Apple number 3 in PCs if tablets included claim analysts

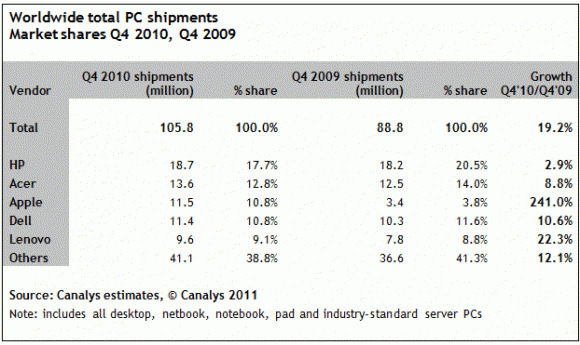

Is the iPad a PC, a tablet or something else? If you're Apple you'd say it's iconic and leave it at that, but if you're market analysts Canalys you lump it in with personal computers in general. They've been crunching numbers and – iPad included – reckon that makes Apple the third largest company in the PC industry, only trailing HP and Acer.

Including tablets – which Canalys insists on referring to as "pads" – is a conscious shift, and one which the company believes other vendors and analysts should follow. "Pads gave the market momentum in 2010, just as netbooks did the year before," Canalys Senior Analyst Daryl Chiam insists, "we are encouraging vendors to plan for the future and not to remain stuck in the past."

The researchers believe that the majority of the PC industry's 19.2-percent worldwide market growth in Q4 2010 (compared to Q4 2009) was down to tablet sales. "Pads gave consumers increased product choice over the holiday season," claims Canalys Analyst Tim Coulling, "while they do not appeal to first-time buyers or low-income households, they are proving extremely popular as additional computing devices."

Press Release:

Canalys reports global PC market growth of 19% in Q4 2010- Apple climbs to third place worldwide

Palo Alto, Singapore and Reading (UK) – Wednesday, 26 January 2011

Canalys today announced strong PC industry growth of 19% in Q4 2010, with Apple climbing to third place in the market, thanks to impressive iPad and Mac sales, as well as fast growth in Asia Pacific. The analyst company attributes the majority of Q4 market growth to the rising demand for pads, a new product category.

'Pads gave consumers increased product choice over the holiday season,' said Canalys Analyst Tim Coulling. 'While they do not appeal to first-time buyers or low-income households, they are proving extremely popular as additional computing devices.'

Canalys urges vendors to accept new market realities, by recognizing pads as an integral new component of the overall PC landscape. Unlike other analyst companies, Canalys incorporates pad shipments, such as the Samsung Galaxy Tab and Apple's iPad, in its total PC market report.

'Pads gave the market momentum in 2010, just as netbooks did the year before,' said Canalys Senior Analyst Daryl Chiam. 'We are encouraging vendors to plan for the future and not to remain stuck in the past.'

'Any argument that a pad is not a PC is simply out of sync,' said Chiam. 'With screen sizes of seven inches or above, ample processing power, and a growing number of applications, pads offer a computing experience comparable to netbooks. They compete for the same customers and will happily coexist. As with smart phones, some users will require a physical keyboard, while others will do without.'

'Each new product category typically causes a significant shift in market shares,' said Chiam. 'Apple is benefiting from pads, just as Acer, Samsung and Asus previously did with netbooks. The PC industry has always evolved this way, starting when Toshiba and Compaq rode high on the original notebook wave.'

At a regional level, Asia, especially China and India, continued to outperform most of the other global markets, to the benefit of Lenovo and Dell. In the United States, sales recovered somewhat, while Europe, the Middle East and Africa remained an ongoing concern due to substantial consumer inventory build-up. Moving forward, inventory issues will be exacerbated by rising VAT levels across five countries – Poland, Latvia, Slovakia, Switzerland and the UK – as well as the urgency created by the upcoming Intel refresh. As a result, Canalys predicts significant retail discounting in this region during the first quarter.

Other bright spots for the PC industry included accelerating corporate refresh programmes, as Windows 7 became an accepted operating system. This trend favoured vendors with a solid presence in B2B, notably HP, Dell and Lenovo. Canalys also noted strong demand for servers and storage, driven by substantial investment in data centre infrastructure.

'Recessionary budgets are over for most companies, and IT expenditure is again being used as a catalyst for growth,' said Coulling. 'The performance of the corporate market, however, contrasts starkly with the decline in public sector expenditure in most Western countries. The big service-led companies, which profited greatly from huge government-led contracts, are in for a tough 2011.'