Why You May Want To Hold Off On Using Apple Card's High-Yield Savings Account

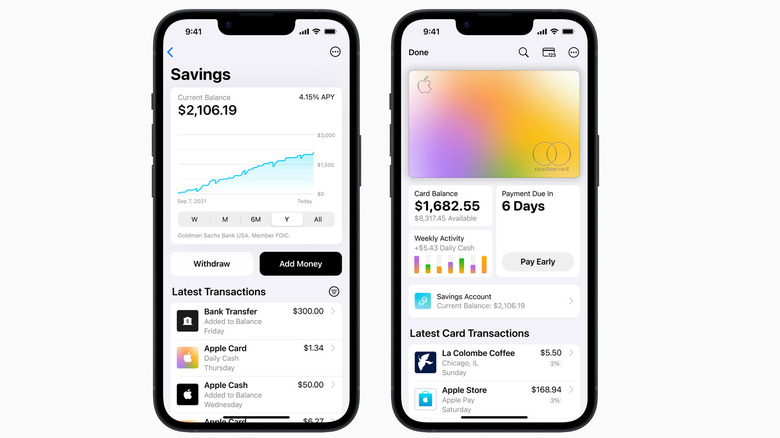

For customers in Apple's ecosystem, there's a lot to like about the company's recently introduced high-yield savings account. Announced in April and available to holders of Apple Card, Apple's co-branded credit card, the savings account is extremely simple to set up, there are no service fees, and it offers a 4.15% APY at the time of this writing. The iPhone maker claims that yield is more than 10 times the national average rate for savings accounts at traditional banks and credit unions.

The Apple savings account is operated in conjunction with banking firm Goldman Sachs, which is also Apple's partner on the Apple credit card. In the first four days that the savings account was offered, Apple reportedly received almost $1 billion in deposits from 240,000 users. However, after several weeks of utilizing their accounts, some customers claim that transferring funds to outside institutions is proving difficult.

Per the Wall Street Journal, some account holders have complained of a weeks-long wait to transfer money from the Apple savings account to an external bank account. Also, the instructions to initiate the transfer haven't been consistent, which is creating an additional layer of stress. Perhaps most alarming is that after the transfer was initiated, some customers report that the funds are removed from the Apple account, yet aren't reflected in the recipient account's balance — essentially disappearing for a period of time.

Goldman Sachs says latency is the exception, not the rule

In one of the most publicized incidents, a user named Kevin Smyth from Minnesota attempted to transfer $10,000 from his Apple savings account to a local bank in order to pay for some home improvements, but the transaction couldn't readily be completed. After a frustrating round of phone calls, Goldman Sachs told Smyth that the transfer was under security review. This prompted an angry tweet to Apple CEO Tim Cook on May 25, to which other Apple saving account holders echoed the sentiment.

@tim_cook was your plan to partner with a bank that holds people's life savings hostage? Do you know their view is that people shouldn't touch their savings account for long periods of time and are enforcing that with "security reviews"?

— Kevin Smyth (@kssmyth) May 25, 2023

Once the transfer was eventually completed, Smyth closed the Apple account, taking his approximately $200,000 in saving to another institution. Apple's fintech partner Goldman Sachs maintains that the reason for the delays is that the accounts are new and that larger transfer amounts are scrutinized more heavily for both security purposes and to thwart money laundering.

In a recent statement to the New York Post, the banking firm reiterated, "The customer response to the new savings account for Apple Card users has been excellent and beyond our expectations," adding that "the vast majority of customers see no delays in transferring their funds." That said, for folks who may need access to their savings sooner than later, it seems prudent to wait until all of the bugs have been worked out before fully relying on Apple's savings account.