The US Needs Huawei More Than Huawei Needs It

The walls are closing in on Huawei. Its retail partners in the US, actual and potential, are dropping it like a hot brick. There will be suspicions, both implied and explicit, of government pressure working against the Chinese manufacturer. It is undoubtedly a loss for Huawei to miss out on one of the most important smartphone markets. But, in the midst of his unexpected rant, CEO Richard Yu does make one important point. It is also a loss for the US consumer as well.

Political Maneuvering

We may never really know whether the US government's suspicions, which, to be fair, predates the Trump administration, has any truth to it. There are Chinese companies that have indeed been used by their government as eyes and ears, but Huawei has also earned a positive reputation in both US and international markets.

But the problem here goes beyond the accuracy of those claims. In a sense, it also goes beyond Huawei or ZTE. It is one that the US smartphone market will be facing as more and more players stop playing in their court. And that will be the problem of having fewer horses to bet on.

More horses in the race

The smartphone market is characterized as s two-horse race between iOS and Android when it comes to platforms, but there are almost countless companies carrying the green robot. Not all of those, however, are available in the US, especially when it comes to top phones. And some that do have different means of selling in the market.

That ultimately means fewer choices for US consumers. Less choice means those that hold the power will have the opportunity to force what they want. People won't have much of a choice if they want the latest and greatest phones. This is the stuff that oligopolies are made of and the US smartphone market is close to becoming one.

At the moment, it might be bordering on safe but the US market is changing. We have Samsung and Apple at the top, with the likes of Google and Essential duking it out below. Motorola has become less relevant, HTC is close to bowing out, and LG is having troubles making ends meet. Sony sells its phones without any carrier involvement but isn't too concerned about the viability of its smartphone future. OnePlus also makes a living off selling its phones in the US directly or through retailers. Nokia doesn't even have its latest flagships available there. It's almost a precarious situation that can change anytime soon.

Troubling Precedent

For now, only Huawei and ZTE are in the government's crosshair. But who's to say that won't expand in the very near future. As tempers flare, there might come a time when governments shut doors on each other or pull out businesses.

Let's make it a bit concrete. Suppose the US decides to block all Chinese-sold phones from the market? That immediately throws Lenovo-owned Motorola, OnePlus, ZTE/nubia, and Nokia out the door. That doesn't yet count the number of US-based companies who take whitebox phones and brand them as their own. It could wipe out the selection of mid-range phones that don't have a "Galaxy" in their name. It's an extreme scenario that simply serves to show how US consumers are really at the mercy of just a small number of phone makers.

Shrinking importance

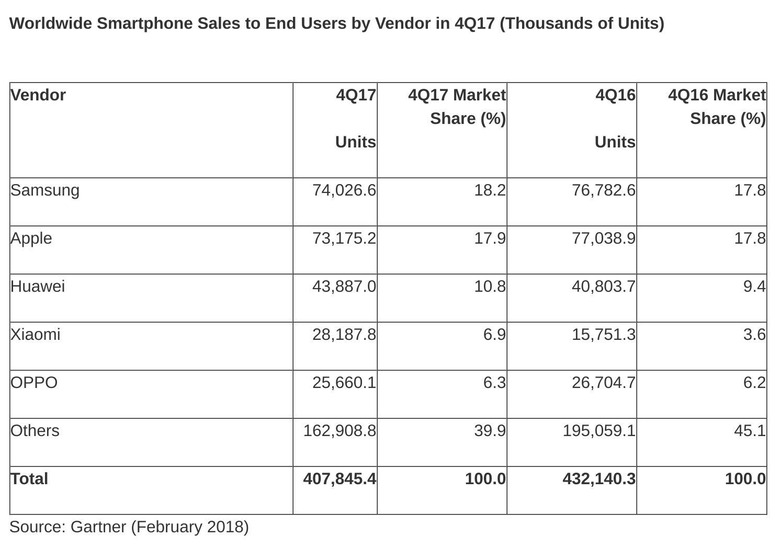

Huawei wants to set up camp in the US, but it might not have to for the same reason that Xiaomi might no longer need to rush its US entry. The US is and will always remain an important and lucrative market, but it is probably past its prime. Years ago, it would have been imperative for any ambitious smartphone company to sell in the US. These days, many have made do without it. If raw numbers are concerned, the US isn't even the largest smartphone market. It is, however, the one with the highest buying power and, therefore, the best chances to sell expensive phones.

But that, too, seems to have reached the tipping point. Reports indicate that today's most expensive phones, like the iPhone X and the Galaxy S9, aren't selling well precisely because of their price. Increasing prices also mean that consumers are less inclined to upgrade often, which would lead to lower sales over time. The strategy of selling a few but expensive phones is no longer working. Selling wallet-friendly ones by the hundreds is winning the game, and that's exactly what the likes of Huawei and Xiaomi have been doing outside the US anyway.

Wrap-up

US consumers are running out of choices. Former smartphone superpowers are slowly bowing out of the competition or at least reducing their presence. Pretty soon, the premium smartphone market will have just a handful of key players, namely Samsung and Apple, who would then be able to steer the market any which way they want with no one to challenge them and keep them in check.