The 5 Best Apps For Receiving Your Payments Online As A Freelancer

Freelancing, with all its challenges, is not easy. You are constantly worried about finding the next gig on job search apps, meeting tight deadlines, and, most importantly, getting paid on time. However, with all the technological advancements happening every day, receiving payments shouldn't be another hurdle to cross. Yet, here most of us are, trying new payment methods every now and then, most of which promise ease but hardly deliver. If you're tired of the uncertainty and delays that come with traditional payment methods as a freelancer, you're not alone.

Below, we share the five best apps you can try for receiving your domestic and international payments online as a freelancer. We have personally tested all the apps in the list. We specifically looked into the transaction fees, ease of use, and how fast you get your money so that you can spend less time worrying about payments and more time doing what you love.

PayPal

PayPal is one of the most popular choices for freelancers, so chances are you've already heard about it or used it before. It allows you to receive money from almost anywhere in the world, which is great for anyone who works with international clients.

Starting with the basics, PayPal is quite user-friendly. You can get started by creating an account, which will involve selecting an account type, adding information about you or your business, linking debit/credit cards, etc. Once you are in, you can share your account details with your clients, and they can deposit money directly into your PayPal account. From there, you can transfer it to your bank or keep it in PayPal for other online transactions. You can deal with a bunch of different currencies, which is a big plus if you're working with clients from different parts of the globe.

Additionally, it also allows you to create a PayPal debit card, which can be used anywhere Mastercard is accepted, whether online or in-store. However, PayPal does have its downsides. The fees can be a bit high, especially when receiving money from international clients. They charge a percentage of the amount you receive, plus a fixed fee for international payments. The exact amount depends on the countries involved and the type of transaction. Also, currency conversion rates on PayPal might not always be the best, which is something to keep in mind when dealing with multiple currencies.

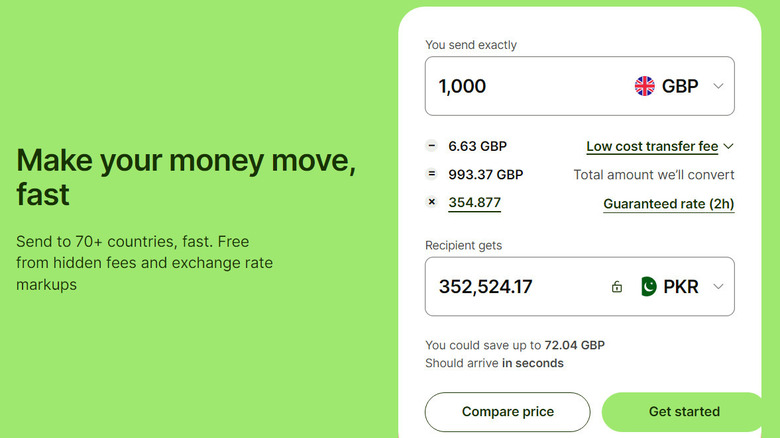

Wise (previously TransferWise)

Wise, formerly known as TransferWise, is another decent option that works by using the real exchange rate. It allows you to create a multi-currency account, which can let you hold and convert money in various currencies.

To get started, you can create an account and link your local bank account to Wise. Your multi-currency accounts can be all seen on the Homepage. Like PayPal, it also offers an international debit card, but this service is only available in selected countries. You can add your clients as recipients and send them payment requests or share your Wisetag (which is a shareable QR code) to get paid instantly. If, in case, you have hired someone and want to pay them timely, you can always set up scheduled transfers.

The pros of Wise are pretty clear. It's generally cheaper and faster than banks for international transfers, and the transparent fees mean no nasty surprises. The multi-currency account is also a big plus for freelancers who work internationally.

However, there are some cons. While Wise is great for international transfers, it's not as useful if all your transactions are domestic, as there are cheaper options for those. Also, although cheaper than banks, transferring money isn't free, and the fees can add up if you're moving large amounts regularly.

Payoneer

If you are a frequent user of Fiverr, Upwork, or other apps that can help you earn money, you may already be familiar with Payoneer. Like most other apps in our list, it also allows you to receive payments in multiple currencies and withdraw those funds to your local bank account or use a Payoneer card. You can also send invoices directly through the Payoneer platform, which can save you some time.

You can get started by signing up for an account on their website and providing some personal and banking details. Once your account is approved, you're ready to start receiving payments.

