The Semiconductor Shortage Is Over, But A New Problem Is Plaguing The Market

In a surprising turn of events, the semiconductor industry, which had finally overcome the hurdles of the COVID-19-induced semiconductor shortage, now faces an unexpected problem — an oversupply of memory chips. According to CNBC, this shift from scarcity to abundance has created a challenging situation, impacting major memory chip makers like Samsung, SK Hynix, and TSMC, whose profit margins are shrinking as a result.

The current oversupply problem is attributed in large part to computer hardware and smartphone manufacturers who ordered memory modules in massive quantities during the pandemic. While these companies expected sustained demand for their products, as the impact of the pandemic waned, so did the demand for electronic goods. With actual demand failing to match inflated projections, these companies are now staring at an oversupply of chips with no devices to put them in.

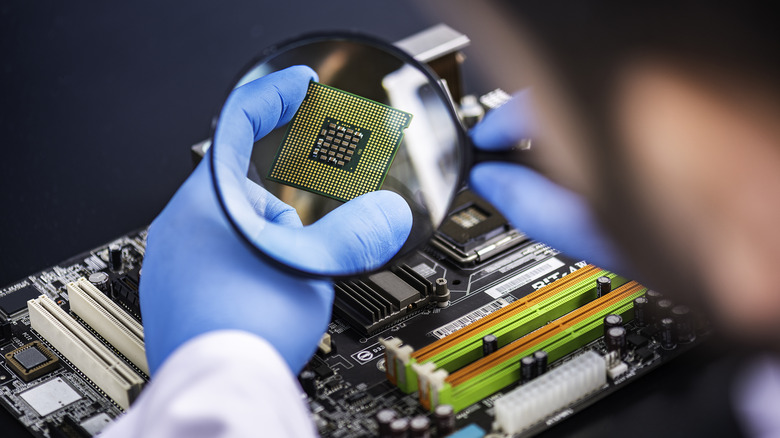

The memory chip glut has hit two crucial types of chips the hardest: NAND and DRAM memory, both commonly used in smartphones, laptops, and data center servers. With excess memory chips in hand, there's little incentive for companies to order new ones from semiconductor manufacturers. This situation has severely impacted Samsung's semiconductor division, which reported a staggering 95% year-on-year decline in second-quarter operating profits. TSMC also faced the repercussions, experiencing a 23.3% dip in net income during the second quarter of 2023, marking its first quarterly profit decline in four years.

Production cuts in the pipeline

To address the dwindling sales of consumer electronics, Samsung Semiconductors took a preemptive step in April 2023 by announcing significant production cuts. Other players in the market, such as SK Hynix and Micron, are following suit by slowing down production in response to the stagnant PC market. TSMC, a major player in the global smartphone market, is also feeling the pressure. Nevertheless, Samsung expressed hope, predicting a recovery in global demand for memory chips in the latter half of the year.

However, as outlined earlier, the production cuts have already had a major impact on the financials of these companies. To somewhat soften the impact, semiconductor companies are diversifying their product portfolios and exploring new markets for memory chips, such as automotive applications, AI, and IoT devices. By expanding their customer base, they aim to reduce their dependence on the more volatile consumer electronics segment and achieve a more balanced revenue stream.

Interestingly, not all types of semiconductors are experiencing oversupply issues. For instance, the auto sector is still witnessing substantial demand for memory chips. However, it's essential to note that chips designed for cars differ significantly from those used in laptops, smartphones, and servers. Hence, automakers cannot readily utilize the surplus chips in their vehicles.

It remains to be seen how well the semiconductor industry — which has proven to be resilient in the past — recovers from this latest challenge.