The Hidden Costs Of 'Buy Now Pay Later' Apps

The realm of personal finance has always been inundated with innovative ways to make purchases and leverage capital. From the establishment of credit, to the use of collateralized assets to increase buying power, finance and new ideas go hand in hand. This can be seen in the cryptocurrency world where new crossover perks are making their way into consumers' hands, as well.

The world of personal finance is often exciting, offering up new ways to invest, save, and purchase virtually anything. But these leaps forward can come at a cost — sometimes a substantial one. With the advent of lax financial regulation and the use of mortgage-backed securities as a financial trading instrument, the U.S. housing market went up in flames in 2008 (via Investopedia).

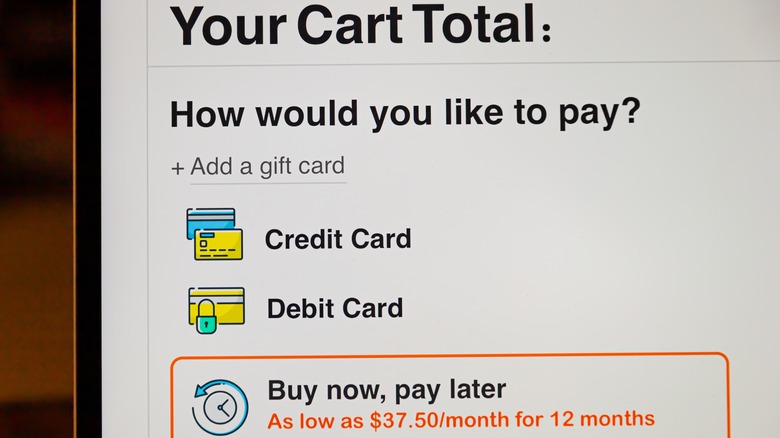

"Buy now pay later" apps are seemingly the next big thing in personal financial management. Alongside a transformation in the way that consumers save (with investment apps directly accessible by phone) and physically pay for things with phones as well, this easy to access line of credit is hugely popular. It's easy to see why, but what may be a little less obvious is the potential trouble that a user may face if they aren't careful with the financial mobility that these tools can provide.

A rise in popularity is making these apps more visible and appealing

"Buy now pay later" (sometimes abbreviated to BNPL, or called point-of-sale loans) offers bite-sized payments for consumers. Some provide interest-free installments over three monthly payments; others grant this reprieve with four payments spread over six weeks. Each app is unique in its structure, but the overarching ruleset is the same. If you make on time payments within the allotted schedule, you can get something today and pay for it without added fees over the course of an elongated timeframe.

Exploding Topics reports that BNPL offers are most commonly used to purchase clothing, and that 16% of those between 18 and 34 already use these services. Juniper Research predicts astronomical growth among users in the coming years, with an estimated 900 million users worldwide by 2027 (up from 360 million in 2022).

With increased pressure coming off the back of runaway inflation in the short-term, and lasting stress over workplace longevity in the weakened global marketplace, consumers are looking for ways to ease their finances. BNPL offers can provide this assistance in the short term. Exploding Topics notes that roughly half of all U.S. citizens has signaled interest in using one of these services. This showcases the fragility of the average consumer, and the weight that interest-free financial opportunities can muster.

Profits are built on poor financial planning

However beneficial a BNPL offer sounds, it's crucial for a consumer to understand how these companies make their money. All card and line of credit issuers enjoy a small margin on the transaction itself. This is a percentage paid by the merchant to the financial institution for handling the nitty gritty of the financial exchange.

In short, paying by card involves a lot of highly technical aspects that simply don't exist in a traditional cash payment. Banks and other financial firms therefore want users to pay with their card or app over other options. The offer to split up payments without added fees is a potent incentive.

But where BNPL businesses really make their money is in late payments, longer repayment durations, and other slip-ups made by the consumers themselves, according to Northeastern Global News. Brands that offer zero interest make up for this offer by charging significant late fees and high interest on longer repayment durations. Simply put, if a user isn't able to manage their finances effectively, these businesses turn a larger profit. This means that it's in the lenders' best interests for a user to miss a payment or require a longer duration or repayment that includes a markup with interest.

"Buy now pay later" provides a significant amount of leverage to a consumer, but this only adds value on targeted spending. If you're using the line of credit for all your purchases, for instance, you are able to push out repayments on today's expenditures, but constantly have to keep up with repayments from last month's purchases. The additional buying power can easily translate into a continuous cycle that may end in heightened markups.

A proliferation of these tools can impact base prices

With the trending utilization of BNPL financing, vendors may soon shift their pricing models as well. SFGate reports that 91% of California's consumer loans in 2020 were classified as point-of-sale loans, and in 2021, American consumers spent more than $20 billion funded through these apps and services. While SFGate notes that an alarming 43% of users have missed a payment — tacking on additional costs to the price tag (as noted above) — this isn't the only way that hidden fees make their way into the use of these BNPL services.

Northeastern Global News reports that these tools typically charge transaction fees to merchants at a rate between 3% and 4%. Compared to the typical cost of 1.5% to 3.5%, this can place an additional squeeze on businesses in your area and online retailers that you frequent. With the weighty incentive of zero interest and split payments, users are flocking to this option instead of utilizing cheaper purchasing vehicles for the seller.

If the balance begins to tilt too far in this direction, a seller may decide to raise prices by a moderate figure to account for the increased cost incurred by just doing business. Business.com notes that some merchants already charge a cash price that's lower than the cost for a buyer that uses a credit or debit card to offset their own added fees. This practice may be poised for expansion with the continued prevalence of BNPL services.

High revolving utilization can reduce your credit score

Finally, using a point-of-sale loan to ease your cash flow on an important purchase can translate into strain on your credit score. A one-time use that's followed by diligent repayments (before utilizing the line of credit again) signals financial intelligence to lenders. This will more than likely translate into a boost to your credit score. However, the typical utilization trend of these services doesn't help consumers make smarter financial decisions. In fact, many people find themselves sucked into a cycle of high revolving credit utilization.

For those who are new to the use of credit, this account may be their only one. Maintaining a high balance therefore signals irresponsible credit use from the outset. Your score is based on a blend of factors; three of which are age of borrowing accounts, total borrowed (as a dollar figure), and revolving utilization (as a percentage).

Experian reports that a good rule of thumb is to keep your utilization rate below 30%. Buy the BNPL model makes it easy to run right up to your limit and keep the account at this maximum limit. Making mistakes with your line of credit usage can create knock-on effects for your credit score for years to come. A lower score will translate into fewer borrowing opportunities, and options that will cost more as well.

Managing your credit in an intelligent way ensures that you always retain a variety of good borrowing options. A BNPL app isn't necessarily a death blow to your financial future. But they can certainly increase your vulnerability at a crucial stage in your life as a consumer.