Equifax security breach 2017: The Fine Print [UPDATED]

Equifax members sought information today after the credit reporting firm revealed an unprecedented company-wide security breach. There are approximately 323.1 million people in the United States according to the United State Census Bureau's 2016 census. Equifax announced that their cybersecurity incident (read: hack) impacted approximately 143 million US-based users.

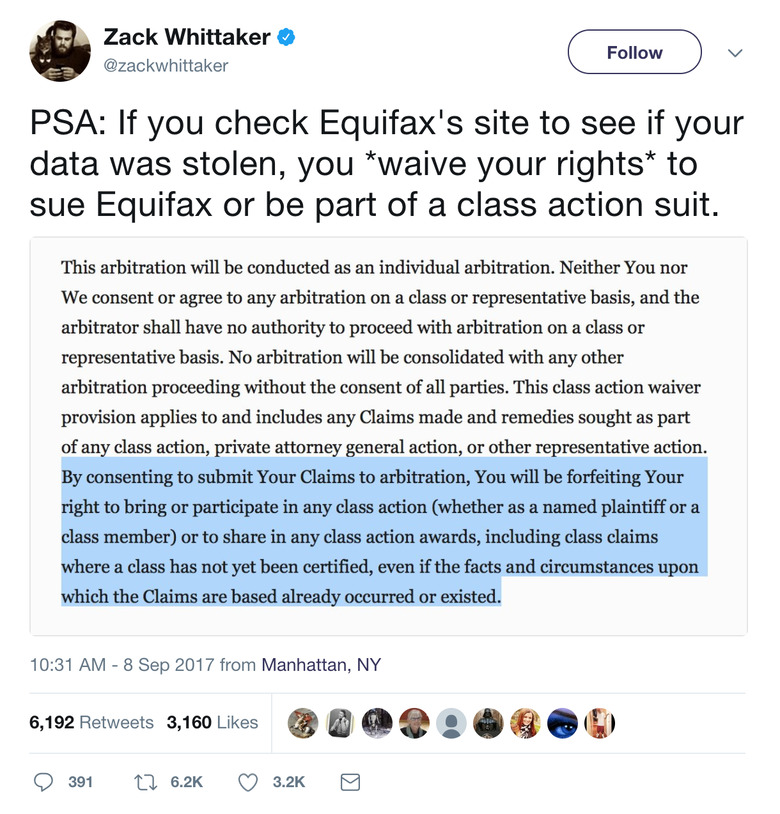

UPDATE: Before you take any action, the following FINE PRINT is probably more important than any other. Don't let the offer of Trusted ID Premier stop you from joining a class action lawsuit in the future – or do. Do whatever you want, I'm not your dad. This comes from Zack Whittaker on Twitter.

How do I check if my account was affected?

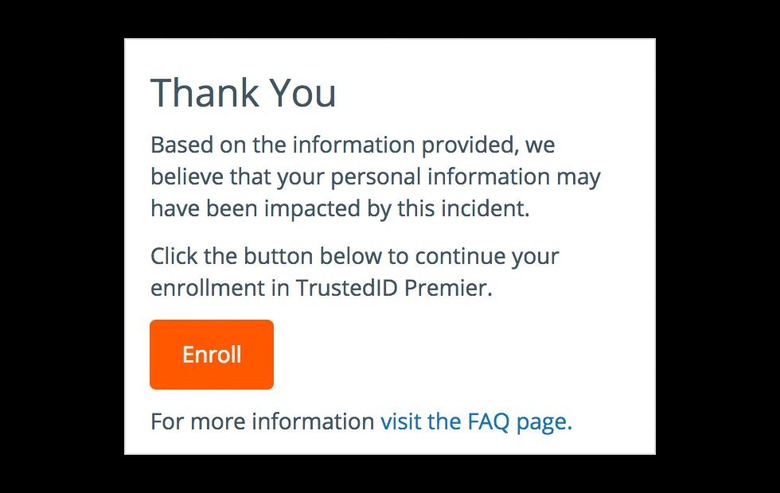

There's a fairly simple way to check whether an account has been affected by this security breach in an Equifax-made website. Over at equifaxsecurity2017 dot com, users can learn all they desire about the impact of the hacker attack – from there, a secondary (also secure) page is linked to check user info for impact. The specific page to check your personal information for impact is housed at Trusted ID Premier.

