PCs, Tablets, And Chromebooks Need To Prepare For The Months Ahead

The consumer electronics market has seen a surge in the past 22 months, perhaps more than any other industry hit hard by the COVID-19 outbreak. The shift in work and school arrangements, the need for more home entertainment diversions, and the reliance on Internet-based communication all worked to give PCs, tablets, and Chromebooks a much-needed boost in sales and shipments. The tides are shifting again, however, and manufacturers will need to adopt new strategies if they don't want to return to the same dismal pre-pandemic figures in the coming quarters.

Tablets

Tablets were believed to be dead, partially thanks to larger smartphones, but Apple's iPad Pro push continued to keep the device category on life support. The large mobile computers, however, found new hope as people started to need even bigger screens that didn't keep them tethered at their desks. Fortunately, tablets offered a wide variety of sizes for different use cases, and the past quarters have been kind to tablet makers, at least until now.

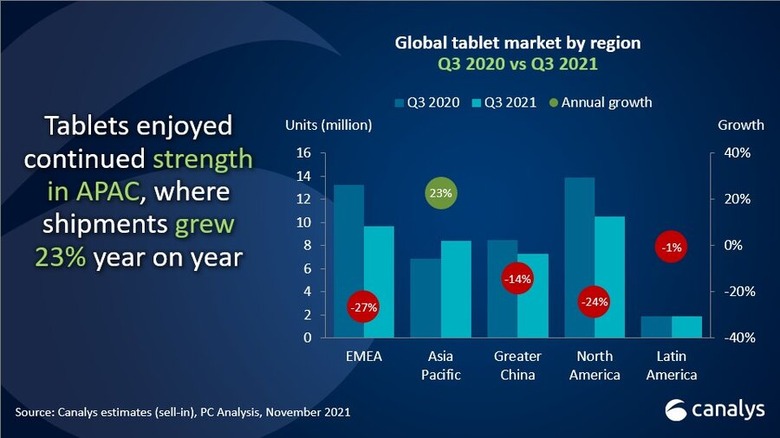

Canalys, unfortunately, has some bad news to share. According to the market intelligence firm, tablet shipments have declined by 14.9% in the third quarter of 2021 compared to the same period last year. The one good piece of news here is that it's still above the figures prior to 2020, but the lesson here is that things have started to plateau for this formerly dying market.

Chromebooks

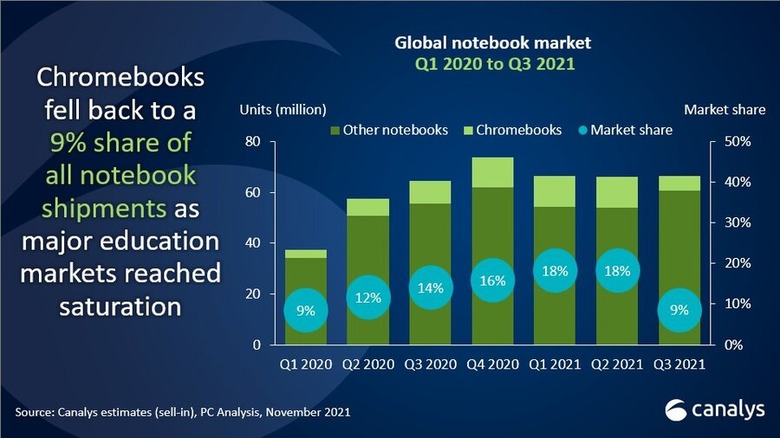

Chromebooks have been the biggest winners in the personal computing space since last year. Their focus on education and their affordable price tags meant that schools could purchase them in bulk for students who would need to stay at home for their classes. Conversely, they are also the ones that got hit the most now that things are slowly going back to normal or a new normal.

The same market figures point to a sharp 37% dive in shipments year-on-year for Chromebooks, which now occupy only 9% of the total notebook market once again. The demand for these devices in the education market has pretty much dropped, and funding for their purchases has also declined. There are markets where Chromebooks still grow a little, but the overall trend doesn't look too optimistic.

Desktops and Laptops

In contrast, PC shipments declined by only 2%, which is still a significant improvement compared to market metrics before the pandemic. Manufacturers might be hoping that the launch of Windows 11 would spur more purchases, especially this coming shopping season, but they face a new threat to those projections. Chipmakers don't see the global semiconductor shortage easing up until late 2022 or 2023, and supplies of laptops, desktops, and tablets might be tight or at least delayed in the coming quarters.

Many OEMs might have been delighted by the market performance in the past few quarters, taking advantage of global events that helped boost shipments despite all the odds. There was, of course, never any assurance that the status quo wouldn't change, and this quarter's figures across different market segments should be the warning that these companies need to adopt new strategies before they drop to pre-pandemic slumps again.