NVIDIA reportedly close to buying ARM from Softbank

It's a bit strange to hear that Arm, whose chip designs and computer instruction set architecture or ISA has been quickly overtaking the computing world, might soon be sold off despite its growing popularity and ubiquity. That is exactly the case, however, for the England-based company who just four years ago was acquired by Japanese conglomerate Softbank. The latter has reportedly been in talks with many potential buyers, including Apple, but one name keeps rising to the top. NVIDIA, however, may be facing an uphill battle if it does make a formal bid for Arm Technologies.

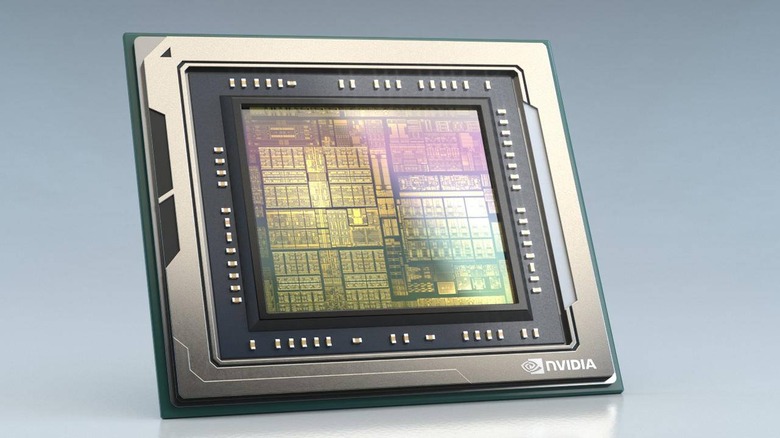

The acquisition makes perfect sense, at least if you're NVIDIA or a neutral market watcher. Already a giant in the computer graphics hardware market, NVIDIA is aggressively pushing its technologies where its number-crunching prowess can shine brightest, particularly in AI and automotive industries and even data centers. But while it is arguably the king of GPUs, it will always need a CPU to pair it up with, which is where is would-be ownership of ARM comes in.

Unfortunately for NVIDIA, Arm has many customers, including its own rivals AMD and Intel. Given the vital role that ARM or ARM-based chips play in smartphones, IoT, and embedded electronics, NVIDIA's attempt to acquire ARM for itself won't get an easy pass from government and industry regulators. Intel and AMD will also most likely require some promise that NVIDIA will play fair, or as fair as it can be.

It won't be cheap either, with some analysts estimating a $55 billion acquisition. In comparison, Softbank bought Arm Holdings, as it was known back then, for only $32 billion in 2016. The computing landscape has changed considerably in those four years and Arm is estimated to be worth $44 billion if it goes public next year.

Softbank, however, seems to be in a hurry to divest itself of its lucrative properties in order to pay down its debts. Negotiations with NVIDIA could take a long time or may even fail, at which point Softbank's Plan B would be to find yet another neutral buyer like itself or put Arm on a public stock listing.