Study shows hybrids popular among financially-savvy consumers

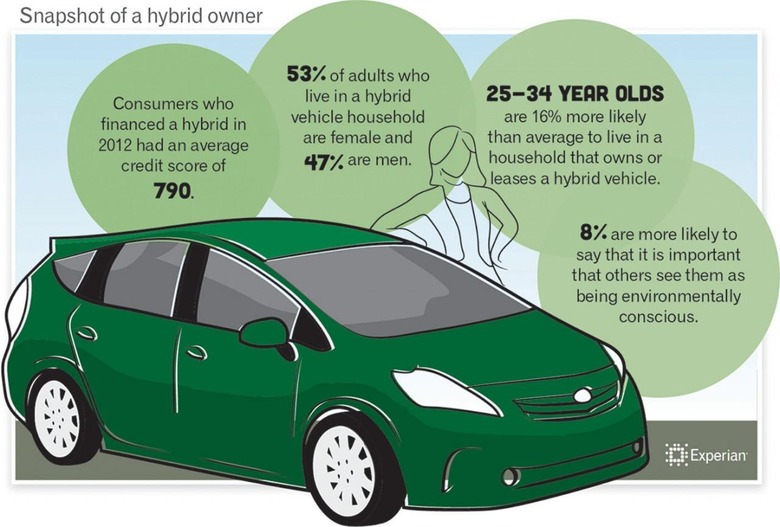

Experian Automotive has published the results of a study on hybrid vehicles, which looked at both the primary consumers who purchase them, as well as overall sales data. What it found is that those who purchase hybrids are likely to be financially-savvy, having a higher credit score on average than other consumers who get a new car loan. In addition, the numbers show hybrid sales – though still low – are slowly rising.

The information on the average hybrid buyer was gleaned from financial data included on vehicle loans, which showed an average credit score of 790. Such a score is slightly higher than the average of 755 for consumers seeking a new car loan for any type of vehicle. The same data shows the average loan for a hybrid at $25,807 with a monthly payment of $461.

The study also looked at hybrid sales, which increased to 3.1-percent last year over 2011's 2.2-percent, a rise of 40.9-percent. While the numbers look big, the tally of hybrids on the roads is still less than 2-percent. However, as the data shows, sales are slowly and steadily rising. In 2006, hybrids only accounted for 1.5-percent. Says Experian, more hybrids are bought than leased.

Experian's Director of Automotive Credit: "Hybrid vehicle owners have long been perceived as environmentally conscience consumers. While they may have made the vehicle purchase due to caring for the environment, our research shows that hybrid owners are economically minded as well. Hybrid owners tend to have outstanding credit histories, which also has enabled them to obtain financing at lower rates than typical consumers."

[via PR Newswire]