Smartphone Sales In Q4 Put Apple, Samsung, Xiaomi, Huawei In A Blender

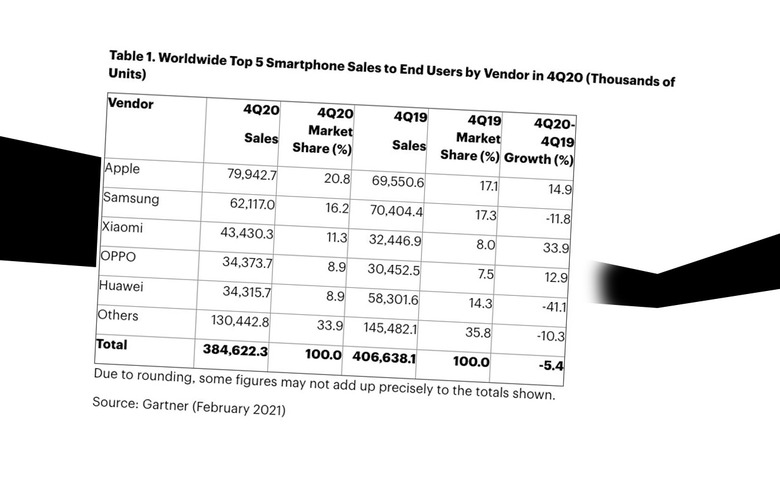

Smartphone sales numbers in the fourth quarter of the year 2020 look like the top brands were playing musical chairs. As Gartner shows, All five of the top brands in smartphone sales worldwide changed places year-over-year. Back in Q4 2019, Samsung was the leader, followed by Apple, Huawei, Xiaomi, and OPPO. At the tail end of 2020, Huawei fell to 5th place, and Apple moved to first, followed by Samsung, Xiaomi, and OPPO in-between.

The numbers shown here represent smartphone sales to end users by vendor in the fourth quarter of the year for both 2020 and 2019. It's important to note here that some analysis charts show shipments – that's ever-so-slightly different from sales. A company can ship as many phones as they like, and sell zero – this chart tracks actual sales to customers.

Apple's back on top, this most recent quarter – but it's only the second-biggest grower in the pack. Apple's growth here rallied 14.9% vs this same quarter in the year 2019. The most massive growth came from Xiaomi, which flew upward with an impressive 33.9% growth year-over-year.

While OPPO was third in growth at 12.9% year-over-year, the drastic changes in sales by the rest of the companies on the list pushed the company up to remain just behind Xiaomi, and a full spot higher on the list than it was last year.

In addition to the skyrocket in sales by Xiaomi, most of this change was due to the fall of Huawei. Likely due in part to COVID-19 and in part to legal battles with the United States Government and fallout therein, Huawei's smartphone sales to end users in Q4 fell 41.1% from 2019 to 2020.

Apple's numbers here rose 14.9% while Samsung fell 11.8%, switching the two on the list of top vendors worldwide. Apple's command of the market in Q4 2020 hit 20.8%, ahead of Samsung at 16.2%. It's worth noting that Samsung's number 1 spot in Q4 2019 held just 17.3%, just ahead of Apple at 17.1%.

When we're looking at market share in this quarter, the top 5 swallowed ever-so-slightly more of the total than this point last year. All "others" had 35.8% of the market in Q4 2019, while Q4 2020 "others" held just 33.9% of the market.