IDC on China: Apple topples Xiaomi, market slowing down

Market research firm IDC has just released smartphone numbers for the first quarter of the year, focusing particularly in the Chinese market. The figures reveal two very interesting "first time" facts. For the first time, Apple has unseated Xiaomi, believed to be the forever king of the Chinese smartphone market. And also for the first time, that market is starting to show signs of contracting, if not decelerating, due to the saturation of the market. If it becomes a trend, it could very well change the way foreign brands look at the Chinese market.

Apple, Samsung, Microsoft, Google. These are just some of the big names in the tech industry that have recently tried to woo the Chinese market. Especially Apple, who has had to made some concessions, even apologies, to please the market and its government. This focus was believed to be motivated by the image of China as a very lucrative market, given its huge population and fast-moving audience. That, however, might soon no longer be true, if IDC's Q1 numbers are to be seen as portents.

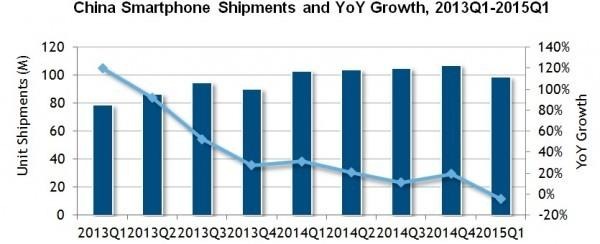

For the first time in six years, IDC saw a decline in the Year on Year growth of the smartphone market. It's not that much, just 4.3 percent actually, but it's still a rather surprising turnout. Or maybe not. Given all the recent push in China, both local and foreign brands, it's not surprising if the market became saturated so fast. Almost everyone probably already has a smartphone. Or two. The challenge now is convincing those to upgrade to newer smartphones just as fast.

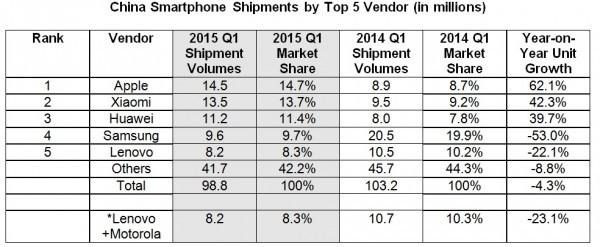

Apple might have just hit the right note in that regard. It seems that its big screen iPhone 6 and iPhone 6 Plus might have become a huge hit in China, where smartphones of those sizes are more the norm. So much so that 2015's first quarter saw Apple's share rise by about 62.1 percent, displacing Xiaomi as the king of the Chinese hill. That said, XIaomi is a close second. With the Mi5 looming over the horizon, it might just retake the crown. Huawei manages to retain it's third spot compared to the same period last year. It is Samsung, however, who saw the greatest loss, losing more than half of its share from last year. Lenovo at fifth completes the top five.

Of course, it's too early to tell given this is just one quarter, so we'll have to look to the next quarters for more clues. IDC predicts that there will be some substantial changes in the Chinese market in the coming months, some of which we've already started to feel. For one, Chinese OEMs are starting to set their eyes outside the country. OEMs are also ganging up on Xiaomi, trying to push new lines to further drive away the king. At the same time, however, these manufacturers might start to price their wares higher, pushing the competition to higher tiers.

SOURCE: IDC