What is Trusted ID Premier?

TrustedID Premier is the service which will be offered to the user if their personal information was (potentially) impacted by this incident. If your account was potentially affected, Equifax will allow you to enroll in TrustedID Premier for a year for free.

Equifax's TrustedID Premier includes:

• Copies of your Equifax Credit Report

• Equifax Credit Report Lock

• 3 Bureau Credit File Monitoring

• Social Security Number Monitoring

• Up to $1 million in ID theft insurance

Can I trust Equifax here?

We'd trust this Trusted ID Premier system about as far as Equifax itself. Given the security breach at hand, that might mean something different for you than it does for me. I checked my information with this site and found that I was potentially affected. As a result, I opted in for TrustedID Premier.

If anything suspicious happens to me from this point forward, I'll be reporting it right here on SlashGear.

The Fine Print

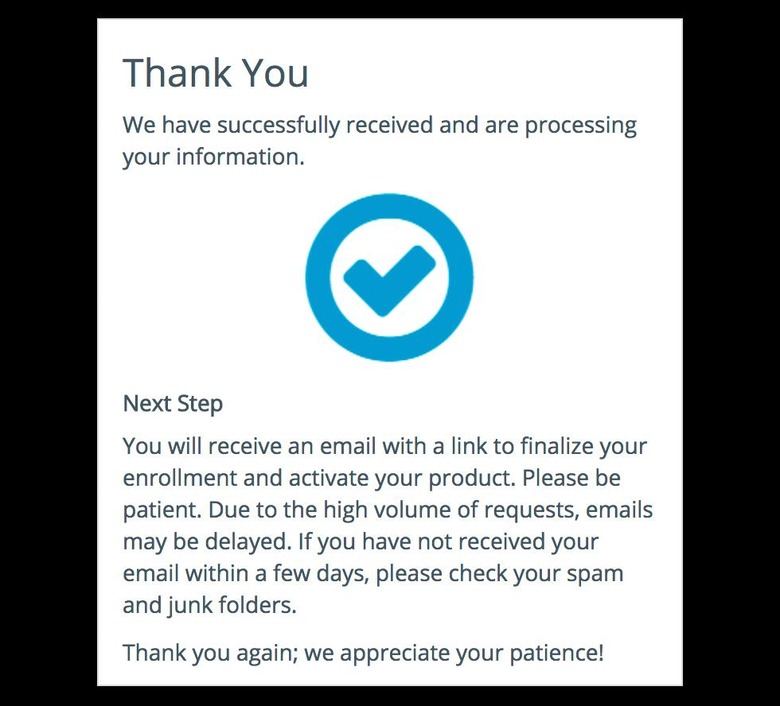

Credit monitoring wont begin instantly. Instead, it "will take several days to begin." This credit monitoring service is provided by Experian and TransUnion.

Credit file locking will not lock this information away from all institutions and agencies. Included in the "will not prevent access" list is Equifax Global Consumer Solutions, federal, state and local government agencies, companies reviewing your application for employment, "companies that have a current account or relationship with you", and collection agencies. Also not blocked are those acting "for fraud detection and prevention purposes; and companies that wish to make pre-approved offers of credit or insurance to you."

It's actually quicker to note which groups this Equifax Credit Report Control blocks. Those blocked groups include "certain third parties, such as credit grantors or other companies and agencies."

SSN Monitoring is an inexact science because of the ever-changing nature of the internet. As such, "there is no guarantee that Identity Protection provided by Equifax is able to locate and search every possible internet site where consumers' personal information is at risk of being traded."

The identity theft insurance included with Trusted ID Premiere is underwritten by American Bankers Insurance Company of Florida or its affiliates.

What else should I do?

Keep an eye on you bank account(s). Report any charges you don't recognize to the bank ASAP and they'll likely help you negate the impact. If you're thinking about signing up for TrustedID Premiere, do so before Tuesday, November 21, 2017 – that's when the complimentary 1-year service sign-up ends.