Apple Could Buy Lion's Share Of Mobile Rivals In Cash Estimate Analysts

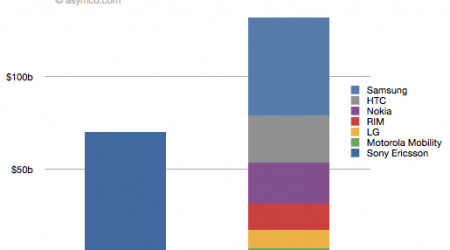

Apple could feasibly buy the bulk of its competitors using its cash reserves alone, it's been suggested, with only Samsung proving beyond its reach should Steve Jobs decide to go on a bizarre cellular spending spree. Asymco crunched the stats and figured that, with Apple likely to announce $70bn in cash and other immediate assets in its Q2 2011 financial results, it could readily snap up Nokia, RIM, LG, Motorola Mobility, Sony Ericsson and LG.

HTC's enterprise value, it's estimated, is $25.4bn, while Nokia comes in at $22.6bn and RIM at $13.8bn. Motorola Mobility is just $4.2bn. As for Sony Ericsson and LG, they're trickier to calculate being subsidiaries of larger firms, but Asymco reckons roughly $3.0bn for the former and a nominal $10bn for the ailing latter.

Samsung is the only hiccup, with a hefty $53bn in the analyst's estimates. That would put it outside the reach of Apple's predicted Cash, Cash Equivalents, Short-term marketable securities and long-term Marketable Securities. However, with Apple's coffers steadily increasing, that may not be the case for much longer.