-dominated sector here if what Forrester projects comes true. It's only Apple's ability to appeal to people in both the business and government sectors in a consumer-friendly way that's shown to have a major effect here, so we must assume that they've not yet made big strides to take the business away from Microsoft and associated manufacturers in these sectors. What'll happen when Apple decides it wants to jump in on the business world? Will they?

Perhaps it's Apple's way to attach to everyone by, again, attaching to the consumer in them – the individuals, not the businesses or governments they work for. We'll see starting this year if Forrester's projections turn true, and if they do, how truly affected Microsoft becomes.

[via Forrester Research]