5 Things You Need To Know Before Buying An NFT

NFTs are all the rage right now. They appear to be the next big thing, and the fear of losing out is driving many people to invest. For context, 950,000 unique addresses bought or sold an NFT in Q1 2022, up from 627,000 in Q4 2021, according to Chainalysis. Many new investors have little to no idea of how NFTs work and are therefore prone to making mistakes that could cost them a lot of heartache and money. If you're a crypto newbie, you might want to read our NFT explainer before we begin.

Like any other worthwhile investment, you'll need to do a lot of homework to ensure that you understand what, exactly, you're buying into. In this quick guide, we share some hard facts and research that should help you get a clearer picture of what an NFT investment involves. So, if you're thinking about investing in an NFT, here are five things you should know before shelling out your hard-earned cash.

Not all NFTs are equal

Crypto newbies often make the mistake of thinking that all NFTs in a collection cost the same. But NFTs are different from fungible tokens like Bitcoin in that regard. Each Bitcoin can be exchanged for and are equal to another, but that's not the case with NFTs. Each NFT is a unique token, which means there's only ever one of whichever NFT you're buying.

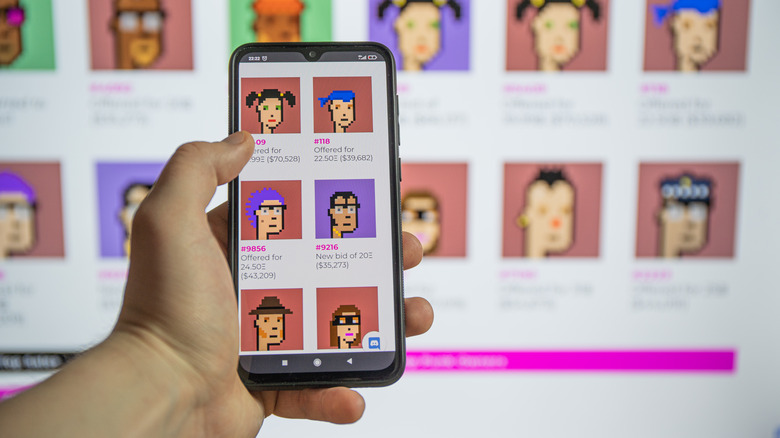

Typically, NFTs come in collections — some popular examples are Bored Apes, CryptoPunks, Meebits, and Hashmasks — but each NFT within the collection carries a different value. Each NFT's price differs depending on its unique qualities or utility. For example, only 4.7% of Bored Apes have red fur, and just 2.5% have a biker vest, according to NFT Stats.

The rarer the traits of a Bored Ape, the higher its price. You want to confirm the rarity of an NFT's traits before you make a decision — that's the surest way to improve your chances of getting an NFT with a lot of growth potential. You'll want to choose the NFT that shares the least amount of common traits with others in the collection.

You're not buying an actual asset

An NFT is a digital token that represents an asset, but it isn't an asset in itself. Sounds confusing? Let's break it down. Say you own an NFT of Da Vinci's Mona Lisa, for example. Your ownership of the NFT does not mean you actually own the Mona Lisa. Even the NFT creator who minted it and put it on the marketplace doesn't own the Mona Lisa — unless Da Vinci himself put the NFT up, and we know that's impossible.

When you buy an NFT, you only get ownership of the NFT and the rights to store, sell, and dispose of it. But (and this is a major but) you do not necessarily own the intellectual property rights of the original work unless, of course, the contract specifically agrees otherwise. This is only possible if you purchase the NFT from its original creator. Capisce?

Gas is expensive

Gas prices aren't only crazy high in the real world; even online, gas can be really expensive. Whenever you make a transaction on the blockchain, you pay a transaction charge called a gas fee. This is an additional charge required to do the main transaction. Basically, the gas fee is the amount you pay crypto miners for the computing energy they use to validate blockchain transactions (via Ethereum.org).

Also, gas fees are not determined by the value of the transaction, but they might fluctuate depending on the demand and supply of the cryptocurrency. In cases where demand is really high, the gas fee might even exceed the cost of the NFT. So, if you're thinking about investing in a promising NFT that has a low floor price, you'll need to factor in gas fees to get an accurate picture of your costs. Don't know what floor prices are? That's coming up next.

Understand the math

There are a bunch of numerical factors you'd have to understand and analyze before you make your first leap into NFTs. This is a for-profit investment, after all, and you can't get those right without crunching the numbers. The first one to consider is the floor price of an NFT, as we mentioned above. A floor price is the cheapest amount you can pay to buy an NFT in a collection. For example, at the time of writing, the cheapest Bored Ape is a little over $82,000 or about 74 Ether, the Ethereum blockchain's native coin, according to NFT Price Floor.

One solid way to determine the popularity (and promise) of an NFT collection is to keep an eye on floor prices. A steadily rising floor price implies rising demand, so it may be a good idea to get in early. A fast-falling floor price, on the other hand, might set off a chain reaction of selling, with investors rushing to liquidate their shares to avoid losing money.

Another important number to keep an eye on is a seller's previous sales. You can check how much (and how well) their other pieces sold for by looking through their previous sales. While you can't necessarily predict future performance based on previous success or lack thereof, it's still a great way to feel confident in your final decision.

Beware of rug pulls

A rug pull is an investment scam in which founders dupe people into investing money in a business, only to abandon the project and make away with the funds. Because of how anonymity-oriented the crypto world is, these things, unfortunately, happen frequently. One example is what happened with Frosties, in what became the first rug pull of 2022. Frosties was a collection of 8,888 cartoon ice cream NFTs on the Ethereum blockchain. The project sold out quickly and seemed promising ... until it wasn't. The collection's website and social media accounts were suddenly deactivated, and the shady founders made away with about $1.3 million. Although the law caught up with the founders, who have now been arrested, there's no guarantee that investors will be getting their money back.

To avoid becoming the victim of a rug pull, do due diligence with research into any prospective project. Read whitepapers, look up track records, and most importantly, don't be greedy to make a quick buck. Calculated, slow progress sounds boring, but it's the only way to prevent the heartache of losing your investment to scammers. Overall, look before you leap. NFTs are still in their infancy, and the market can be risky if you don't make informed calculations and decisions. It's reasonable that you don't want to lose out on a potentially lucrative investment opportunity (like that Bitcoin Pizza guy) but it's always better to be safe than sorry.