Now, let's talk pros and cons. On the upside, since Payoneer focuses on an international market, you can easily do business with clients worldwide. You have the option to receive payments in multiple currencies and convert them to your local currency at any time. You can also use your Payoneer card to access your funds quickly. The customer service is reliable and mostly responds on time. You also have the option to set up two-factor authentication for a more secure experience.

However, there are some downsides. The fees can be a bit confusing and may add up, especially if you're converting currencies. Also, withdrawing money to your bank account can sometimes take a few days, which might be inconvenient if you need quick access to your earnings. In some cases, the account verification can take a long time as well.

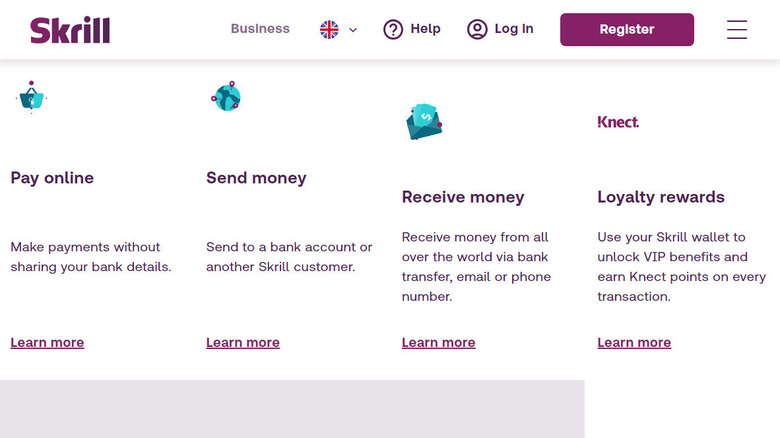

Skrill

Skrill (initially known as Moneybookers) is a digital wallet provider that's been around for a while. You can use it in three ways: as a digital wallet to store money in your Skrill account and use it whenever you want, use the Skrill card to shop online or in stores, and as a money transfer service to send money to other Skrill users or to bank accounts around the world.

Setting it up is easy and straightforward. You can create an account and link your bank account to Skrill. The platform also has a rewards program known as Knect that allows you to earn points every time you make a financial connection through the app. These points can then be exchanged for cash rewards.

Overall, the app is quite easy to use, secure (regulated by the Financial Conduct Authority), and reliable. You also have the option to choose between a personal and business account on the platform. One downside that you should know about it is that Skrill's fee can be a bit confusing. Skrill charges for withdrawing funds, international transfers, currency exchanges, and even has a small fee that you will be charged if your account is inactive for a year. It also does not have a live chat feature as of now.

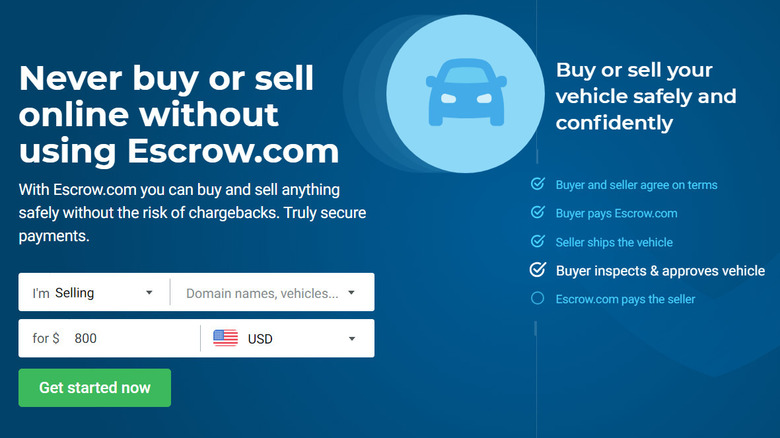

Escrow

While Escrow is not exactly an app that you can install on your phone, it deserves a spot on our list as a platform for those who prioritize the security and protection of funds. Let's begin by understanding how it works. When you start a contract, both you and your client agree to the terms and conditions, including payment. Instead of paying you directly in advance, the client sends the money to an Escrow account.

This means the payment is securely held until both parties are satisfied with the contract's fulfillment. You will have the peace of mind that the client has paid and won't back off after the work is completed, and your client will have the assurance that they're only paying for work that meets their expectations. It's a win-win situation where both sides have a safety net.

Once you have created an account on the platform, you can begin a transaction by entering the details of your contract and the buyer's details. You can share the transaction via a QR code or URL with the client, and once they deposit the sum in Escrow, you can start working on the project.

However, it is essential to note that there is a fee involved, which is typically a percentage of the amount being held. In some cases, Escrow can slow down the payment process as funds are only released when all conditions are met, which can take longer than direct payments.