IRS Updates Free File Agreement, Putting TurboTax On Notice

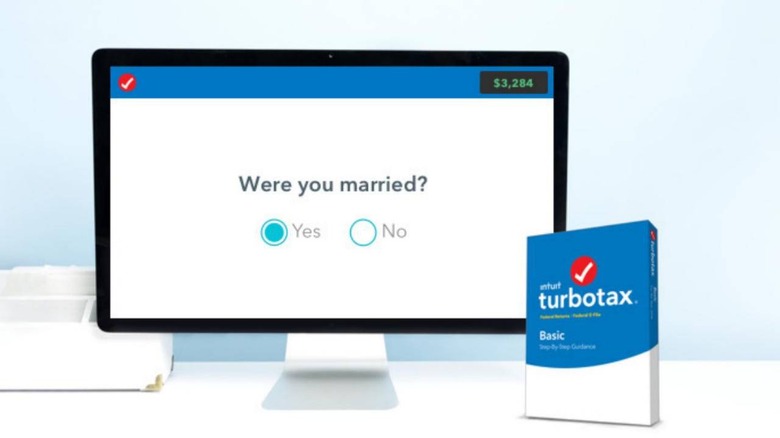

It's almost tax season again which, especially for those in the US, is one of the most grueling tasks of their lives. It doesn't help that the process can also be an expensive one since the software that promises to ease the burden actually puts a load on your wallet. That, however, should not have been the case and the IRS is announcing an addendum to its Free File program that promises to make filing tax returns online easier and cheaper, despite TurboTax's attempt to make it otherwise.

The announcement seems straightforward at face value but the IRS' history with tax preparation software companies underlies this rather significant change. The agency has an agreement with private companies that make up the Free File Alliance that, on paper, should have made it easier for taxpayers to prepare and file their tax returns. In fact, the agreement even allows certain income classes to have access to free versions of such software.

That's where TurboTax developer Intuit comes in. The company has been reported recently to have pulled every trick in the book, from lobbying to misdirection to deception, to get people to pay for software they should be able to get for free. The IRS is now putting its foot down in two major ways, though the exact effects still remain to be seen.

For one, the addendum to the Free File agreement now requires member companies to make the free versions of their software to be discoverable through Internet searches. The IRS is now also allowed to make its own online tax filling software and offer it for free. This is intended for those who are already experts at filling in forms by hand, which still leaves room for software like TurboTax.

Intuit is publicly in support of the addendum but it may not have to change much of its old behavior anyway. It will likely find some other way to sell TurboTax as the optimal option or at least offer its free version with plenty of strings attached.