IFTTT premium accounts soon as "IoT glue" gets funded

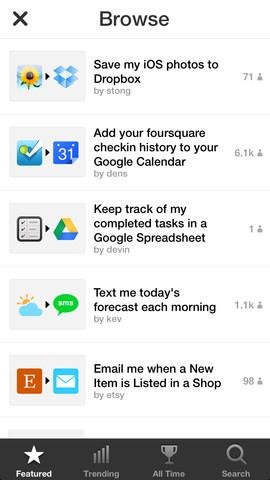

Internet-of-things and web service glue IFTTT (If This Then That) will soon launch premium accounts for greater flexibility, as the company celebrates $30m in new funding. The service works as a 21st century exchange between products and services like Gmail, Facebook, Dropbox, SmartThings, and more, allowing simple "recipes" to be set up that prompt different functionality depending on various triggers.

So, for instance, once you take a photo with your iPhone, you could have an IFTTT recipe automatically upload that image to Google Drive for safe-keeping. Alternatively, IFTTT could keep a Google Docs spreadsheet updated with all of the daily statistics from your Jawbone UP24.

That bridging of physical hardware and web services has also made IFTTT popular with DIY home automation enthusiasts. SmartThings, which we reviewed recently, effectively relies on IFTTT to bridge the various components around your home – like door and movement sensors, hue lights, and other devices – with online systems that can send out SMS notifications, cause lamps to flash according to weather alerts, and more.

What IFTTT hasn't had, so far, is a payment model. Premium accounts will change that, with the company confirming to Bits that the paid version will include such features as multiple social account support, so that various different Twitter or other accounts could be linked with different recipes.

That way, you could have IFTTT notify certain things on a personal email address, while business-centric notifications might go to a work address instead.

Unclear at this stage is whether IFTTT will also address one of the common requests for conditional recipes, such as triggering lights based on movement but only at certain times of the day. We've got a request in with the company for more information on what features may be included, and will update if we find out more.

Update: IFTTT declined to comment on specific features of premium accounts.

The funding comes from venture capital firms Norwest Venture Partners and Andreessen Horowitz.

VIA Bits