Facebook Messenger Hides A Way To Send Friends Money

Health might not be the only thing Facebook is eying for the near future. Facebook's belittled and sometimes even antagonized Messenger app was discovered to have code in place that will let users send money to their friends easily and maybe even without transaction fees.

CEO Mark Zuckerberg already mentioned in his Q2 earnings call that there might be some overlap between messaging and payments but also cautioned for onlookers and analysts not to expect it any time soon. They want to get this right first, which might be a good idea considering Facebook isn't exactly popular for its privacy and security. That, of course, doesn't stop Facebook from trying to break out into more profitable ventures.

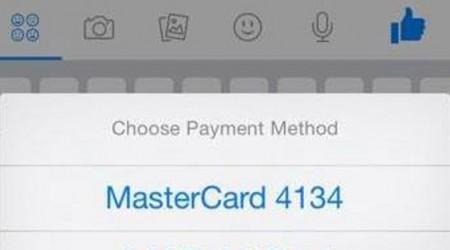

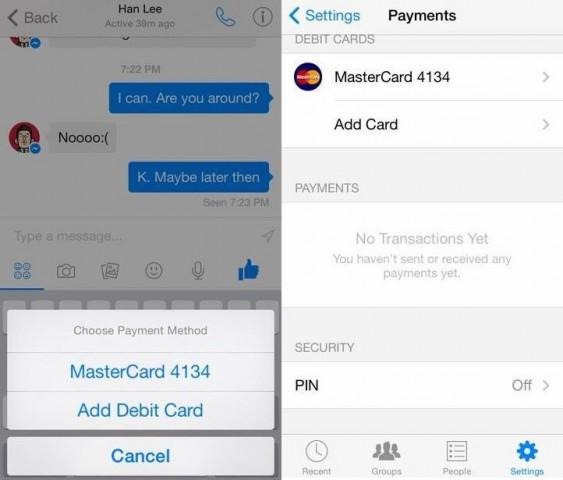

Based on the leaked screenshots and Vine video, sending money to a contact is as easy as sending, say, a video or a photo. Users will have options to add new debit cards or reuse those they've already introduced to Facebook via in-app purchases from the social network. It was noted that only debit cards are supported, which makes a bit of sense considering there are less transaction fees and handoffs involved there compared to credit cards or direct bank accounts.

PayPal was also noted to be missing from the payment options, which could hint that Facebook intends this Messenger feature to compete directly with PayPal, Square Cash, and similar services, to the exclusion of those rivals. It might not be that surprising at all, considering how Messenger's new top executive is former PayPal president David Marcus.

This new payment option, which could be rolling out to the US first in the next few months, could be a differentiating factor for Facebook Messenger in the heavily saturated instant messaging market. While others like LINE, WhatsApp, and Viber compete and monetize on stickers or subscriptions, Facebook Messenger's battle cry might be friend-to-friend cash transfers. Whether that helps change the public's opinion of the app is something yet to be seen.

VIA: TechCrunch